INTRODUCTION

August 8, 2021

Hi everyone—I’m so glad to have you here. What a week.

Have you ever heard of Hugo Stinnes?

Stinnes became the richest man in Germany, earning the title ‘Inflation King’ in the early 1920’s. This was in Weimar, the scene of one of the worst hyperinflation events in modern history, where the value of the currency was getting devalued at a literal exponential rate and people started using paper bills as napkins.

Stinnes didn’t become wealthy by just saving his money or buying derivatives of that money (stocks, bonds, etc.) and letting runaway inflation cause prices to rise in nominal terms. That doesn’t really work, since everyone’s money is inflating. So everyone is still in the same place in terms of purchasing power relative to each other. No one gets ahead if everyone gets ahead.

His trick: Stinnes borrowed large amounts of the currency from the banks, and invested it in hard assets like steel, coal, transportation infrastructure, and desirable real estate right as the crisis began unfolding.

When hyperinflation finally hit, the value of the Papiermark money he borrowed was worth less and less, which means he owed the banks less and less in real value over time. But the hard assets he bought with the borrowed money all increased in real value. They were worth more.

So by 1924, when the value of the Papiermark was relatively worthless, Stinnes repaid all of his once-large debts by selling a small portion of his hard assets which had then ballooned in price, making Stinnes the richest man in Germany by 1925.

Notice what happened: the currency he borrowed went UP in number terms because its purchasing power (i.e. real value) was DECREASING. You needed more of the paper bills to exchange for things. And the hard assets he already owned were also going up in number terms, but so was their real value.

People are doing this right now with the U.S. dollar. Michael Saylor famously borrowed $650 million in debt in December 2020 and used those funds to buy 29,646 more Bitcoin (over $1B worth) for the treasury of his company MicroStrategy. It’s what’s called a speculative attack on the US dollar.

This logic also helps explain why political pressure to “tax the rich” never gets the intended results. Wealthy people buy scarce, hard, desirable assets (Picasso paintings, football teams, Bitcoin…) and wait a very long time to sell them if ever, which means they rarely if ever have to report any gains for tax purposes. Instead, they just use those assets as collateral and borrow money against them, since they can easily afford the interest payments. In other words, they take out a loan to pay all their lifestyle expenses. In a society that has an inflationary currency, debt gets easier and easier to pay as the value of the hard assets increases at the same time. And as many people are aware that money you borrow—e.g. student loan debt, mortgage, etc.—isn’t taxed.

Gresham’s Law states that “bad money drives out good,” meaning an increasingly weak and debased currency keeps sensible people from wanting to hold it. We’re seeing that today with the U.S. dollar. But there’s also something known as Thier’s Law: good, strong currencies drive out bad, weak ones. We’re seeing that today with Bitcoin. Prey attracts predators.

It’s hard to say how this will al play out, but it should be clear why this has everything to do with stocks, bonds, real estate, and any other asset people use to function as a kind of store-of-value for their wealth. Caveat emptor. Buyer beware.

There’s a big difference between real and nominal terms when talking about value, and those who understand that difference place their bets accordingly.

Until next time 🤙,

“There are those who reason well, but they are greatly outnumbered by those who reason badly.” —Socrates

Breaking News 🌊

📈 Infrastructure bill would add $256 billion to deficits over a decade, CBO says [CNBC]

⚠ World’s biggest pension fund cuts U.S. bond weighting by record, allocating to France, Italian, and German debt instead (whose 10-Year yields are -0.102%, 0.607%, and -0.461% respectively) [Bloomberg]

🚨 Senator Joe Manchin Urges Fed To "Immediately Reassess" Monetary Policy Amidst Growing "Inflation Tax" [ZeroHedge]

💱 The IMF approved a round of new SDRs, valued at $650B USD, to be credited to the reserves of member nations. This more than triples the SDR market cap outstanding, and is another small step towards a more diversified or multi-currency global reserve system. [Lyn Alden]

💸 Just 1.3% of Robinhood users participated in the trading app's IPO [Business Insider]

🕵️♀️ Apple plans to scan US iPhones for child abuse imagery; security researchers raise alarm over potential surveillance of personal devices [Financial Times]

🛒 2021 e-commerce sales in the US have nearly hit the $1T mark. With 1.2M stores on Facebook and Instagram, and 1.75M on Shopify [The Motley Fool]; 1 out of every 153 American workers is an Amazon employee [Business Insider]; 🖐 Amazon will give you a whole $10 for your palm print. [The Verge]

🎮 Beijing Denounces Video Games As "Spiritual Opium", Tencent Imposes Limits On Teenage Players [Reuters]

"Everything other than Bitcoin is either absolutely centralized or relatively centralized, and that's a lot of cash that's going to end up in Bitcoin.” —@maxkeiser

Bitcoin News 💱

₿ Senators file crypto broker amendment to infrastructure bill after industry backlash [CNBC]; Janet Yellen Has Been Lobbying Against Wyden-Lummis-Toomey Crypto Amendment [Coindesk]

₿ SEC Chairman Gary Gensler “quotes writings of Satoshi Nakamoto, the pseudonymous creator of Bitcoin, from memory and knew some of the core developers of the digital currency.” [Bloomberg]; his appearance at the Aspen Security Forum on Tuesday focused on cryptocurrencies, mainly addressing lending platforms, trading platforms, stablecoins, decentralized finance (DeFi)—all of which may implicate securities laws. [Watch]

₿ Wells Fargo clients can now get Bitcoin and cryptocurrency exposure through the bank; Wells Fargo chief investment officer for wealth and investment management says Bitcoin “can be a nice diversifier to portfolio holdings.” [Bitcoin Magazine]

₿ Bitcoin ATM operator LibertyX is getting acquired by Fortune 500 firm NCR Corporation; NCR has nearly 1 million ATMs around the globe. [Bitcoin Magazine]

₿ Bitcoin is now 58% of Square's total revenue [Zerohedge]

₿ Grayscale Poaches Alerian CEO to Lead Crypto ETF Push [Blockworks]

From The Tweetbox 🐦

“Entire German yield curve now negative yield…bond holders own a liability not an asset.” [Tweet]

“Liberals are going to love bitcoin when they figure out what it will do for lower income families but democrats will hate it. Conservatives will love bitcoin when they figure out what it will do to the budget deficit but Republicans are going to hate it.” [Tweet]

“SEC chairman said he’d be more open to a Bitcoin ETF if it was based on futures. 24hrs later, both Invesco and ProShares have filed Futures-based Bitcoin ETFs.” [Tweet]

“Nakamoto’s innovation is real” —SEC Chairman Gary Gensler [Video]

For The Pros 😎

Eigenquestions: The Art of Framing Problems (Link available to Pro subscribers)

Here’s An Idea 💡

Jurors could use VR to visit crime scenes, and help them reach a verdict

Check This Out 👀

Trubill, an app that identifies and cancels unwanted subscriptions. It also offers standard financial planning app features, such as expense reporting.

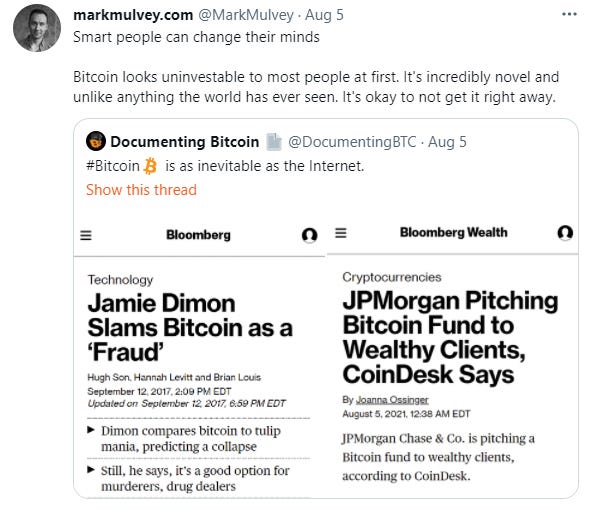

PNG 🖼

A tale as old as time.

Pods & Schools 🐬🐠

Recent podcasts + books I highly recommend, and upcoming courses + seminars that look promising

📽 Former Fed Advisor Danielle DiMartino Booth Talks US Economy, Women in Finance & Trading

“One of the things that helped me begin in the industry is that the best way for a woman to level the playing field on Wall Street is to be in sales. It is the one venue in which management is fairly agnostic. They simply want you to produce.”

🔊 The Macro Economy, Stocks, and Bitcoin with Amanda Agati, on The Pomp Podcast. Amanda is the Chief Investment Officer for PNC, which is one of the largest banks in the world.

“If all we do is use what we’ve historically used in terms of gauging the path forward, I think you really miss potentially significant opportunities”

🔊 Jeff Immelt, Leadership in a Crisis, on The Knowledge Project podcast. Former General Electric CEO looks back o his two decades with the company and the strategies he used to lead during three separate crises.

“Good leaders absorb fear in a crisis. They absorb all the things that are going on, but they don’t point fingers, they don’t point blame… and they’re able to keep a flexible point of view, and what I call ‘two truths’ which is: great things can happen; terrible things can happen. And you need to keep your mind open to both those things at the same time.”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.