INTRODUCTION

June 20, 2021

Hi everyone—I’m so glad to have you here. What a week.

Friday saw a quadruple witching event in the US markets—the charming name given to the 3rd Friday of March, June, September, and December when stock index futures, stock index options, stock options, and single stock futures all expire simultaneously. It comes from classic folklore, where the "witching hour" is a time of night when supernatural activity is heightened and the power of ghosts and goblins is particularly strong.

Quad witchings are usually marked by heavy trading and more volatility as contracts are all settling, margin calls are being issued, and traders look to take advantage of any temporary price distortions to arb the difference.

Of course, these events are also expected, and if you zoom out far enough they don’t really matter much over the long term. But they’re a fun curiosity, and often used to mark a “fresh start” that can have psychological effects at the individual level.

I mention it because this supernatural witchery specifically describes derivatives, which sit on top of underlying securities and commodities, which in turn are subordinate in capital priority to underlying debt (bond) markets. A derivative is a contract that derives its price from fluctuations in the underlying asset, like waves on top of a huge ocean.

It’s the waves sailors fear, not the currents. But it’s also the waves that surfers love.

Here’s what’s wild: it’s the volatility that really matters.

The volatility of derivative markets attracts traders looking to make big profits. They therefore provide constant liquidity to markets, and when markets are highly liquid (meaning you can buy or sell easily and get your money out) it attracts larger and larger, more conservative investors who can be more sure there will always be someone out there buying and selling.

Derivatives trading is what “discovers” prices. And it’s that price that people pay to buy the underlying asset. We think of derivatives markets as risky and secondary to the more safe and primary underlying, but without the risk-takers there is no healthy functioning market at all. Traders keep things fluid and in motion.

This is why the Federal Reserve has been such a failure. Their entire premise—the reason it was supposedly created—was to artificially bring more stability to markets. But stability is not a thing you can do, as the 2008 financial crisis and 2020 Covid shock have shown. When you try you just distort all the useful signals. Stability is an emergent property of a system that allows risk-takers to fail, since it’s only by experiencing consequences that learning, feedback, and improvement can occur.

All this to say: there’s nothing spooky or wicked about quad witching day. It’s just the settling up of active participants who pay for and profit from their own risk and speculation. Without traders, price can’t be discovered. And without a stable price, there’s nothing for investors to buy.

I don’t trade derivatives, but I’m glad for those that do. They’re surfers at heart who bring the liquid on which we all float.

Until next time 🤙,

“The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by an endless series of hobgoblins, most of them imaginary." —H.L. Mencken

Breaking News 🌊

🥤 Coca-Cola lost $4B in market value after a soccer star moved two Coke bottles to the side, endorsing water instead [Yahoo Finance]

💳 The UK is edging closer to being a cashless society, with only 1 in 6 payments currently made in cash [The Guardian]

🆔 Stripe goes beyond payments with Stripe Identity to provide AI-based ID verification for transactions and much more [TechCrunch]

🛒 Shopify expands its one-click checkout, Shop Pay, to any merchant on Facebook or Google [TechCrunch]

🎮 Amazon's game streaming service Luna is opening access to all Prime members June 21 and 22 [The Verge]

Bitcoin News 💱

₿ Legendary investor Paul Tudor Jones likes bitcoin, calls it a great portfolio diversifier to protect his wealth over time [CNBC]

₿ China is kicking out more than half the world’s bitcoin miners – and a whole lot of them could be headed to Kazakhstan and Texas [CNBC]

₿ Paraguay's deputy Carlos Rejala intends to legislate Bitcoin next month [Documenting Bitcoin]

₿ Bitcoin Ban Upheld at Danske Bank Amid Growing Client Demand [Bloomberg]

₿ A leading telecommunications provider, GoldConnect, with locations in 17 Latin American countries, now accepts Bitcoin as payment. [PR Newswire]

From The Tweetbox 🐦

“‘Stripe’s mission is to grow the GDP of the Internet’ says @patrickc. That used to be the mission of Google and Amazon too but they lost the plot somewhere along the way, which creates enormous opportunity for those, like @stripe, who still see it that way” [Tweet]

“The concern about the ineffectiveness of a 60-40 portfolio embodied in a chart: bonds and stocks are moving in tandem the most since 1999” [Tweet]

“Yield on Junk Debt hit another all time low today at 3.84%. Lend money to the riskiest companies and receive an annual yield less than the rate of inflation.” [Tweet]

“While the SEC continues denying a bitcoin ETF, a 2X daily leveraged inverse junior silver miners ETF launched today…” [Tweet]

U.S Senator, @SenLummis says, "#Bitcoin is sourced by 40% renewables, whereas globally, the average grid is only 12%. So even now, #Bitcoin is using more non-carbon sources of energy." [Tweet]

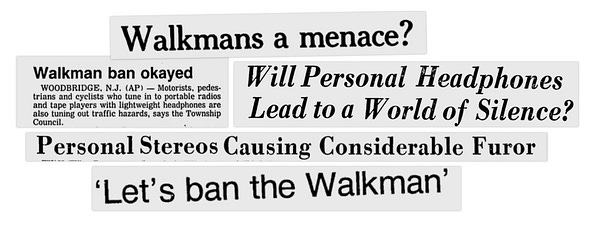

In the years after the Walkman was released anti-walkman legislation popped up across the US:

For The Pros 😎

Learning SEO – A Roadmap with Free Guides & Tools. Really great resource worth reading/saving. (Link available to Pro subscribers)

Creating the future of work and where the opportunities are (Link available to Pro subscribers)

Learning from Roku, and how they beat the bigger players by using their own playbook against them (Link available to Pro subscribers)

Check This Out 👀

I spoke with a twitter buddy of mine for 9 minutes about bitcoin & El Salvador, from the lens of finance, philosophy & culture. A tiny podlet for your listening pleasure.

PNGs 🖼

Pods & Schools 🐬🐠

🔊 Jeff Booth: Bitcoin vs Fiat “Extend and Pretend,” on the Stephan Livera podcast

“Are property rights themselves—and our infatuation with owning a home—a derivative of a system that has to leverage us into control? So you [take on] a 30-year mortgage and you’re locked into a system that makes the government bigger and bigger and bigger?”

🔊 El Salvador - The Whole Story with Jack Mallers, on the What Bitcoin Did podcast

“We discuss:

- What led to Bitcoin becoming legal tender

- Meeting the President of El Salvador

- Bitcoin Beach

- The mission of financial freedom”

📚 Confessions of an Economic Hit Man, by John Perkins. Perkins famously pulled back the curtain on the ways he and others cheated countries around the globe out of trillions of dollars. A particularly relevant read in light of El Salvador’s recent Bitcoin power move, and Covid’s recent impact on government legislation and human rights. Wars have been started over less.

“Fear and debt drive this system. We are hammered with messages that terrify us into believing that we must pay any price, assume any debt, to stop the enemies who, we are told, lurk at our doorsteps.”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey. You even get $10 for free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.