INTRODUCTION

July 25, 2021

Hi everyone—I’m so glad to have you here. What a week.

Check out one of my favorite unintuitive facts: money invested when the market is at all time highs has outperformed money invested on any given day.

Think of it like this: Imagine your investment as condensed to 5 days. Monday opens to an all time high. Tuesday goes up 1. Wednesday is up 1 again and then Thursday it drops 1. Friday is up 1 again. Buying Monday’s “all time high” was better than waiting for Thursday.

Here’s a related insight that someone spotted: If global stocks are at an all-time high at month end, then own them. If not, own bonds (meaning Treasuries from 1970-76, or an aggregate bond ETF like $AGG after):

There’s no need to fear global markets at all-time highs just because they’re at all-time highs.

People are always afraid they’re going to time the market wrong, but if they deliberately timed the market wrong they would be right.

But why?

One theory is simply: because that’s how human nature works. You need to play it out past the first order effect.

A market that has reached an all-time high is evidence of positive momentum and supposedly a booming economy, which is fundamentally a good thing.

But highs also stoke emotions in people that it can’t possibly continue. Fear is a much stronger emotion than excitement or happiness. Fear also trumps logic. So people, trying to be sensible, start selling and there’s a gradual decline.

If the decline accelerates then there’s a fast drop or crash, which causes people to panic sell at the bottom creating a self-reinforcing feedback loop of doom & gloom.

This creates a new buying opportunity in a market that was otherwise healthy but affected by emotional reactions, so level-headed investors go in and buy quality equities that are on sale.

This creates a rapid rebound followed by a slow steady climb as cooler heads start to prevail and people accept that the worst is probably over.

This then accelerates to a fast pump as people FOMO back in. (FOMO stands for Fear Of Missing Out. There’s that word “fear” again…)

History has shown that all time highs are usually followed by ongoing rises in the market where new all time records are set over and over again.

But as we saw last week, all of these price signals are particularly distorted right now. So can this logic still be trusted? Are we in a healthy market or a precariously fragile one? Is an all-time high a sign of irrational euphoria or honest market information?

The above examples offer some useful insight for all kinds of markets, but I don’t live by them. One premise that governs most of my thinking, in markets or otherwise, is this quote from John Maynard Keynes:

“When the facts change, I change my mind.”

Just because something is unintuitive doesn’t mean it’s false.

Just because something sounds reasonable doesn’t mean it is.

And just because something is true doesn’t mean it can’t stop being true.

Until next time 🤙,

“If you make people think they're thinking, they'll love you; but if you really make them think, they'll hate you.” —Harlan Ellison

Breaking News 🌊

💸 Treasury Secretary Janet Yellen warned Congress on Friday that the U.S. economy faced “irreparable harm” if lawmakers failed to raise or suspend the nation’s borrowing cap and that the Treasury Department would begin taking “extraordinary measures” to avoid breaching the so-called debt limit. [New York Times]

😬 Big sell off ongoing in the bond market. 10-year yields down to 1.18% [CNBC]

🏦 Square Banking is live. Checking, savings, debit card for small businesses. [Square]

⚡ Japan sets internet speed record, transferring 319 Terabits per second [Vice]

🔊 Newsletter platform Substack is funding the launch of a new podcast network called Booksmart Studios. [Axios]

Bitcoin News 💱

₿ JPMorgan has given its financial advisors the green light to give all of its wealth management clients access to cryptocurrency funds, making it the first major US bank to do so [Business Insider]

₿ Mastercard Creates Simplified Payments Card Offering for Cryptocurrency Companies [BusinessWire]

₿ Fidelity: 71% of Institutional Investors Plan to Buy Crypto [Blockworks]

₿ Twitter’s focus eventually will be on Bitcoin, CEO Jack Dorsey told investors at the Q2 earnings call. “We must aggressively invest in Bitcoin” [Bitcoin Magazine]

₿ Amazon is looking to hire a “Digital Currency and Blockchain Product Lead” [Amazon Jobs]

₿ CNBC: Bitcoin mining isn’t nearly as bad for the environment as it used to be, new data shows [CNBC]

₿ Musk: Tesla Likely to Resume Bitcoin Payment System [Blockworks]

₿ Circle K has become the first major retail chain to deploy Bitcoin ATMs within its stores. 700+ in 30+ states are already installed. [Documenting Bitcoin]

₿ Upgrade launched a new credit card that incorporates Bitcoin rewards, powered by NYDIG [Upgrade]

₿ New Jersey Bureau of Securities Orders Cryptocurrency Company ‘BlockFi’ to Stop Offering Interest-Bearing Accounts [NJOAC]

From The Tweetbox 🐦

“The economy is so fubared. The Fed can no longer use the two tools necessary to regulate the ponzi economy via money printing and interest rate manipulation.” [Thread]

“87% of S&P 500 companies tracked by Bloomberg have mentioned inflation in conference calls so far in July” [Tweet]

“So far this year we’ve been told, in this order:

- There’s no inflation

- There’s a little inflation

- The inflation is transitory

- Inflation is good

- It’s not inflation it’s the supply chains

Which of these is the misinformation, I would like to have it banned pls” [Tweet]

For The Pros 😎

70% of Americans dream of owning a business and being their own boss. 41% of employees worldwide considering leaving their employers in 2021. Here’s a great breakdown of the pros and cons of quitting vs. starting a side gig to help you think through it: (Link available to Pro subscribers)

Here’s a 100-part course that covers pretty much everything you need to start making money with SEO, based on 7+ years of experience: (Link available to Pro subscribers)

Worth A Read 📃

The game makers and artists pushing Roblox to its limits

One of the most notable things about Roblox is how instantaneous it is. Rather than booting it up like you would a regular video game, its worlds are accessed from a webpage on your internet browser. You search a term or, more likely, scroll through what’s popular at any given moment, pick a world depending on its thumbnail, and, whoosh, you’re in. It feels closer to navigating a social media app, which, of course, is also kind of what Roblox is — every creator and player has a profile and friend lists.

Watch This 🎥

Canadian MP argues Pierre Poilievre calls for Parliament to “end the inflation tax” caused by unrestrained central bank money printing. Watch.

Here’s An Idea 💡

Peloton plans to launch an in-app video game where you pedal to control a rolling wheel (instead of an instructor-led class)

The game, which will only be available for Peloton bike owners and subscribers, involves riders changing their cadence and resistance to meet various goals and control an on-screen rolling wheel. Players can choose a difficulty level, the type of music they want to hear, and the duration of the track before starting.

Turns out there’s a good reason Irish pubs are so successful, and one company has generated ~$2B shipping units of their Irish "Pub in a Box" to 50+ countries. The pubs are delivered complete with everything from furniture to authentic Irish knickknacks (they'll even do the setup for you).

PNGs 🖼

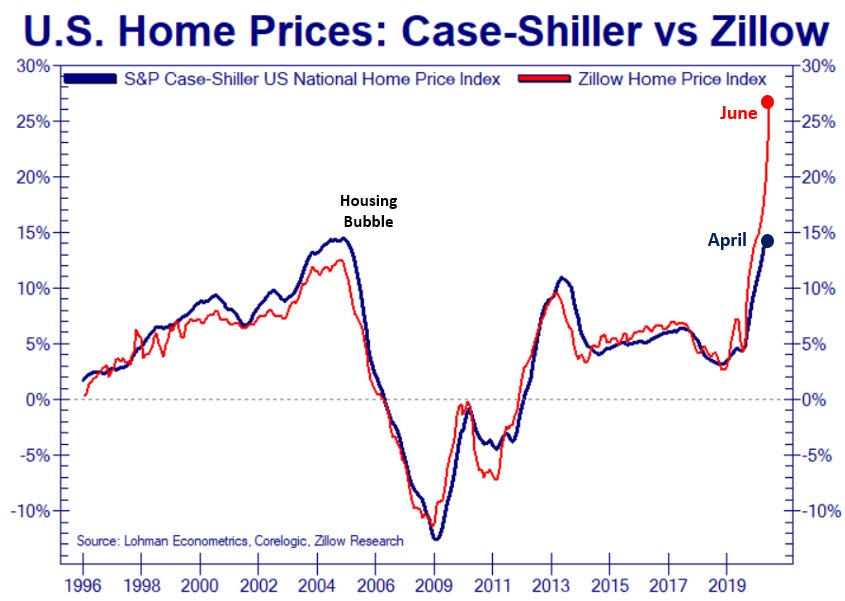

Case-Shiller Home Price Index is about to shatter record set during housing bubble

The dollar system is… complicated.

Pods & Schools 🐬🐠

Recent podcasts + books I highly recommend, and upcoming courses + seminars that look promising

🔊 A Bitcoin Debate/Discussion w/ Greg Foss & David Collum, on the Investor’s Podcast Network with Preston Pysh

“The Fed will control the inflation narrative. They will not be able to control the credit narrative.”

📚 The Alchemy of Finance, by George Soros

“Scientific method seeks to understand things as they are, while alchemy seeks to bring about a desired state of affairs. To put it another way, the primary objective of science is truth, - that of alchemy, operational success.”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.