Surf Report: Perception Deception

Issue 34: 05.16.2021 (Free Version)

INTRODUCTION

May 16, 2021

Hi everyone—I’m so glad to have you here. What a week.

Good news: the government is finally acknowledging the inflation they created but have been denying for the past too many months. Overall inflation as measured by their preferred basket of constantly-changing goods (the CPI) rose to 4.2%—the highest since 2008. Which means even though it’s still being understated I can stop blabbering about it now.

Instead I’d like to turn your attention this week to another species of intentional nonsensery.

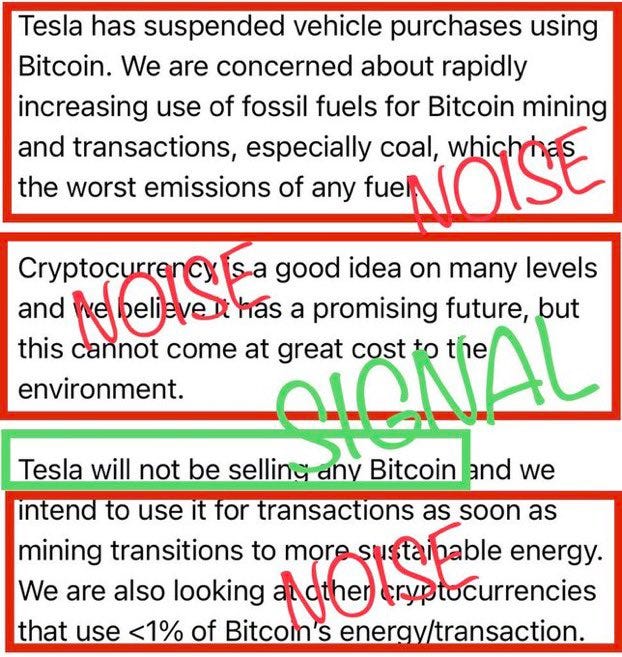

On Wednesday, Elon Musk tweeted that Tesla has suspended the ability to buy their cars using Bitcoin because [checks notes] they want to investigate how much coal power is used for mining it.

It was easy enough to read between the lines.

(He’ll probably sell it eventually anyway, so don’t hold your breath)

First of all, Bitcoin miners are contributing to the security of the entire Bitcoin monetary network and do so regardless of how many transactions are occurring, so energy use per transaction isn’t even a metric that makes sense.

But more importantly, Bitcoin mining actually incentivizes the use of cheap, renewable energy sources.

This is because energy cost is the biggest expense for miners, but they can go to remote locations to use stranded energy sources that are otherwise going entirely wasted, located too far away from human populations to be used at all. Miners have a huge incentive to find the most efficient sources of energy possible. This is why 75% of Bitcoin mining is already powered by renewables, and companies like Great American Mining are working with oil and gas firms to use their otherwise wasted (and highly pollutive) mandated methane flareoffs to power mining rigs instead. Actually capturing this gas instead of flaring it not only reduces emissions but subsidizes power costs in the process. And guess where they’re doing it? In Texas, where Tesla is headquartered.

Elon knows all of this.

But for some reason people have chosen to believe that only just now has he even considered the long-term energy and environmental impact of Bitcoin, and not before he added $1 Billion worth of it to his companies’ balance sheets. Which makes no sense.

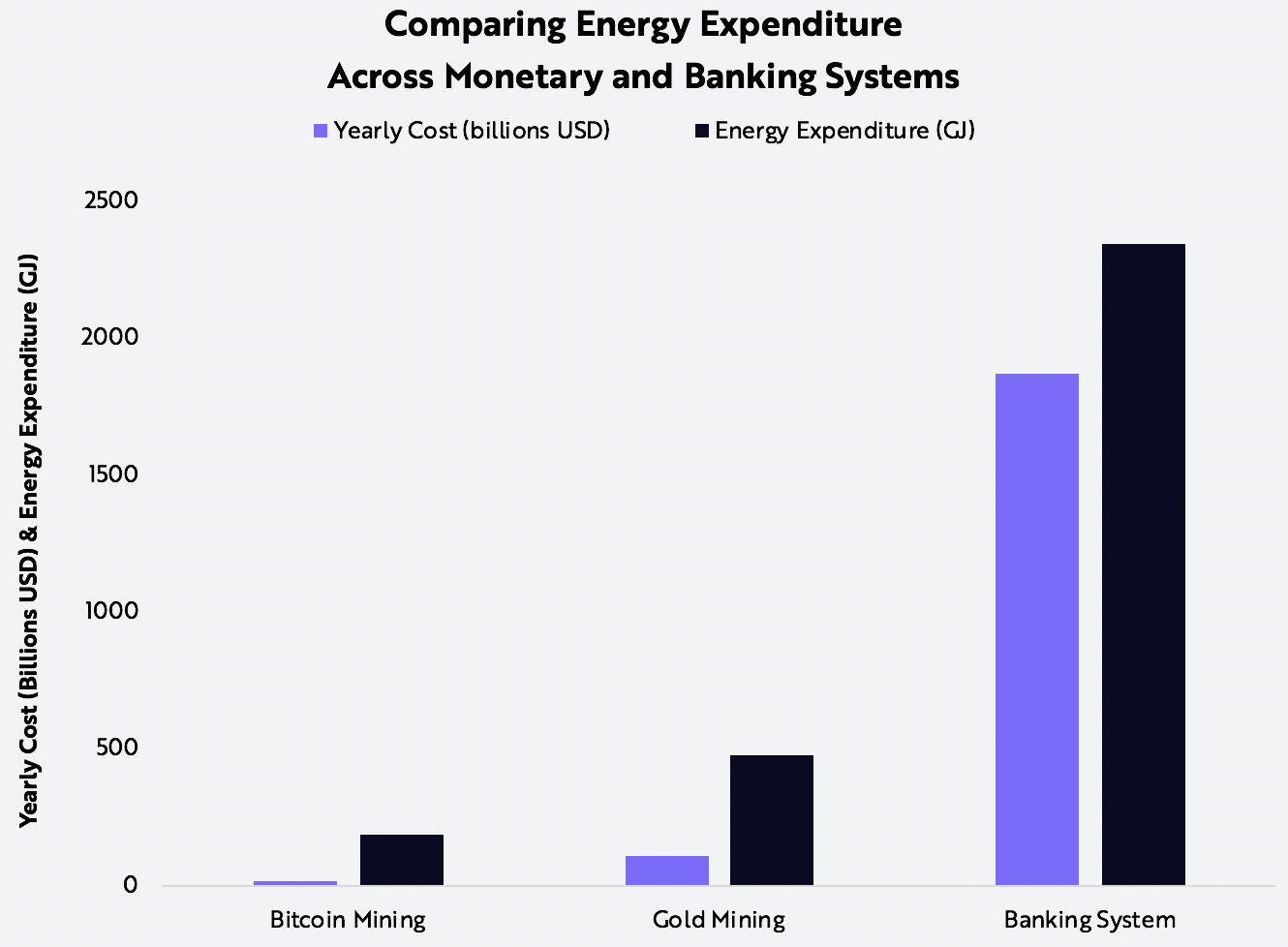

If the issue is with the energy consumption of the Bitcoin network itself then the argument requires a basis for comparison. People say Bitcoin uses an amount of energy on par with the yearly energy use of some countries, but then again so do Americans with their Christmas lights. It would be more accurate to compare it to something relevant, like the current banking system: the energy used to mine gold, or to power the military, office buildings, and administrative workers that currently work to secure the US dollar.

There’s a reason the government doesn’t want people making that comparison.

And I suspect Elon wouldn’t want people to investigate the environmental impact of mining the rare earth metals used in rechargeable batteries either.

So what’s going on here?

It seems clear that Elon was probably pressured to release this statement as a compromise in order to remain in good favor with powers-that-be who are continuing to subsidize Tesla’s operations with carbon tax credits and other “green” freebies, and worry that misconceptions around Bitcoin’s energy use might be turning off potential buyers at a time when more car companies are releasing viable alternatives.

Then again, maybe I’m just being a conspiracy theorist oh wait here we go:

Tesla made more from selling some of its Bitcoin holdings earlier this year than it ever has from selling cars. It survives mostly because of subsidies provided by the US government + selling carbon credits to other companies who haven’t been able to achieve their required mandates. But now that scheme is coming to an end and new tactics will be required to stay afloat

The point is the same one I was trying to make with regard to inflation: to understand what’s really going on don’t look at what they say, look at what they do.

Thinking like a government or the CEO of a major public company helps as well. They created a great opportunity for Tesla to develop some sort of solar powered mining rig and save the day. Those rigs already exist of course, but most people don’t know that and it makes sense for Tesla to want credit for it.

It’s sneaky, misleading, and full of deliberate distractions but at the end of the day, this is business. This is how the world works.

You don’t have to like it, but it helps when you can see it.

Until next time 🤙,

“There are no solutions, there are only trade-offs; and you try to get the best trade-off you can get, that's all you can hope for.” —Thomas Sowell

Breaking 🌊

⛽ A ransomware attack shut down a 5,500 mile fuel pipeline causing widespread gas shortages; service was restored following a $5 million ransom payment [The Verge]

💸 As of Friday, old Swiss bank notes will no longer be legal tender and cant be used as a valid means of payment. [Le News]

📍 Pinterest to test livestreamed events this month with 21 creators [TechCrunch]

🎮 Top gamers are quitting esports to become Twitch and YouTube influencers as esports organizations and game publishers reallocate resources to streamers [Wired]

₿💱 Billionaire investor Stanley Druckenmiller says it will be difficult to unseat bitcoin as the top store-of-value crypto asset, even as new challengers emerge daily [Markets Insider] You can now buy and sell #Bitcoin with cash at 1000s of MoneyGram stores in the USA [CNBC]; Palantir is adding Bitcoin to its balance sheet, also accepts #Bitcoin as a form of payment [CNBC]; BlackRock, with $9.01 trillion under management, says "Bitcoin is durable and it will be part of the investment arena for years to come" [Cointelegraph]; Microsoft shut down its blockchain and built on Bitcoin [Documenting Bitcoin]

From The Tweetbox 🐦

“‘Meet Amazon dot com. Somewhere in America, a lump of coal is burned every time a book is ordered on-line …’ from 1999: [Tweet]

“Here's what video games can teach you about content creation.” [Thread]

“The original American income tax was also ‘transitory.’” [Tweet]

“~4.2% increase in CPI in the past year, the largest since September 2008, despite CPI being a metric rigged to remain low.” [Tweet]

“Institutions love cheap BTC” [Chart]

“Preston do you own any ETH? No. Here's why.” [Thread]

“This year, at the Indy 500, car #21 will be racing for Bitcoin, human freedom, financial literacy, financial inclusivity, savings technology, and Bitcoin open-source development.” [Tweet]

For The Pros 😎

This person audited 500+ websites over the past 6 years and shares 17 learnings to help your landing page convert: (Link available to Pro subscribers)

Recent study reveals how to improve judgments made by visitors on your website’s credibility (Link available to Pro subscribers)

Nobel winner Daniel Kahneman’s new book on bad decisions has a lot to say about market overconfidence and money mistakes (Link available to Pro subscribers)

The pros & cons of IPO v. SPAC v. Direct Listing (Link available to Pro subscribers)

Worth A Read 📃

The Great Online Game, by Packy McCormick

This didn’t start as a piece about games. I set out to answer this question: why are tech growth stocks sagging while crypto moons and value roars back? […]

We’re all playing a Great Online Game. How well we play determines the rewards we get, online and offline.

The Ultimate Guide to Inflation.

Lyn Alden covers all the different measures of inflation, what CPI is, who it benefits and the controversies surrounding it. It’s a long piece, but probably the best way to get up to speed quickly on the topic.

Inflation is a controversial and complex topic. This article looks at 150 years of data across multiple countries to provide a general idea of what inflation is, what to look for, and how to invest with inflationary and deflationary risks in mind.

Read from the beginning, or jump to the section you want.

Here’s An Idea 💡

Sell Google Sheets & Notion templates.

Perhaps the fact that these informational products are the exact opposite of those classic internet schemes is what's connecting with users. Real people, who aren't shooting fancy sales videos in front of mansions and Ferraris, sharing what they know about a topic they excel at in the most non-flashy medium possible: a spreadsheet.

PNGs 🖼

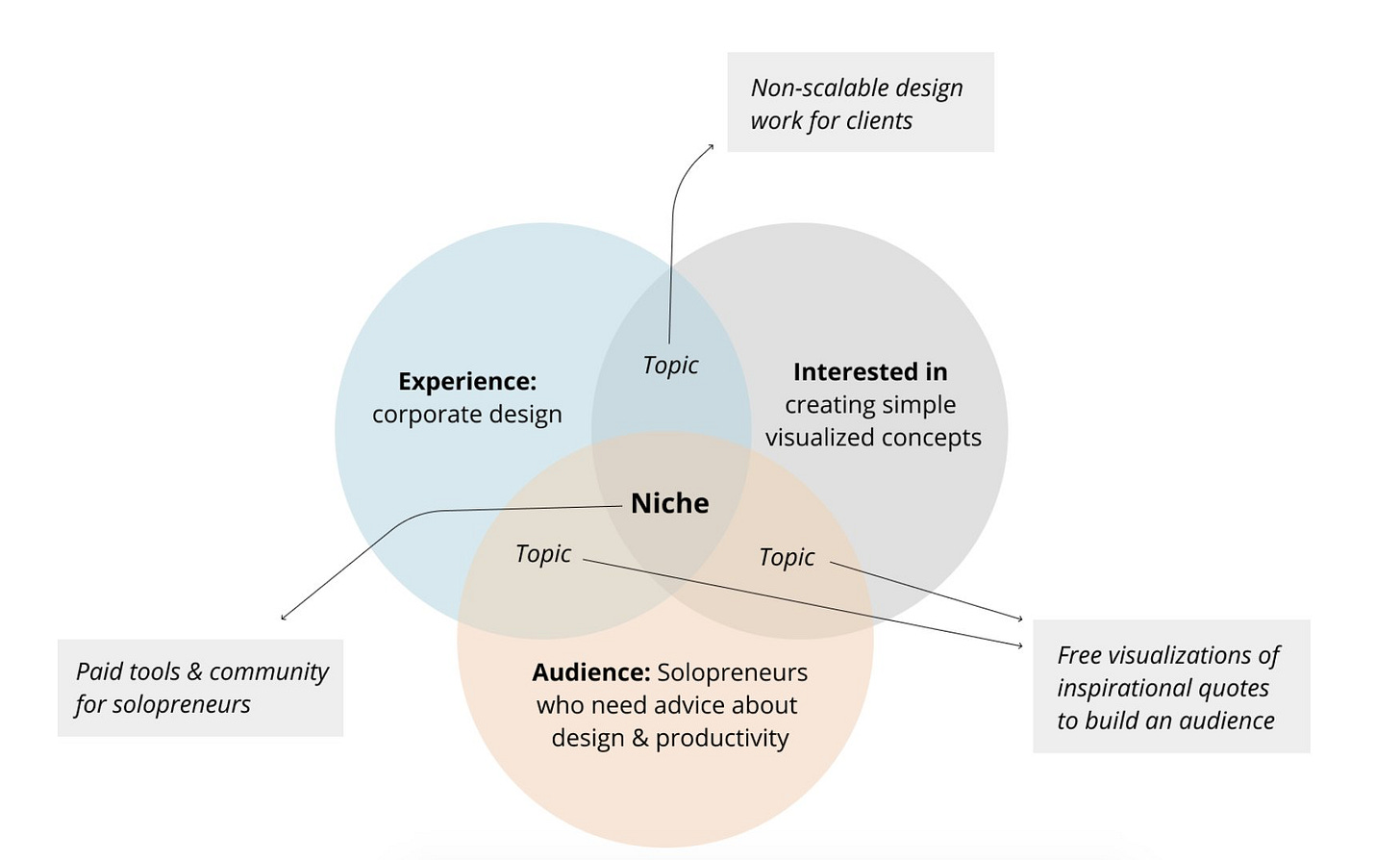

The unexpected (but proven) way to find your niche in the creator economy:

There are millions of job openings that aren't being filled because workers are making more money staying home and getting unemployment checks than they were before the lockdowns began:

Pods & Schools 🐬🐠

🔊 Real Economy Shrinks, Interest Rates, Inflation Myths, Fractional Reserve Lending with George Gammon, on the Market Disruptors podcast.

A discussion of what the Fed does with printing money, the problems it causes to societ, how they're able to do this and get away with this, and what the ordinary person can be doing right now to ensure this doesn't continue.

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey. You even get $10 for free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.