Surf Report: Captain's log

Issue 21: February 14, 2021 (Free Version)

INTRODUCTION

February 14, 2021

Hey everyone—I’m so glad to have you here. What a week.

Over time I'm learned that a lot of things I found perplexing in linear terms make more sense when I switch to a log chart. I’ll explain in a second, but the underlying insight is this: in a digital world driven by network effects, it's all a game of gradually… and then suddenly.

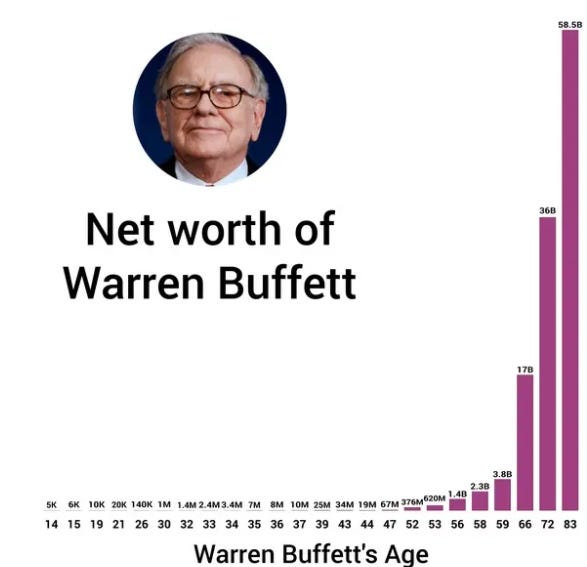

The example of this most people are familiar with involves compound interest, which grows slowly and steadily for most of the time until towards the end the growth starts exploding, seemingly out of nowhere. Check out how Warren Buffett’s $66 Billion net worth played out:

Seeing money grow exponentially is fun, even magical-looking. Except when it’s not. Since the prospect of hyperinflation is a hot topic these days in the US, let’s look at the classic example of the devaluation and eventual elimination of the German papiermark in the Weimar Republic during WWI:

Exponents are an example of the doubling phenomenon, which is surprisingly counterintuitive. Here’s a fun example: If you fold a piece of paper in half 30 times the thickness reaches over 6 miles high, which is about the height that planes fly. If you fold it 40 times—just 10 more folds—it reaches 7000 miles, which is where satellites orbit. At 45 times—a mere 5 more folds from there—the thickness becomes 250,000 miles. (The distance between earth and moon is around 239,000 miles)

Things get out of hand very quickly when you’re dealing with nonlinear properties. So how do we wrap our heads around something that’s unfolding at an exponential or rapidly accelerating rate? One trick is to switch from graph paper to log paper.

If you’re like me, you struggled to grok the concept of the logarithm in school. I was told it’s the inverse function to exponentiation. It answers the question "How many of this number do we multiply to get that number?" Uh, okay. But what’s the point?

No one explained to me that putting things in logarithmic terms is a way to make exponential activity more clear. Why didn’t they just say that from the beginning? I don’t know, I don’t make the rules.

When things unfold exponentially, like the number of Facebook users or virus infections, the line will eventually go parabolic and start to fly up and off the chart. You can keep changing the scale to try to fit it in, but eventually all the earlier values toward the beginning of the line will be so tiny that the plot basically becomes worthless. This is representative of just how hard it is for us humans to fit the true nature of power laws into our visible thinkspace.

So what am I getting at?

Most people think and act in linear terms, but life mostly unfolds in a non-linear way. We are always at risk of underestimating the impact of things that have network effects. Use this to your advantage when making bets (or investments), and let the log scale be your guide.

Until next time,

“The secret of all victory lies in the organization of the non-obvious.” —Marcus Aurelius

Breaking 🌊

🛒 Shopify expands its checkout system to Facebook and Instagram, allowing users to complete purchases on the social platforms directly.

💑 Dating app Bumble saw its public debut on the NYSE on Thursday (ticker: $BMBL), making founder/CEO Whitney Wolfe a billionaire after the stock price surged 63% to $70.31. It joins Match ($MTCH) as the only other publicly traded dating product.

🌐 The new social audio app Clubhouse is now banned/blocked in China at the same time it’s seeing huge popularity stateside. It’s currently invite-only but has over 2 million users, and recently valued at $1B making it the fastest growing startup in history.

💸 Reddit's valuation doubles to $6 Billion after the latest funding round (up from $3 Billion last year), after adding new users through the pandemic.

🎮 Electronic Arts buys Glu Mobile for $2.4 Billion, one of the biggest gaming acquisitions ever. A sign of the stay-at-home times, together the companies hold a lineup of mobile games that generated bookings of $1.32 billion over the last 12 months. (Glu makes Disney Sorcerer’s Arena, WWE Universe, Diner Dash, & Kim Kardashian: Hollywood. EA owns the Madden, FIFA, and Battlefield franchises.)

💱 Tesla’s purchase of $1.5 billion bitcoin (and news that they will accept it as payment) makes the front page of the Wall Street Journal in the same week America’s oldest bank and Mastercard both announced support, helping to drive the price of BTC to an all-time high ($49k). Miami’s mayor also declared a resolution to allow employee payroll, tax payments, and the city’s treasury to accept bitcoin as payment.

From The Tweetbox 🐦

“Every past decline looks like an opportunity, every future decline looks like a risk.”

“Don’t Cling to a Mistake Just Because You Spent a lot of Time Making it.”

For The Pros 😎

An interesting argument for investing in exotic alternative investments today. (Link available to Pro subscribers)

On Canva, and how to analyze products from an atomic concepts framework. (Link available to Pro subscribers)

A new study that shows why influencers may matter less than you'd think in a world where ads work even slightly well. (Link available to Pro subscribers)

On the 2 different ways that companies distribute specialization and ownership. (Did you know that Stripe had no Product Manager for its first 5 years of existence?) (Link available to Pro subscribers)

Insight 💡

Ark's Cathie Wood explains how bitcoin could increase by $400,000.

“Bitcoin is only [at] roughly a $600 billion market cap. So even half the size of Apple or Amazon, right now. And yet, it is a very big idea, I think. A much bigger idea than Apple or Amazon.”

Check This Out 👀

I’m always on the lookout for new ETFs (Exchange Traded Funds), since they’re an easy, cost-efficient way to invest in a core sector you like but doesn’t force you to choose which horse in the race you’re betting on.The latest one to catch my eye is ticker $SUBZ, by the folks at Roundhill investments. It’s a streaming ETF, and includes companies like Roku, Netflix, Spotify, Tencent, and more.

Another ETF I just learned about are called Covered Call ETFs. Selling covered calls is a somewhat complicated derivatives strategy that allows you to make income no matter what the market is doing by capitalizing on volatility. If that sounds like a headache to you, you can just invest in a covered call ETF that tracks the S&P 500 ($XYLD), the Nasdaq ($QYLD), or the Russell 2000 ($RYLD) and let them generate income for you.

Here’s An Idea 💡

Replace your Zoom meetings with Clubhouse meetings. The founder of Gumroad is giving it a shot.

Invest where people with neck tattoos spend their time.

"When you look around and you see somebody who has a super edgy haircut, cool neck tattoos, and arm sleeves art, follow them and see where they're hanging out and that is the next place. I would create an entire fund off of just following people with hidden tattoos.”

– Claire Cormier Thielke, Real Estate Investor, on the Invest Like the Best podcast

PNG 🖼

“Reddit is unique in social media. 15 years after launching, it still hasn't peaked.”

“The beginnings of all things are small.” —Cicero

Groms 🐣

I’m a big fan (and customer) of Janel’s Newsletter OS product, which helped me plan, prep, and curate this very newsletter you’re reading. So if you have a podcast or want to start one, I’d check out her newly released Podcast Operating System.

“Don’t tell me what you think, tell me what you have in your portfolio.” —Nassim Nicholas Taleb

Drop Ins 🏄

My latest investments & trades

Buy & Hold Investments (I will hold these forever)

This section is only available for contributing subscribers. If you’d like to trade and invest along with me, consider one of the paid tiers!

Swing Trades (1-3 month time horizon)

This section is only available for contributing subscribers. If you’d like to trade and invest along with me, consider one of the paid tiers!

Barrels 🎯

Portfolio Highlights

Winning Trade of the Week: $HTBX, scaled out profits for a 178% gain

Pods & Schools 🐬🐠

🔊 A chat with Daniel Crosby, PhD, the Chief Behavioral Officer at Orion Advisor Solutions, on the Animal Spirits podcast. It packed with useful insights about human psychology and behavioral biases. (Also it’s only 30 minutes long)

“Low cost really is better than free when it comes to making financial decisions, because low cost at least makes you stop and consider whether or not the decision should be made at all. When a trade is free, it’s perceived as consequenceless.”

🏫 Michael Saylor released a “Bitcoin for Everybody” course on his non-profit website Saylor.org, led by Stephen Livera. It covers history, philosophy, technology, and investment approaches for the everyday user, and includes a certificate of completion.

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey. You even get $10 for free ✨

Wealthfront. ~25% of my portfolio is in Wealthfront, which since 2016 has netted me a time-weighted return of ~65% (~62% money-weighted) at the time of this writing, all while harvesting tax losses like the pros do. Use this special link to get your first $5,000 managed for free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.