INTRODUCTION

June 13, 2021

Hi everyone—I’m so glad to have you here. What a week.

Strong end-of-debt-cycle vibes in this summery center of two-thousand twenty-one. Vibes this strong haven’t hit since the end of the last long-term debt cycle. That is, the “Roaring Twenties” that preceded the Great Depression.

More and more people are starting to spot the cracks and corruption in traditional financial markets, turning to naked shorts, kooky meme stocks, and shiba inu coins either out of desperation or entertainment—though the distinction between the two is becoming harder and harder to make out.

It’s not just the madness of crowds but the madness of government and its central bankers too. The Fed keeps printing money with unprecedented frequency and volumes, never acknowledging the long-term costs and consequences. They do this so their bankers can buy their debt (because no one else will) and keep interest rates artificially low. They’re also stuffing cash directly into the hands of individuals and mandating rent payment moratoriums to make The Economy™ appear healthier than it actually is.

Financial firms are now turning to something called “reverse repo,” essentially choosing to park their money with the Federal Reserve for 0% interest since “there are few other short-term investments available, and in some cases, these private market investments actually cost money to invest in.” [WSJ]

What the hell is going on? And what the hell are we as supposedly sensible, reasonable people supposed to do about it?

On the one hand, an argument can be made to just roll with it, “not fight the Fed,” and get while the getting is good. Go mad while madness is normal.

On the other hand, there’s a case for seeing the madness for what it is and opting out of the clown carnival completely. Be the adult in a room full of toddlers drunk on Willy Wonka milk product.

The reasonable man adapts himself to the world: the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man.

—George Bernard Shaw

It’s tricky to walk that line between the world as it is and world as you think it should be. These are strange times, but this is also what trading, investing, and asset allocation has always been about. Tradeoffs. Choices. Costs. Values.

Every trade we make with another person is a fraction of the number of trades we make with our future selves every day.

Every decision requires tradeoff. When something new and enticing comes along must always be asking what the tradeoff is, and whether or not that tradeoff makes sense given our personal goals, priorities, time horizons, and ability to bear the costs & risks.

To bring it back to these interesting times we find ourselves in today: I can safely say I’ve chosen not to conform to the mania or dive head first into the pool of this Titanic deck party, fun as it may be. It’s all occurring in terms measured in an increasingly debased currency anyway, which makes gains largely illusory. The Fed has also done a decent job hiding its yield curve control and inflationary policies, giving people more confidence and trust than is probably warranted.

Here’s the thing: history has shown that parties can end fast.

How fast will it end this time? That is the question. But a better question may be:

Will it feel more like an end or a beginning?

“To be, or not to be: that is the question: Whether ’tis nobler in the mind to suffer the slings and arrows of outrageous fortune, or to take arms against a sea of troubles … ” (Shakespeare)

And indeed, that IS the question: whether to float with the tide, or to swim for a goal. It is a choice we must all make consciously or unconsciously at one time in our lives. So few people understand this! Think of any decision you’ve ever made which had a bearing on your future: I may be wrong, but I don’t see how it could have been anything but a choice however indirect— between the two things I’ve mentioned: the floating or the swimming.

—Hunter S. Thompson

Until next time 🤙,

“There is perhaps nothing worse than reaching the top of the ladder and discovering that you’re on the wrong wall.” —Joseph Campbell

Breaking News 🌊

🤔 The Federal Reserve balance sheet topped $8,000,000,000,000 for the first time and the S&P 500 hit an all-time high on the same day (June 10).

📈 May 2021 Consumer Price Index shows fastest inflation since the 2008 financial crisis. [CNBC]

📉 Hedge funds lost $6 billion in May by shorting meme stocks like AMC [Seeking Alpha]

😐 The April jobs report was a huge miss, with only a recorded 266,000 jobs added to the economy compared to the 650,000 that “experts” expected. “Markets reacted positively to the report” because they expect The Fed to continue holding rates low to encourage more spending and debt. [CNBC]

❌ Dozens of websites in the U.S. and Europe briefly went dark Tuesday—including the New York Times and the UK government portal—as Fastly, a major cloud services provider, experienced a major outage. [WSJ]

Bitcoin News 💱

People are liking the Bitcoin news + there’s enough of it for me to give it its own section! So starting today this will be the new format.

Bitcoin is increasingly becoming an important piece of the larger macro and traditional financial landscape. I think some other crypto projects have talented people doing interesting things that hold potential for startup founders and venture capitalists at the moment, but Bitcoin being the largest, most secure, and most decentralized monetary network is what I’ll keep focusing on for this newsletter.

₿ El Salvador becomes first country to adopt bitcoin as legal tender after passing law [CNBC], with the president offering permanent residency for immigrants that post 3 bitcoin in collateral [Twitter] and announcing that the state-owned geothermal electric company is offering facilities for Bitcoin mining with “very cheap, 100% clean, 100% renewable, 0 emissions energy from our volcanos 🌋” [Twitter]

₿ After El Salvador, India may move to classify Bitcoin as an asset class, reversing their recent stance on cryptocurrencies [The New Indian Express]; Tunisia's Minister of economy says he's going to decriminalize bitcoin [Twitter]

₿ Joe Biden’s tech advisor just disclosed a holding of $1-5 million in Bitcoin, his largest investment. [Politico]

₿ Ransomware hackers used a rented cloud server to hold their bitcoin and private keys, which the FBI subpoena’d and took control of to recover. [CNBC]

₿ State Street, the second-oldest bank in the United States with $40.3 trillion under custody, declared a “tipping point” in customer desire for exposure to digital assets and cryptocurrency [Financial Times]

₿ Texas to allow state banks to hold Bitcoin [Bitcoin Magazine]; the largest renewable energy Bitcoin mining center in the USA is also being built in Texas [Bitcoin Archive]

₿ The worker’s union IBEW, just fought in favor of bitcoin mining and the job opportunities it brings to New York [Documenting Bitcoin]

₿ Director of the Dutch Bureau for Economic Analysis is calling for a complete ban on mining, holding and trading Bitcoin and other crypto assets. [fd.nl]

₿ Berkshire Hathaway Invests $500M in Brazilian Digital Bank Nubank [Coindesk]

From The Tweetbox 🐦

“If you bought a 5-year Treasury note this time last year (yielding around 0.35% at the time), the rise in CPI in one year already outpaced all five years of the interest payments you will receive.” [Tweet]

“If you make investment decisions based on what you see in newspapers, magazines, and what’s on tv… you’re ngmi” [Thread]

“In 2019 $AMC had a market cap of $1 billion. Now it is $25 billion. Do you think its movie theaters are worth 25x more now and if so, why?” [Tweet]

“I took a deep dive look into the reason why countries will start holding #Bitcoin in the future here:” [Thread]

“Blackrock is buying every single family house they can find, paying 20-50% above asking price and outbidding normal home buyers. Why are corporations, pension funds and property investment groups buying entire neighborhoods out from under the middle class?” [Thread]

For The Pros 😎

New research reveals the key to increasing word of mouth—from 44% to 62.7% in one case! (Link available to Pro subscribers)

4 affiliate marketing tips that made one creator nearly $30,000 in sales (Link available to Pro subscribers)

The psychology behind “going viral” and how to engineer your product to make it more shareable (Link available to Pro subscribers)

The 100-year-old strategy that can help you get your schedule under control with just 15 minutes each night (Link available to Pro subscribers)

How to price your Enterprise plan using your prospect's marketing site as a guide. (Link available to Pro subscribers)

Worth A Read 📃

Russia Drops the US Dollar — The End of the US Dollar Hegemony Over the World Is Getting Closer, by Sylvain Sourel

More and more countries will seek to exit the US dollar system in the coming years.

3 Ways El Salvador Has Changed Bitcoin Forever, by Nik Bhatia

Century-old exploits by American fruit conglomerates, Western-sponsored military coups, and IMF loan sharking have shaped a Latin American distrust of the dollar system. Now, their leaders and citizens are realizing that... there is an exit.

Check This Out 👀

Business coaching: search interest is up 142% in five years

Agile methodology coaches: search interest is up 241% in five years

Executive coaching: Searches are up 55%

Gaming coaches: Searches up 614%

Virtual health coaches: Searches up 133%

Lots of potential ways to capitalize on some of these trends if you’re looking to start a side hustle or new business. [Source: Indie Hackers]

PNGs 🖼

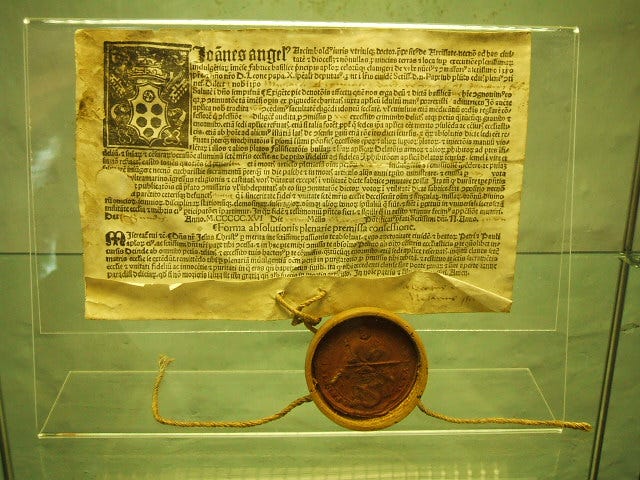

Here’s a real-life example of “ethics offsets,” once sold by the Catholic church. Remind you of “carbon offset” credits? Same energy.

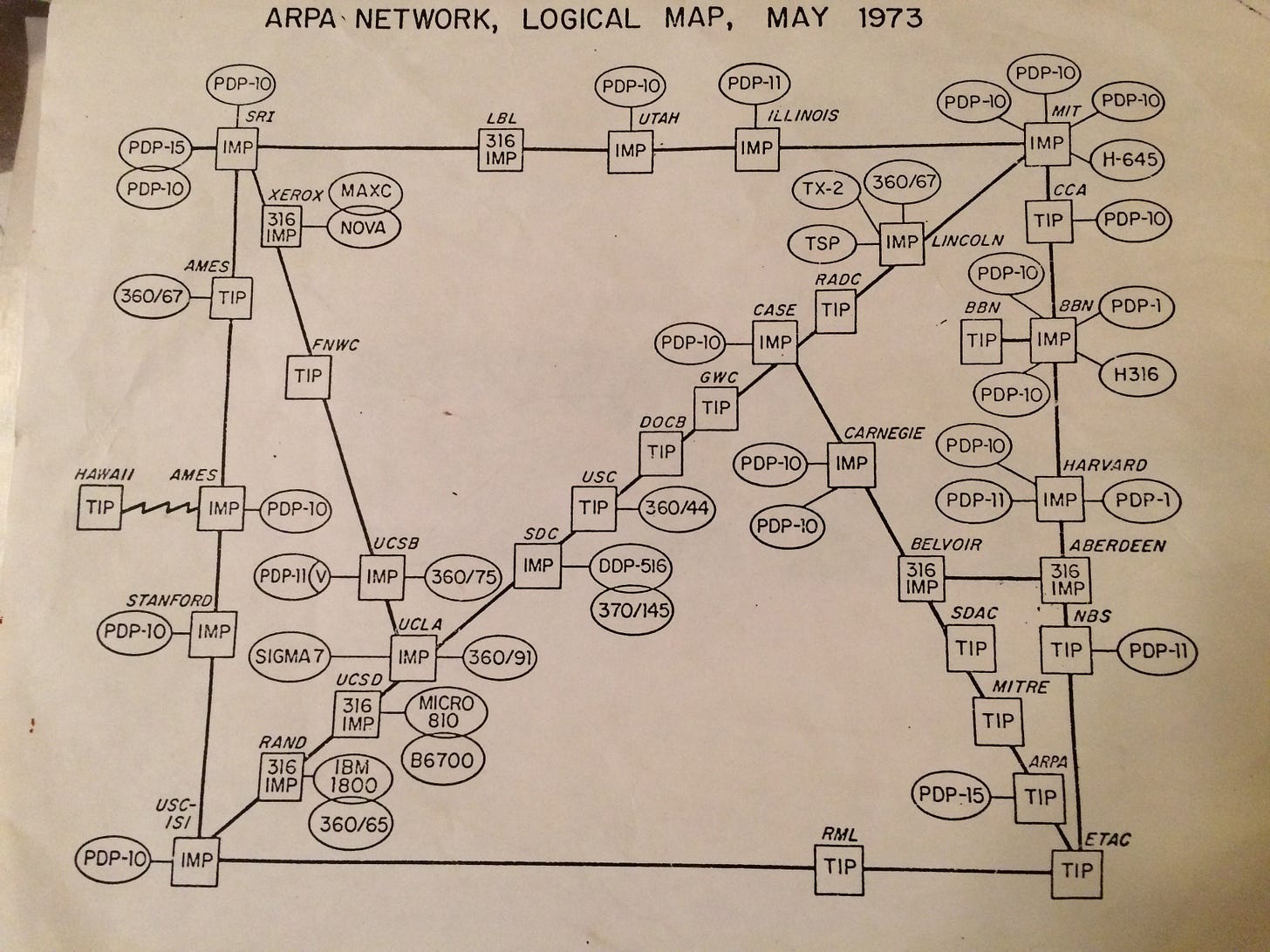

“Going through old papers my dad gave me, I found his map of the internet as of May 1973. The entire internet.”

Watch 🎥

President of the Financial Committee of El Salvador's Congress, Dania González, delivered a powerful speech in support of the country’s adopting Bitcoin as legal tender:

This is a must-watch 30-minute documentary about James J. Hill, who refused government handouts, avoided debt, and invested ruthlessly in human capital to become one of the most successful entrepreneurs of all time:

Groms 🐣

Remote: global HR for remote, distributed teams

Pods & Schools 🐬🐠

🔊 Arnold Van Den Berg - A Must Listen Life, and Investing, Discussion, on the Business Brew podcast. Incredible life lessons, investing insights, and powerful mind/subconscious hacks to lift your life to new levels in nearly every way. Highly recommend.

Arnold Van Den Berg is one of the most unique investors alive today. He is Jewish and was born in Amsterdam, Holland, in 1939. As a toddler, he and his family were forced to hide in a small closet when the Nazis searched his street. His mother was concerned that Arnold and his brother, then 5 years old, would not be able to keep quiet during the searches. Consequently, she arranged for Arnold and his brother to be smuggled out of Amsterdam. […]

Arnold is a testament to what humans can do. He and his immediate family survived the most hellish conditions on Earth. Yet, he holds no resentments. In fact, he discusses his experiences as something he’s almost grateful for because they enabled him to become the person he is now.

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey. You even get $10 for free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.