INTRODUCTION

July 11, 2021

Hi everyone—I’m so glad to have you here. What a week.

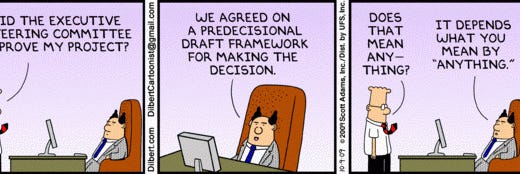

Have you ever heard of bikeshedding?

It’s a term that was coined as a metaphor to illustrate Parkinson’s Law of Triviality, a 1957 argument stating that people within an organization typically give disproportionate weight, time, and attention to trivial issues.

“Parkinson provides the example of a fictional committee whose job was to approve the plans for a nuclear power plant spending the majority of its time on discussions about relatively minor but easy-to-grasp issues, such as what materials to use for the staff bike shed, while neglecting the proposed design of the plant itself, which is far more important and a far more difficult and complex task.”

Bikeshedding is when people spend lots of time to debate the details of a topic ad nauseam, out of all proportion to its actual importance.

As it happens, in April the State of New York abruptly shut down Indian Point—their perfectly good nuclear power station producing reliable, clean energy for ~20% of the grid—mostly for political reasons. It is estimated that the center’s closing could result in the release of 12 to 15 million metric tons of extra CO2-equivalent emissions into the air as a result of increased strain on the remaining power sources. There has still been no discussion of a replacement or plans to create one despite NYC now experiencing rolling blackouts in seasonally common 90-degree weather.

The favored topic of discussion hasn’t been about potential energy solutions. It’s been about the temperature.

Most people just prefer to spend time on the bikeshed.

You see bikeshedding in open-source software projects too, where small details are vigorously debated while larger more consequential topics remain less popular.

Part of the reason is that taking a stance on something consequential creates more reputational risk than quibbling over safer topics that can be easily forgotten about.

In truth, bikeshedding is really just a form of hiding, related to procrastination and avoidance.

The lesson to take from this isn’t the obvious point that people generally like the path of least resistance. The point is that our feelings and preferences are not reliable signals of determining what is important and relevant.

As the public continues to bikeshed over what to spend $6,000,000,000,000 of newly-printed “stimulus” money on, and how arbitrarily high the federally-enforced minimum wage should be for small business owners, no one wants to talk about how the latter is a direct consequence of the former.

No one is outraged over an inflationary policy being imposed on society and accelerating an already massive wealth gap, but lots of people have lots to say about what minimum wage should be.

Sovereign debt is at negative real yields and the 10-year reached a new low below 1.3%, which means Treasuries no longer serve as a functional store of value. So investors are being forced into riskier investments like sky-high real estate, stocks, and corporate bonds.

Bond Market Sounds Alarm, says CNBC

There are still more than 11 million Americans receiving benefits through pandemic-related programs

and yet… the S&P 500 has hit a new all-time high for 7 straight days. 🤔

No one wants to talk about the difficult, but consequential, elephant in the room.

How can people look at this chart and not suspect the current system itself isn’t horribly broken? That high prices are not a sign that things are going great but rather that money is simply worth less?

The answer, of course, is the bikeshed.

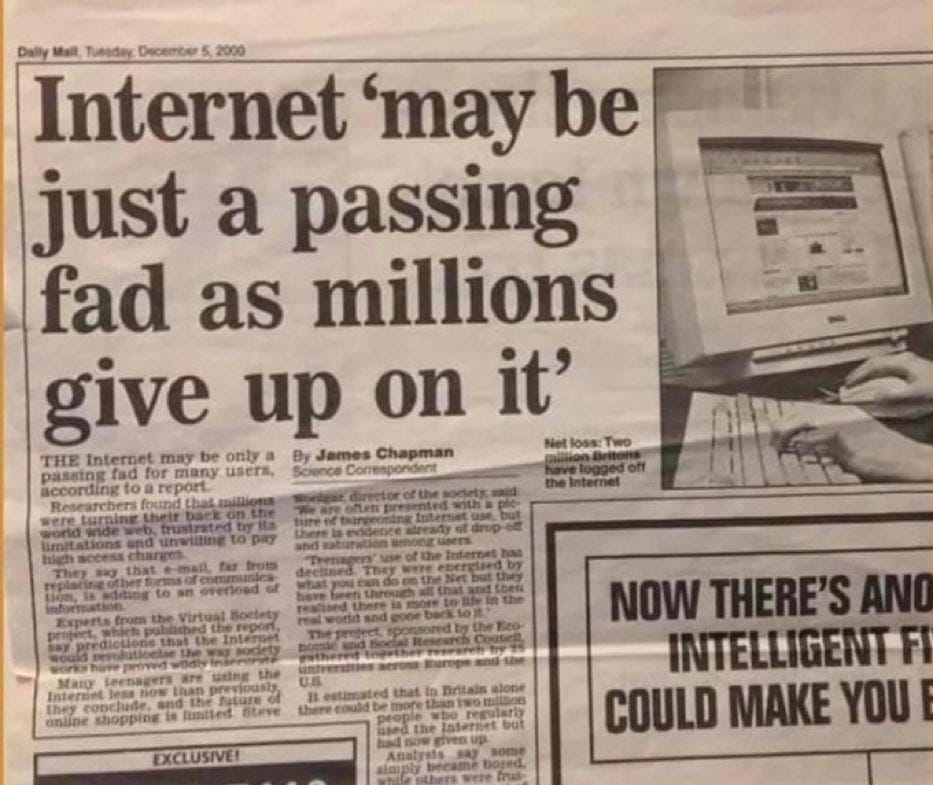

None of this is easy or trivial. But easy and trivial is what people will continue to discuss until the difficult and consequential become impossible to avoid.

Until next time 🤙,

“When the whole world is running towards a cliff, he who is running in the opposite direction appears to have lost his mind.” —C.S Lewis

Breaking News 🌊

🤨 FOMC minutes revealed that officials discussed the possibility of scaling back their unprecedented asset purchases, claiming inflation is due to supply chain and bottleneck issues and will be fleeting. [Blockworks]

📉 The 10-year U.S. Treasury yield fell as low as 1.25% on Thursday, its lowest point since February, continuing a sharp reversal in the bond market [CNBC]

💸 As Robinhood prepares to IPO, they revealed 34% of cryptocurrency transaction-based revenue was attributable to Dogecoin and 37% of total revenue came from users trading options. [The Verge]

📅 Iceland’s short work week trial declared an “overwhelming success” [New Atlas]

Bitcoin News 💱

₿ Visa says crypto-linked card usage tops $1 billion in first half of 2021 [CNBC]

₿ In India, parents are beginning to give their children bitcoin instead of gold as a wedding gift. [South China Morning Post]

₿ Wyndham Hotels is experimenting with Bitcoin as a new guest reward [American Banker]

From The Tweetbox 🐦

“If we look at several decades of data, the interest rate has never been below the official price inflation rate for this long. The only other time in history like this is the 1940s.” [Tweet]

“This is the number institutions and corporations are watching. These aren’t just new users they’re valuable additions to the Total Addressable Market for profit-seeking businesses with lots of capital. This game is about seeing like a state and thinking like a CEO” [Tweet]

“Banks don't like Bitcoin. Taxis don't like Uber. Hotels don't like AirBnB. Bookstores don't like Amazon. Cinemas don't like Netflix. 9-5's don't like remote work. Innovation is not always liked.” [Tweet]

“Every hyperinflation has occurred on a fiat standard. No hyperinflation has ever occurred on a commodity standard. Every hyperinflation (bar one) has taken place in the 20th or 21st c.” [Tweet]

“The point is not whether dollars are created by commercial banks or central banks. The point is that a small unelected group gets to change and control dollar monetary policy. *That* is fiat.” [Tweet]

For The Pros 😎

Amazing copy won't guarantee a successful launch but it will help you generate sales if you have two other crucial elements in place. Here’s a valuable thread of all the key ingredients: (Link available to Pro subscribers)

How to make $100+ a day with an email list. 10 actionable tips to turn your Twitter followers into paying customers: (Link available to Pro subscribers)

The best landing page design inspiration, templates, resources, and more: (Link available to Pro subscribers)

Here’s An Idea 💡

Creativity Could Give Investors an Advantage

“By definition, in his view, creativity is doing something that you have never done or combining things you have never combined. But “in order to know what you don’t know, you have to make a good map of what you do know,” he says — hence the need for deliberately reviewing mental skillsets and models.”

PNG 🖼

A nerve has been struck:

Probably nothing.

Pods & Schools 🐬🐠

Recent podcasts + books I highly recommend, and upcoming courses + seminars that look promising

🔊 Balaji Srinivasan - Optimizing Your Inputs - [Invest Like the Best, EP. 233]

“‘Russell conjugation’ at first seems like just a fun observation. It comes from Bertrand Russell, and he observes that: I sweat; you perspire; but she glows. The same concept can be gift-wrapped in positive or negative connotation as one sees fit.

Here’s the thing, and it’s not obvious: Russell conjugation is a way to embed a hidden org chart in language.”

🔊 Saifedean Ammous: Bitcoin Fixes What Fiat Destroyed, on Natalie Brunell’s Coin Stories podcast (I highly recommend subscribing, it’s new on the scene but great)

“People blame capitalism for what fiat did.”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral linkyou get 5,000 sats free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.