INTRODUCTION

August 29, 2021

Hi everyone—I’m so glad to have you here. What a week.

We never do what we’re supposed to do, do we?

We’re encouraged to save, save, save our whole lives, at least to the extent that we can. But then: the better things seem to go for us, the more we’re encouraged to spend.

And then, after we get used to spending, we’re informed of the hedonic treadmill—that constant upgrading of lifestyle that comes with each successive raise, causing us to be trapped in a newer, more expensive normal.

And finally, when times get tough and things don’t go as planned, we’re not being encouraged to save and protect what we have. No, instead we’re encouraged to spend even more money, and even borrow some to buy things we can’t afford. Like new houses, or new cars. All this at the time when to us it seems like the most foolish thing to do, we are told by The Media and The Banks that spending and borrowing is a good thing. That it helps. That it “stimulates the economy.”

“The logic would be that in a downturn The Fed will reduce the cost to borrow money, and that will cause people to borrow and make investments in homes, and corporations to make investments in new output capacity and whatnot… and then that will drive employment growth, income growth, and so on for the overall economy.”

So who’s benefitting from all this stimulated economy? Well, it doesn’t seem to be the person who’s now in debt and has new bills to pay that’s for sure.

[…] The problem with trying to stimulate an economy by lowering interest rates is that what ultimately drives nominal growth of any kind is gonna be spending. When you lower the cost to borrow money you don’t necessarily create conditions under which more people are able to spend because when you borrow money you’re encumbered by the borrowing process—you have a debt that you have to take on.”

So which is it? Should we spend or save? And why does either one never seem to help matters much anyway?

Economist John Maynard Keynes referred to this whole thing as the paradox of thrift: If spending money and buying things from businesses is good for the economy, especially during a recession, then personal savings (i.e. not spending money) is a drag on the economy and should, theoretically, be discouraged. By lowering interest rates and encouraging people to spend money they don’t have, banks are attempting to “help” the economy… often to the detriment of the borrower in the long term.

It’s an example of a disconnect between the individual and the group. What’s good for the former is not always good for the latter, and vice versa.

Another example occurs in war, when hundreds of thousands of individuals may lose their lives for the greater “good” of a larger victory for the country they serve. What then happens is people—usually starting with the artists, writers, and philosophers who experienced war firsthand or served in those armies themselves—start to question the very notion of words like “good” and “victory.” Good? For who? Why? At what cost? These same questions pop up in the world of business and finance.

At its heart, business isn’t about money and profits it’s about needs and wants. It’s a system of trade and goes back millennia. And the stock market—an abstract layer on top of this mercantile commerce stack—is not a window into business it's a window into people. It’s propelled by greed and tumbles out of fear. Prices and values are openly talked about in terms of expectations, hope, and projections. These are not financial instruments we’re talking about, they’re human behaviors and feelings.

The paradox of thrift highlights the deficiency of any economic theory that relies on individuals to sacrifice their own well-being for the well-being of the theory. It’s like a map placing blame on the terrain for being incorrect.

One person’s revenue is another person’s expense. The way forward may be to help individuals get on the other side of the transaction—to sell more goods or services of their own. Right now the limited downside of comfort is more alluring than the enormous upside of starting a business, no matter how humble. But maybe shouldn’t be.

The way out would be to remember that we can only save so much money, but there’s no limit to the amount we can make. Saving money is a bounded thing, based on scarcity and limits, but creating money has no limits or rules about how it can be done. It’s an unbounded, positive-sum game—creating a new side project or product does not deprive someone else of creating a side project or product of their own. Joining forces with other creators usually generates more profits for each, not less.

In our society, more emphasis is placed on being a good consumer and hardly any emphasis is placed on being a good creator.

Doing so may not resolve the paradox entirely, but it would soften its impact and put more control in the hands of people who are otherwise subject to the whims of policy and politics. And at least that’s a start.

Until next time 🤙,

“The world is a tragedy to those who feel, but a comedy to those who think.” —Horace Walpole

Breaking News 🌊

🤡 S&P 500 Hits Second-Straight Record High [Forbes]

📈 Median new home sales price hits a record $390,500 [Zero Hedge]

⚠ Powell’s benign view on inflation is getting pushback at the Fed, and elsewhere [CNBC]

🤔 Legendary investor Jeff Gundlach says the US is running its economy like it doesn't care if the dollar loses its status as the world's reserve currency [Markets Insider]

🛢 Oil firms slash U.S. Gulf of Mexico output by 91% ahead of powerful Hurricane Ida [CNBC]

Bitcoin News 💱

₿ Substack is now accepting Bitcoin payments on the Lightning Network powered by Bitcoin payment processor OpenNode [PR Newswire]

₿ Fidelity projects $1 million bitcoin price in 2026. [Documenting Bitcoin]; from Fidelity’s latest bitcoin analysis [Documenting Bitcoin]

₿ Morgan Stanley has just reported owning a large amount of Grayscale Bitcoin Trust across multiple portfolios. The largest of these appears to be 928,051 shares held by Morgan's Insight Fund. [MacroScope]; Miller Opportunity Trust, run by billionaire investor Bill Miller, reported owning 1,500,000 shares of Grayscale Bitcoin as of June 30 [MacroScope]

₿ Citi to trade bitcoin futures. [Coindesk]

₿ Cuba’s central bank now recognizes cryptocurrencies such as bitcoin [CNBC]

₿ Iran to lift bitcoin mining ban in September [Bitcoin Magazine]

₿ MicroStrategy purchased an additional 3,907 bitcoins for ~$177 million in cash at an average price of ~$45,294 per bitcoin [MicroStrategy]

From The Tweetbox 🐦

“Why are so many businesses ‘more open to taking risks?’ Uh, easy money. When borrowing's too cheap, ‘It’s not that entrepreneurs become idiots. It’s that idiots become entrepreneurs.’ [Tweet]

“Certain market participants, ironically, never participate. They are always bearish.

Even as securities fall -50% or real estate falls -20%, they still find reasons not to take a risk. Personally, not taking a risk at the time of a discount worries me more than taking a loss.” [Tweet]

"Many value investors are driven by what I call accounting value as opposed to economic value. The greatest example of that in the markets in the last 25 years is the people that hated Amazon since it became public because they claimed it never made any money." [Tweet]

For The Pros 😎

Don't build what shouldn't be built (Link available to Pro subscribers)

Top 25 Chrome extensions for marketers (Link available to Pro subscribers)

Simple pricing tweaks that will make you more money (Link available to Pro subscribers)

Worth A Read 📃

Netflix and Video Games, the latest from Matthew Ball

Netflix has ‘officially’ entered gaming. During the company’s Q2 2021 earnings call, Hastings confirmed Netflix had hired its first-ever VP of gaming, and also began to unveil how the video streamer would enter video gaming. […]

This essay will cover four areas: (1) Why Netflix wants to enter gaming (beyond the money); (2) The challenges Netflix faces when entering gaming; (3) What Netflix seems to be doing; and (4) Where this might be going and when.

Digital Scarcity in the Time of Bitcoin, the latest from NYDIG’s Global Head of Research, Greg Cipolaro

While we currently believe the biggest use case for digital scarcity will likely be money, the transition to digital goods in the virtual world is an undeniable secular trend. As these applications of digital scarcity continue to evolve, it’s important to remember that they are all possible because of the innovations brought together by Bitcoin.

Check This Out 👀

Paxful: Changing Lives in Africa

“Paxful is a peer-to-peer (P2P) Bitcoin marketplace. However, they aren’t just your run-of-the-mill trading platform: they have a very real agenda for good. Their mission is to help the unbanked gain financial freedom and improve the lives of communities across Africa.”

Go follow Paxful founder and CEO Ray Youssef if you want to be more inspired and bullish on the future of humanity ✨

PNGs 🖼

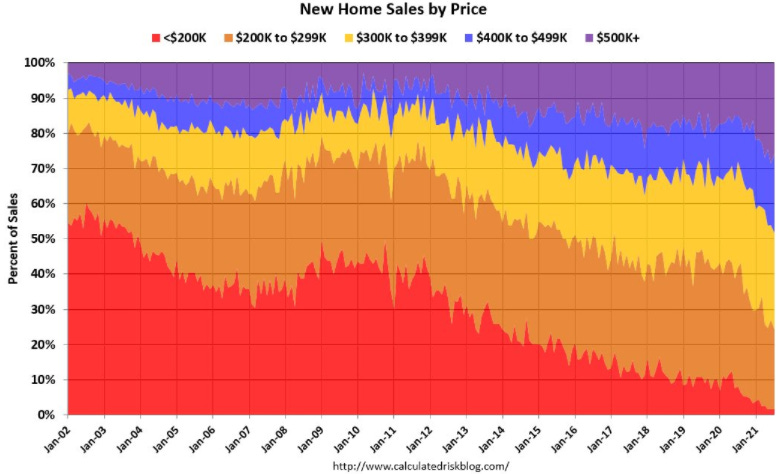

No new homes under $200k

"in the complete uncertainty as to the future, all business became a game of chance, and all business men, gamblers." —A.D. White, ‘Fiat Money Inflation in France’ (1912)

Pods & Schools 🐬🐠

Recent podcasts + books I highly recommend, and upcoming courses + seminars that look promising

🔊 Karen Karniol-Tambour - All Things Macro. Karen Karniol-Tambour is the Co-CIO for Sustainability at Bridgewater Associates. We cover a variety of the most important themes in the market today, how each of them has become more important for investors, and what today's 60/40 portfolio might look like.

Last time we had big inflationary shifts in the '70s and ‘80s the structure of the economy was really different. You had unions, and collective bargaining… and now you’re in this case of: who really chooses to get higher wages? Who really chooses to go raise the price of an iPhone? In the last few months you’ve read really funny stuff that I think breaks textbook economics.

📚 When Genius Failed: The Rise and Fall of Long-Term Capital Management, by Roger Lowenstein

‘You can overintellectualize these Greek letters,’ Pflug reflected, referring to the alphas, betas, and gammas in the option trader’s argot.

‘One Greek word that ought to be in there is hubris.’

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.