INTRODUCTION

September 12, 2021

Hi everyone—I’m so glad to have you here. What a week.

Well, this is issue 51, which means it’s been almost one full trip around the sun of Surf Report without a single week missed. That may not mean much to you but it’s important to me. I like to keep my word to myself.

The timing of things is poetic. This newsletter was born in Ecuador, a country named after its balanced position at the middle of the world, where I spent a week going through the process of selling some scarce, desirable property while talking trading & investing with my friend—a surfer, surfboard shaper, and hotel owner.

After a year that shocked the markets and a policy response that helped drive the meteoric rise of Bitcoin (a scarce, desirable digital property and inflation-resistant store of value in cyberspace), this past week brought my attention back to the equator where I began. Only this time it involved another small Latin American country, and it was their Bitcoin monetary policy that shocked the world.

Make no mistake: a monetary revolution has occurred.

El Salvador (transl. “The Savior”) officially made Bitcoin legal tender on Tuesday, just days before the 20th anniversary of the 9/11 terrorist attacks and the same day of the week as the original tragedy in 2001, which first struck (not coincidentally) the financial district of New York City. All of this just weeks after the United States officially withdrew from Afghanistan in what marked the end of the ensuing 20-year war in that region. The US is now looking to wage a different kind of war—this time within its own borders and against an even more nebulous foe.

Money, war, and freedom have always had everything to do with one another.

Nations can’t afford to fight constant wars without a monetary system they can control and manipulate, and people can’t ever be free without a way to safely store and spend their energy in a way that can’t be easily controlled, manipulated, or confiscated.

The only reason most people invest is because they can’t save. And they can’t save because the money they hold loses value with each passing day, which was a design decision by governments to “encourage” spending. So the decision to invest isn’t a result of being interested in investing, it’s a result of simply needing to survive. Most of us put our capital at risk simply because we can’t afford not to.

“The beauty of inflation for the US government is they’re able to tax everybody through a hidden inflation tax, and then if you successfully escape the inflation tax by buying hard assets they charge you capital gains that are inflated through the inflation.” —Matt Odell

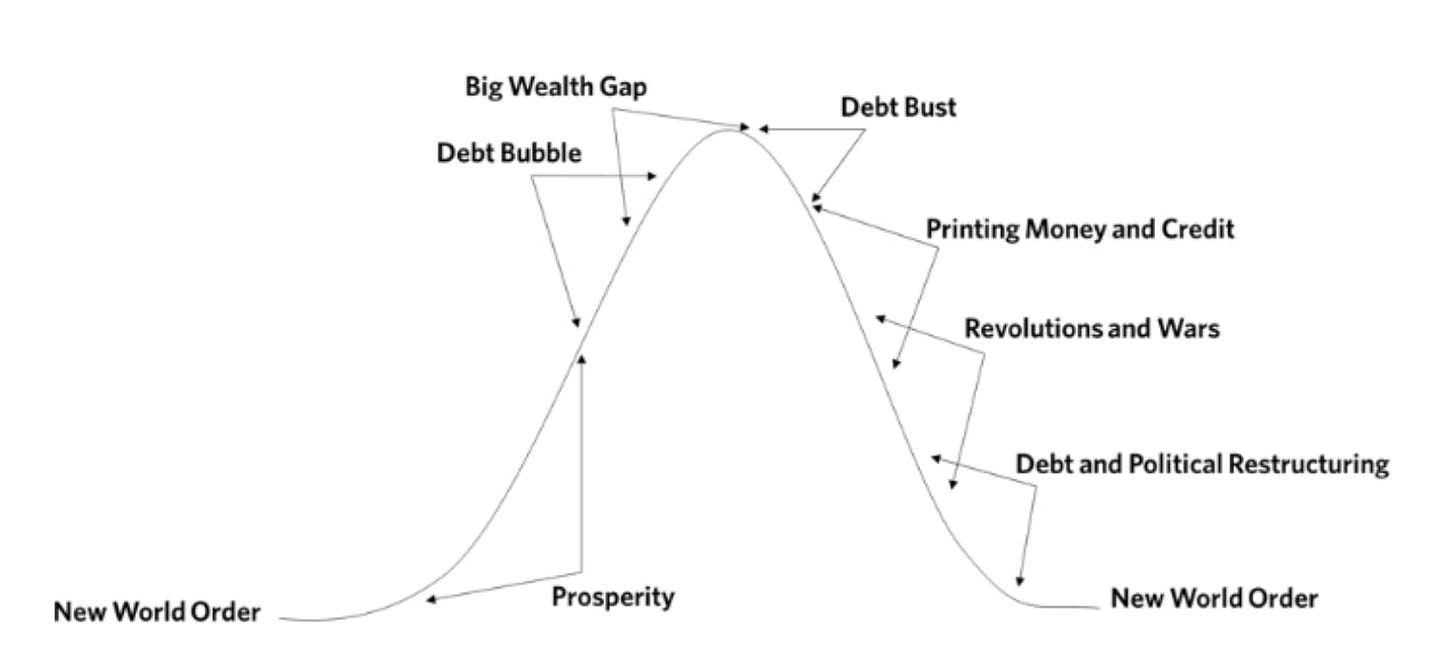

Last week I mentioned that we’re at the end of a long-term debt cycle, which is a framework of macro understanding formulated by billionaire investor Ray Dalio. He notes that the last big long-term debt cycle, the one we are now in, was designed in 1944 in Bretton Woods and centered around the US dollar and then put in place in 1945 when World War II ended. So when the government starts talking again about a “great reset,” new digital dollars, an elimination of debts & obligations, and a “War on _____”, you’ll know why. Simply: it is time.

As it happens, the trailer for latest Matrix sequel was just released this week too. The film is called Matrix Resurrections, to be released later this year, 22 years after the original and a follow-up to The Matrix Reloaded & The Matrix Revolutions. Everything just seems to be coming full circle these days.

Saviors and Resurrections. War and Freedom. Cycles within cycles.

Revolution. Redemption. Repeating. Recurrence. A constant turning through history in ways that rhyme with an eerie sense of déjà vu—a feeling that this has happened before. And that it can happen again.

Surf Report has never been about investing. Not really. It’s been about learning to see markets for what they really are. To zoom out and develop a stronger knowledge base and intuition on which to balance ourselves through its cycles.

Hopefully it’s helped. Hopefully you’ve thought about unfamiliar ideas and considered things you’d never have considered otherwise, or made decisions based on new information. It’s that last part that’s most important, actually making decisions and taking action. But I’ve always stopped short of telling you what to do, or how, or when. This was by design.

After all, I can only show you the waves. You’re the one that needs to surf them.

Until next time 🤙,

Next week will be the final issue of what I consider “Season 1” of Surf Report, after which I’m going to take a hiatus from the weekly schedule to plan the details of Season 2.

If all this talk bums you out, reply to this e-mail and tell me why! I’d love to hear from anyone who’s still with me or recently climbed onboard. 🙂

“He who is not contented with what he has, would not be contented with what he would like to have.” —Socrates

Breaking News 🌊

⚠“85% of US junk bonds have negative real yields—after 08' it peaked at 10%. Pair this with the fact that 25% of global government debt yields negative NOMINALLY.

Never in history has the world seen more negative yielding debt - markets are backed into a corner.” [Eric Yakes]

🤨 China allows Evergrande to reset debt terms to ease cash crunch [The Business Times]

📱🎮 Apple vs. Epic ruling reveals 70% of App Store revenue comes from a small fraction of customers playing games; That 70% is generated by less than 10% of all App Store consumers, the court said. [CNBC]

Bitcoin News 💱

₿ El Salvador Becomes First Country to Adopt Bitcoin as National Currency The government is rolling out bitcoin ATMs, an e-wallet, and kiosks[Wall Street Journal]; Global giants like Starbucks, McDonalds, and Pizza Hut are now accepting Bitcoin as payment in the country. [Seeking Alpha]

₿ “El Salvador's new bitcoin wallet allows for cross-border, virtually instantaneous, zero-fee transactions -- a game changer for a country where 70% of the population depends on money sent home from abroad to get by.” [CNBC]

₿ App developers can now choose Bitcoin payments in iPhones after a court order Apple to allow 3rd party payment options; there are more than 1 Billion iPhones in the world. [Bitcoin Archive]

₿ Ukraine is the latest country to legalize bitcoin as the cryptocurrency slowly goes global [CNBC]

₿ A new bill in Panama aims to recognize Bitcoin as an alternative payment method and enable freedom to use crypto. [Coin Telegraph]

₿ The SEC plans to sue crypto exchange Coinbase if it goes ahead with plans to launch a product allowing users to earn interest by lending digital assets [Reuters]

₿ Zebedee raises $11.5M for Bitcoin payment systems for games [VentureBeat]

From The Tweetbox 🐦

“Play the game you want to see in the world” [Tweet]

“In today's investment world, with abundance of information & data, the real edge is a reliable judgment.

How to improve judgment & decision-making?

• decrease exposure to tech devices

• dial down the constant flow of news (noise)

• increasing solitude & spend time in nature” [Tweet]

The SEC asking crypto founders like Brian Armstrong to work with the agency, only to turn around and sue them doesn't really invite rule following. …Often those playing by the rules are suffering more trouble” [Video]

For The Pros 😎

$7,056 ARR in 7 days after launch (+ some lessons) (Link available to Pro subscribers)

Link Building Mistakes to avoid - From a Head of SEO (Link available to Pro subscribers)

Worth A Read 📃

Cryptocurrencies: developing countries provide fertile ground

“In Lagos a software coder bills her client in London and is paid in bitcoin, sidestepping a costly banking system and the naira currency’s miserly official exchange rate”

Check This Out 👀

Why Bitcoin and not altcoins?

PNGs 🖼

Pods & Schools 🐬🐠

Recent podcasts + books I highly recommend, and upcoming courses + seminars that look promising

🔊 Todd Simkin - Making Better Decisions, on The Knowledge Project podcast. Todd calls on experiences from his lengthy career in financial services and educating traders to help us understand how to make better decisions.

“Annie Duke talks about it as ‘resulting,’ Kahneman refers to it as ‘hindsight bias’… it’s something we look to avoid as frequently as we can. When people talk about trading decisions that they’ve made to more experienced traders, we do everything we can to shield the person giving feedback from knowing the results.

I’m not gonna tell you whether or not this trade worked out—I will tell you the information that was available to me at the time that I made the trade, and then what I did, and you can give me feedback on that process.”

🔊 Parallel economies and "ethical Veksláks" w/ Juraj Bednar, on the Opt Out podcast

“I have a friend from Panama, and after The Panama Papers he was trying to send less than $1000 to his daughter who was living and studying in Spain. And by the way she has a Spanish passport… The receiving bank, the Spanish bank, stopped the payment because it’s from Panama so it’s, you know, dirty money laundering. And it was less than 1000 euros! It was not $10 million. The payment just didn’t go through. They returned it and she couldn’t pay for her tuition or books or for whatever the money was for.

So unless you try these things, you don’t really know how the situation is really bad. For some things, the crypto *is* just more user friendly. Today.”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.