INTRODUCTION

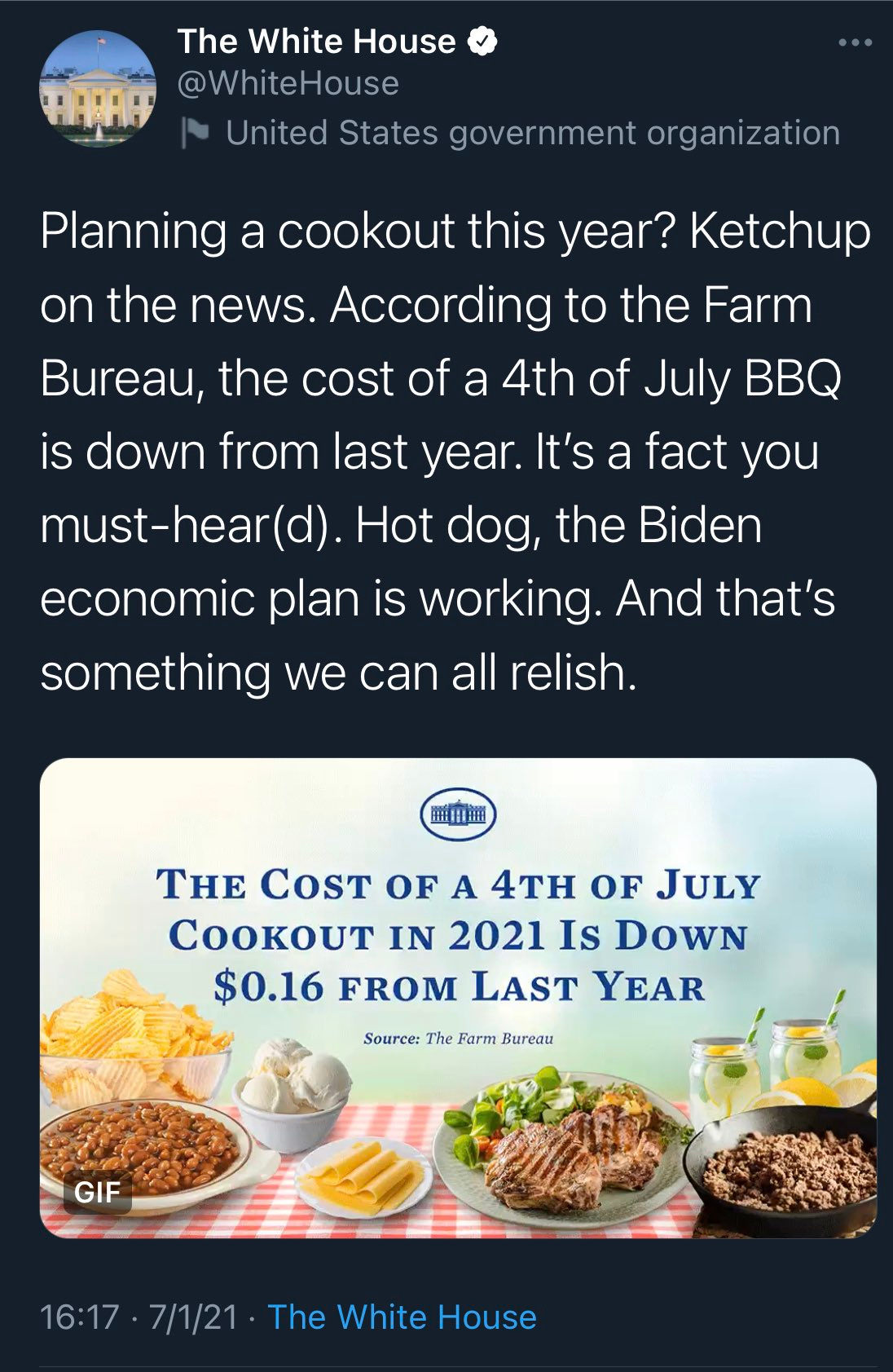

July 4, 2021

Hi everyone, and to my fellow American readers Happy Fourth of July!

And I must say: what a week.

As I sit here reflecting on the anniversary of America’s independence from foreign rule, I can’t help think of all the ways the country has become more dependent in other ways.

Of course, depending on people and systems is unavoidable and not inherently bad—the patchwork of interpersonal relationships, services, and trade channels is what a society is—but it can become problematic.

The relationship between needing help and giving help is a complicated one.

In the world of psychiatry there is a mental disorder called Munchausen by proxy where a caregiver makes up or causes an illness or injury in a person under their care. It can range from altering test results to active harm, usually on the young or elderly, and the underlying rationale has been attributed to everything from wanting attention to gaining monetary benefits.

There’s also the concept of iatrogenics, where unintentional harm is brought on by the one trying to do the healing.

Finally there’s the patient side of the equation. The one on the receiving end of help or treatment sits in a confusing position of wanting to feel better while also enjoying the benefits that come from needing assistance:

Illness has a few advantages that health cannot have; don't become attached to those advantages… The ill person gets sympathy from everybody else; nobody hurts him, everybody remains careful what they say to him, he is so ill. He remains the focus, the center of everybody—the family, the friends—he becomes the central person, he becomes important. Now, if he becomes too much attached to this importance, to this ego fulfillment, he will never want to be healthy again. He himself will cling to illness. And psychologists say there are many people who are clinging to illnesses because of the advantages illnesses have. And they have invested in their illnesses for so long that they have completely forgotten that they are clinging to those illnesses. They are afraid if they become healthy they will be nobody again.

—Osho, from Courage: The Joy of Living Dangerously

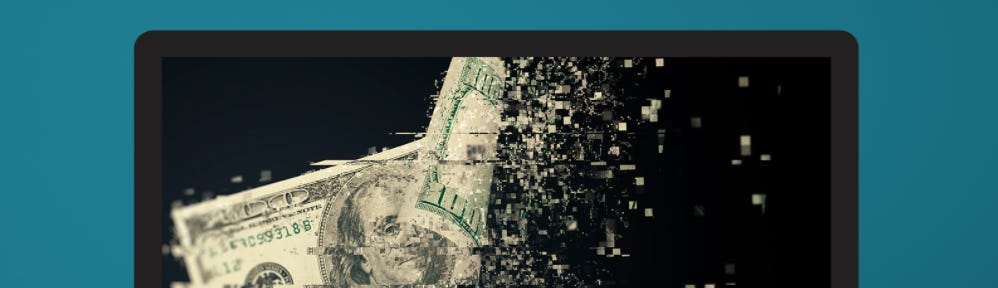

We sit here with an economy trillions deep in debt without the GDP to show for it, importing far more than we export, and artificially propped up by a perpetual cash creation and giveaway scheme that has created a new class of dependents.

We’re being kept financially unwell by policies designed to provide the remedy, and even though the healing of free money is causing real harm everyone is mostly just happy that their house and stocks are worth more.

Most negative macro consequences can usually be traced back to individual positive incentives, so the economy is an important window into human nature. Just follow the money. “Show me the incentives and I will show you the outcome,” as Charlie Munger says.

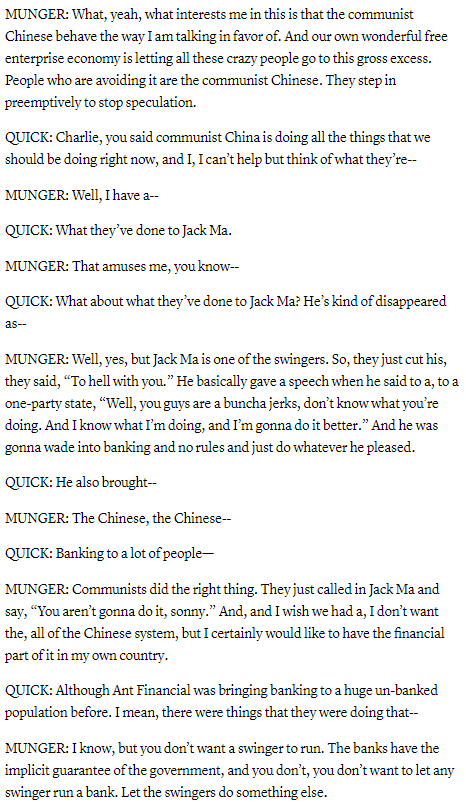

Speaking of Charlie, Warren Buffett’s billionaire business partner and 97 years young: he’s super into Communism these days 😬

Not the American Dream I thought he would have had in mind, but incentives explain it. When you have more centralized control you can just eliminate the things you don’t like rather than dealing with them.

To be the same age as Thomas Jefferson in 1776 a person today would have been born in 1988. But we don’t have a 30-something Millennials leading the country today—for the first time ever, the person sitting in the White House is actually a member of the Silent Generation (born between ~1928 & 1945).

Why are our oldest and supposedly wisest members of society being drawn so strongly to dependence on the government and centralized Communist-style control?

Does this discrepancy between bold youthful idealism and a cautious elderly caretaking instinct explain some of what we see in today’s America?

Well, perhaps. Perhaps not. We are pattern-seeking creatures, so noise is often confused for signal and correlations get mistaken for causes. But it is troubling.

The problem with constant free and easy money isn’t that it has clearly helped people, but rather that it has quietly harmed them. Inflation being what it is and with an interest rate hovering at 0% (or even flipping negative), it literally costs people money to save for their future. This is by design—the small cartel of unelected bankers known as the Federal Reserve don’t want people to save their money, they want people to spend their money in order to Stimulate The Economy™. And so that’s what people do.

But if people don’t save their money then it means they don’t have the freedom to plan their future. A country of only-spenders is a collection of people who quite literally have no future value.

"You can't have savings without an interest rate to encourage people to save. So if interest rates are zero, then you have no savings. What's the value of capital at zero percent? Where's my dividend discount model if my cost is zero? You can't do a model. If you don't have savings you don't have this idea that you have value in the future."

—Max Keiser

To become independent one must plan for the future now and accumulate the means to become self-reliant later. Long-term thinking and vision is what bootstraps the American Dream into existence. It’s what bootstrapped America into existence.

The idea of this whole grand American experiment is to become less dependent on power structures and more dependent on direct human relationships. Independence from top-down control in favor of personal, bottom-up value exchange. This is also the ethos of the Bitcoin protocol: a decentralized free and open-source monetary policy driven by rules, not rulers.

We can be a nation of “forever patients” who constantly want to be taken care of, or we can learn to become forever patient and take better care of our own future selves.

The best part of this grand American experiment is: we have the freedom to choose which one we want to be. And that’s the one freedom that can never be taken from us.

That’s the idea anyway. That’s the Dream.

“Everything can be taken from a man but one thing, the last of the human freedoms: to choose one’s attitude in any given set of circumstances. To choose one’s own way.”

—Viktor E. Frankl, from Man’s Search for Meaning

Until next time 🤙,

"In investing, what is comfortable is rarely profitable." —Robert Arnott

Breaking News 🌊

😞 Lebanon’s economic collapse and devaluing currency has caused violence and military intervention in Tripoli [Thread of footage]

📉 Homebuyer confidence collapses as applications to purchase a home fall to 17% lower than the same week one year ago [CNBC]

🦉 Duolingo files for US IPO, reporting revenue growth of 129% YoY in 2020 and $55.4M in revenue during Q1 2021 [TechCrunch]

📈 On Monday, Facebook's stock rose 4.2%, closing at $355.64, giving Facebook a $1T market cap for the first time, the fifth US company to hit the milestone [CNBC]

💰 Robinhood files for long-awaited IPO, says it will set aside up to 35% of shares for retail investors [Axios]

📛 Massive data leak exposes 700 million LinkedIn users’ information [Fortune]

Bitcoin News 💱

₿ 650 U.S. banks will soon be able to offer Bitcoin purchases to an estimated 24 million total customers [Forbes]

₿ Soros Fund Management, the family investment firm managed by billionaire George Soros, has been given the green light to trade Bitcoin [Bitcoin Magazine]

₿ Support for making Bitcoin legal tender grows in Latin America [Fortune]

₿ Ark and 21Shares file for Bitcoin ETF [Blockworks]

₿ Binance, the world’s largest cryptocurrency exchange, gets banned by UK regulator [CNBC]

₿ MicroStrategy and Galaxy ‘Bitcoin Mining Council’ Claims Mining is One of Most Sustainable Industries [Blockworks]

From The Tweetbox 🐦

“At starterstory.com we don't have any meetings, or use Slack, and rarely use email. All projects are executed, communicated, and documented in (essentially) one huge Google Doc. Everyone has access. 100% async. I think it works really well. We get so much done.” [Tweet]

“The gap between U.S. high-yield and investment-grade bond spreads has narrowed to the least since 2007” [Tweet]

“The Human Genome Project launched in 1990. By 1998 it was at 2% progress. The project reached completion by 2003. This is the nature of exponential growth. Bitcoin's adoption doubles every year. It's currently at 2% global penetration.” [Tweet]

“The Man who broke The Bank of England can now acquire Bitcoin.” [Tweet]

“Countries don’t ban bitcoin. They only ban themselves from the bitcoin network.” [Tweet]

For The Pros 😎

25 startup launch platforms, compared across 5 parameters (Link available to Pro subscribers)

What's the worst question that a founder can ask someone, and why? (Link available to Pro subscribers)

Polina Marinova Pompliano is the author of The Profile, a newsletter written about (and read by) thousands of the world's most successful people. Her subscribers include The Rock and legendary investor Jim O'Shaughnessy. Here are all of her tips, strategies, and advice: (Link available to Pro subscribers)

Check This Out 👀

A Metaverse ETF launched on the New York Stock Exchange, stock ticker $META.

It spans leading companies in gaming, platforms, cloud, XR, networking, crypto, VC, media, and more. Popular media analyst and writer Matthew Ball partnered with Roundhill Investments for its creation. The top 10 public companies included in the index, by rank (Sea, Facebook, Snap, and CloudFlare are also included):

Nvidia

Tencent

Roblox

Microsoft

Fastly

TSMC

Unity

Autodesk

Amazon

Qualcomm

From the Washington Post: The ‘Metaverse’ is growing. And now you can directly invest in it.

“Today’s generation of children express themselves, often learn and constantly socialize through virtual worlds they can touch, change and collaborate in. That’s not going to stop,” Ball wrote in his essay. “Rather, the capabilities of these virtual worlds will expand, their ease of use will improve, and their significance will grow. What’s more, the ‘iPad native’ generation will continue to mature. Most are still consumers, a few are creators, and almost none are business leaders. They will be, and their frames of reference will lead to transformative change.”

PNG 🖼

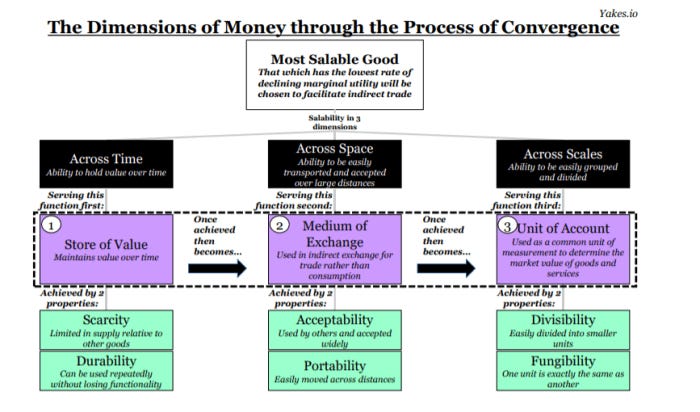

The best visual I’ve seen that explains how something becomes money:

“Tell me you know inflation is a growing concern, without telling me you know inflation is a growing concern”:

Pods & Schools 🐬🐠

Recent podcasts + books I highly recommend, and upcoming courses + seminars that look promising

🔊 But Hoarding Money Destroys The Economy!, from the Bitcoin Audible podcast.

“What the government does by manipulating the prices is they break the glass on the front of the altimeter and they push the gauge back to level so that it looks like everything’s fine.

And then they serve drinks to everybody on the plane to make sure everybody’s drunk and nobody thinks about it too hard.”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.