INTRODUCTION

September 5, 2021

Hi everyone—I’m so glad to have you here. What a week.

If there’s one thing that sums up the past year of writing this newsletter it’s financial news pundits and talking heads being perplexed. Here’s the latest:

It’s notable because their profession is to have something to say about everything, even when they don’t know what’s going on. So to be at a even a small loss for words is just another alarm bell for me that things are breaking at a scale and depth most people still aren’t fully grasping.

“Whether the news is extremely positive and people want to buy into it, or if the news is less positive or negative people essentially say, ‘Well, all this means now is that the Fed is going to continue to have to be a bit more conciliatory and supportive of the market,’ so, uh, I was left scratching my head there.”

No one on that panel has any idea what’s going on but it didn’t stop them from speaking gobbeldygook for five minutes. Which, to be fair, is sort of impressive.

“I think the main issue is… is… we already know that Chairman Powell has already made the difference between ‘taper’ and ‘tightening,’ so I think the market is just digesting this and maybe they’re not getting shocked, which is a great thing… Bad economic news is good news for the marketplace, which we probably shouldn’t scratch our heads anymore.”

Bad economic news is good news for the marketplace. Everyone has lost their minds and it’s seeping out through their mouth holes.

I’m not trying to be harsh, I’m trying to draw attention to the thing no one feels comfortable facing or admitting: the economy is completely broken, artificially distorted beyond repair, and fragile to the point of absolute dependence on a cartel of unelected bankers instead of true market signals and actual participants.

How broken? Consider that on Friday the NY Federal Reserve decided to just eliminate their measurement of GDP entirely:

Why would they suddenly stop caring about Gross Domestic Product as the measure of economic health? Oh I don’t know, maybe because:

“A weaker jobs number means we’re gonna get more stimulus, it increases the odds of a bigger stimulus package getting passed…”

We’re on the fast track to full-blown Universal Basic Income, folks. No need to produce here, Uncle Sam and his money printer have got you covered. (You still have to pay taxes though, he can’t print those for some reason)

Ironic too, given that this newsletter falls on Labor Day weekend in the US—an annual holiday in celebration of workers and the labor force's achievements. 🙃

So what’s really going on here? Let’s add up the facts:

We were poised for a recession well before covid came around

The prolonged and precarious standing of the US in the Middle East (which was just suddenly, hastily ended) coincided with the prolonged and precarious state of the dollar as the global reserve currency. We’re actually due for a new one. (Ask yourself: does the “full faith and credit of the US” hold much value to other nations anymore?)

There’s more incentive than ever to cede the dollar’s reserve status, as I wrote about back in February in Issue 23, “Straight Triffin.” Doing so would help balance the US trade deficit by reducing reliance on imports.

It’s almost as if… they’re trying to tank the dollar, and quickly. But why?

I think what we’re seeing is a big Monetary Reset being rolled out in slow motion. It’s clear that the US is in the midst of an implicit default, and covid offered a tremendous opportunity to both slow the velocity of money in circulation (which makes the effects of inflation less pronounced) while also justifying excessive, irresponsible monetary policy without having to take too much direct blame. The economy has been effectively turned off with people home not working and not having to pay rent while the US government continues to “stimulate” its way into deeper and deeper debt.

I think the next decade will see the transition onto Central Bank Digital Currencies—CBDCs—that will allow us all to “start over” fresh and fix the problem with a clean slate, now conveniently packaged with digital surveillance, cross-border medical credentials, and expiration-based cash to encourage “healthy” spending and reward good citizens inside their digital mobile wallets. It affords governments much more control and visibility over the economy, all For Your Own Good™ of course.

Sound crazy? It shouldn’t. I’m just describing the news. Which is increasingly unsettling. Drastic measures are usually slipped in under the guide of protection.

But maybe I should pump the brakes on all this dot-connecting and do what the pundits suggest: just go with the flow and consider all news good news. Even the bad news. Which, as we’ve now been told, is in fact good news!

What a relief. I feel better already.

Until next time 🤙,

“The party told you to reject the evidence of your eyes and ears. It was their final, most essential command.” —George Orwell, ‘1984’

Breaking News 🌊

📈 Global stock benchmark at new high, dollar slips: “Big tech shares edged higher on Friday, helping a benchmark world stock index post a sixth consecutive closing high, after a weak U.S. jobs report likely pushed back the timetable for when the Federal Reserve reduces its massive support of the economy.” [Reuters]

💸 The Social Security trust fund most Americans rely on for their retirement will run out of money in 12 years, one year sooner than expected, according to an annual government report. Treasury blames Covid. [CNBC]

😬 Evergrande, based in China and the world’s largest real estate developer, is on the verge of default, holding $15-$16B in offshore debt and more than $300B in total liability. Its bonds are trading at 27¢ on the dollar. [Nikola Bakić; Bloomberg]

🪓 Norway is considering separating its $1.4 trillion sovereign wealth fund, the world’s largest, from the central bank [Bloomberg]

🚘 Apple introduced digital driver’s licenses in eight U.S. states [Apple]

Bitcoin News 💱

₿ Vast Bank becomes first chartered US bank to offer Bitcoin buying and custody [Bitcoin Magazine]

₿ Twitter is now beta testing a Bitcoin Lightning tipping service [Bitcoin Magazine]

₿ El Salvador's democratic assembly approves $150 million Bitcoin trust. [Bitcoin Magazine]

From The Tweetbox 🐦

“The refusal of central banks to pull back even a bit on stimulus has become laughable. It increasingly looks like the end-game they have in mind is to simply monetize as much as possible before moving to some type of grand reset.” [Tweet]

“$1 billion just isn't that cool anymore…” [Tweet]

“In 4 years, every iPhone will have the capacity of 1TB according to Moore's law. In 10 years this will be 8.5TB. Currently at 360GB, in 10 years everyone will be able to store the entire Bitcoin blockchain on their phone. That's decentralization.” [Tweet]

“Bitcoin remains the 6th largest money in the world. 7th if you include gold.” [Tweet]

“A lot of large and important institutions bought #bitcoin over the summer. They will announce their purchases between September 7 and November 19. Enjoy the fireworks.” [Tweet]

For The Pros 😎

A guide to self-promoting on Reddit (Link available to Pro subscribers)

This guy learned to code and built a real software product in 6 months and shares his approach + tips (Link available to Pro subscribers)

This software + method makes remembering things easy. Works great for things like memorizing people's names and faces, learning a language, and studying for exams or interviews. (Link available to Pro subscribers)

Worth A Read 📃

The Social-Media Stars Who Move Markets. A look at social media stock pickers, many of whom generate more income from ad revenue than investment success, and how bullish advice brings more page views.

“Mr. Paffrath says he earned $5 million in the first three months of this year, as page views and demand for his guidance have skyrocketed during the pandemic. Receipts he provided to The Wall Street Journal showing YouTube revenue payments confirm that he earns several million dollars a year in ad revenue alone.”

“Every investor is making a bet on the future. It’s only called speculation when you disagree with someone else’s bet or time horizon.”

Tip ☝

Get customers in the door by using exploratory words.

When Google changed a call-to-action from "Book a room" to "Check availability," form engagement increased by 17%.

It appears many potential customers avoided the original call-to-action because it sounded like a commitment, and were more open to the alternative because they felt that they had more time to think about their options. (Another example would be to rephrase a "Create an account" button to be “"Give it a try" instead, as seen on Swipe.page)

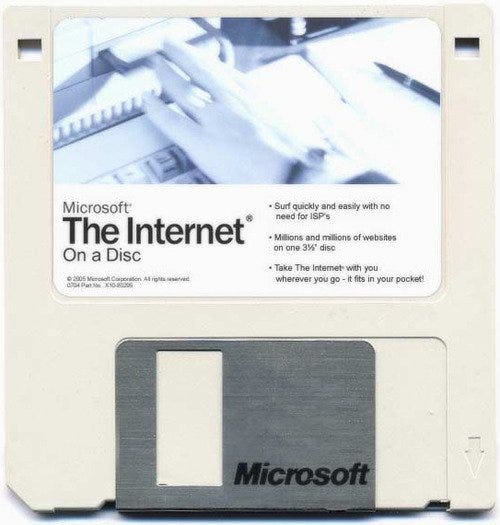

PNGs 🖼

Things were much simpler in the 90’s.

Pods & Schools 🐬🐠

Recent podcasts + books I highly recommend, and upcoming courses + seminars that look promising

🔊 Chris Williamson — Embracing Your Weirdness (EP.62), on the Infinite Loops podcast

“If anybody has managed to emerge from the last 16 months with their faith in higher powers still intact—CDC, WHO, government, policy makers—I would be amazed. You'd have to have basically not read or seen anything.”

📚 The 33 Strategies of War, by Robert Greene

“If there is an ideal to aim for, it should be that of the strategic warrior, the man or woman who manages difficult situations and people through deft and intelligent maneuver.”

“The moment you aim for results, you are in the realm of strategy.”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.