Surf Report: The thing everybody needs but nobody cares about

Issue 24: 03.07.2021 (Free Version)

INTRODUCTION

March 07, 2021

Hey everyone—I’m so glad to have you here. What a week.

This tension between not caring about money but also needing money is at the heart of, I’m increasingly convinced, pretty much everything. Add to it the fact that talking about money/salary/investments is considered culturally taboo & “in poor taste” and you have a society in serious turmoil.

Many people try to relieve the tension by emphasizing that there are more important things in life than money, and that “the best things in life are free.” The problem with that expression is it’s technically not true. It’s simply that experiences which only accept time as currency—like playing with your kids or going for a long walk on the beach—are worth a lot to you. But your time is worth a lot too (unlike money, you can’t make more of it), so it’s a fair exchange. In dollar terms, extra time spent with a loved one is priceless and not for sale. But in time terms, it’s the best return on investment you can get and completely worth the price of admission: your time.

Some people have really taken to this line of thinking and refer to themselves as “time billionaires.”

If you had the opportunity to switch places with Warren Buffett, would you do it? You could be one of the richest people in the world. But you would also have to be 90 years old.

[The] majority of people think they want money until they are forced to evaluate the lack of time that comes with it in this scenario. Quickly, the value of time becomes evident and people opt for being younger, rather than richer.

We're all born “time billionaires,” and we just get poorer as we spend our time.

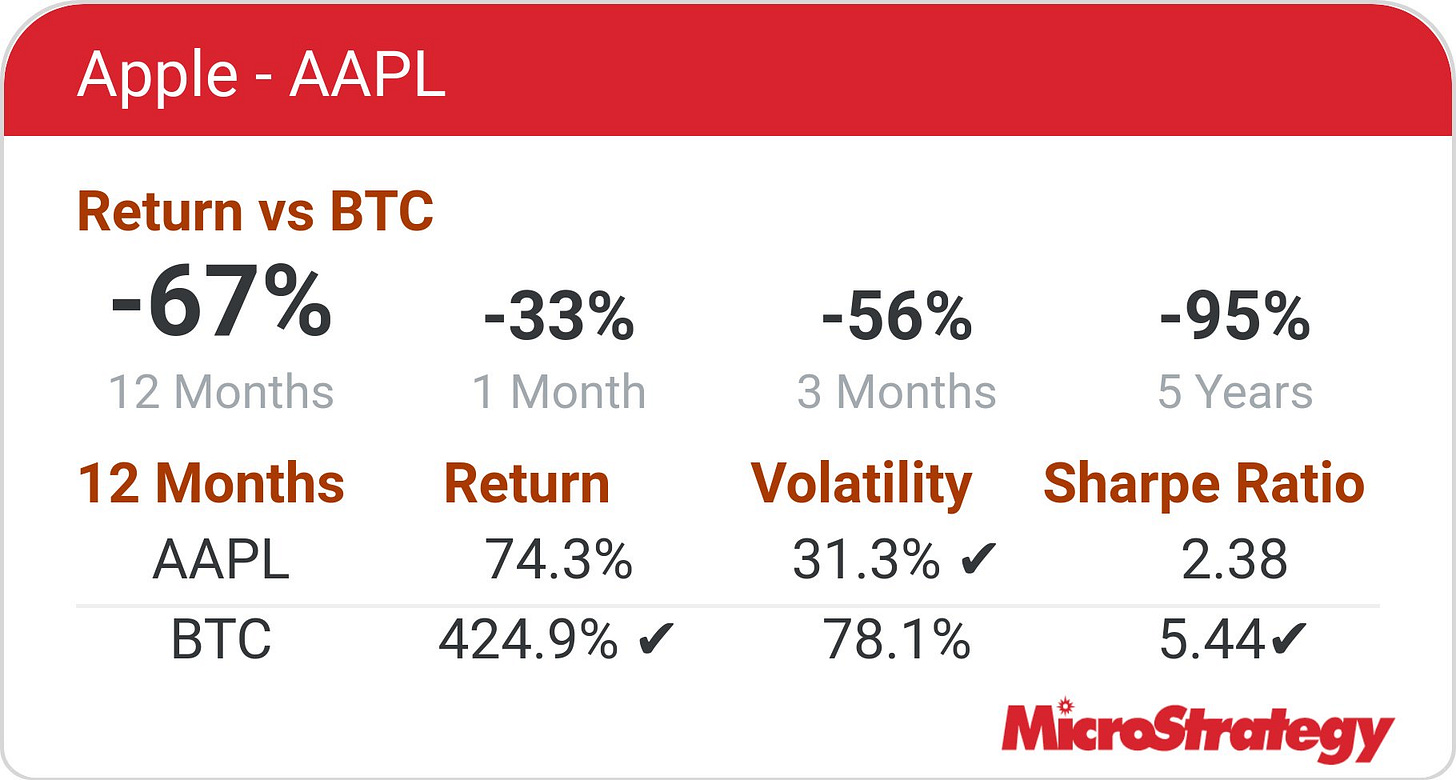

People like Ross Stevens, Elon Musk, and Michael Saylor, who have converted billions of dollars of their treasury reserves into Bitcoin, are denominating their performance in BTC and measuring against that instead of the inflating USD. Bitcoin is essentially their unit of account now, and they’re betting on it becoming the standard by which everything eventually gets valued in the future, including the dollar.

So through that lens Apple stock, and really the entire S&P 500, has been trending toward zero over time in Bitcoin terms:

FTSE Russell is a well-known financial resource that offers similar comparisons:

Bitcoin is an emerging store of value, not a fully mature one, so its near-term volatility in dollar terms is what has many people nervous about owning some. Those who are adopting it as a percentage of their cash reserves are betting that this near term volatility will be dwarfed by its long-term appreciation and market cap, at which point its volatility will have settled down and its store of value properties will be more apparent, which will attract more buyers and network participants and stabilize it even further.

But this type of comparative thinking can be applied to all sorts of things to provide more useful context. For example, this past week the market cap of Tesla’s stock fell by Ford + GM + VW’s combined market caps, but still stands at 2x Toyota’s value. Comparing their value to other automakers not only makes sense but is more in line with industry standard than saying *TESLA FALLS FOR 4TH WEEK, PUSHING MKT VALUE LOSS TO $234B

The denominator matters. What you use as your baseline comparison makes all the difference.

Everyone is measuring stock market performance in dollar terms, but if that dollar is being debased through quantitative easing (money printing + bond purchases) and stimulus (cash giveaways) then maybe we should compare its performance to something else entirely. After all, politicians have manipulated currency before in order to get the result they wanted to promote. ("If you wanted to come up with $1 trillion without anyone noticing the difference, all you needed to do was change the value of money.")

Make no mistake: everything is broken right now.

Believe it or not I don’t care much about money either. Recently I’ve had to become an amateur economist of sorts just to try to avoid all this financial funny business and set myself up for a life I can spend doing other things entirely: play games & surf waves, but also read books, make music, and study philosophy. There’s a reason they’re called the liberal arts: the ancient Greeks coined the term to describe pursuits afforded only to “free” people who didn’t have to toil all day long to survive.

It’s only once you deal with the thing you don’t care about that you get the time to spend on the things you do.

Until next time 🤙,

“The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn.” —Alvin Toffler

Breaking 🌊

📉 Jerome Powell reaffirmed the Fed's commitment to low interest rates and cheap money until inflation rises above 2%, which sent (and is still sending) the markets into turmoil as it was not what investors wanted to hear.

💸 The Senate passed Biden's $1.9 trillion stimulus bill.

🏛 Gary Gensler, Biden’s pick to head the Securities and Exchange Commission and former MIT professor of economics and blockchain technology, fielded questions from Senators during this week’s congressional hearing.

🏧 Square officially became a bank, offering business loans and deposit products. 😯 They also bought the majority of music streaming service Tidal and added Jay Z to its board. 😎

🔎 Citing privacy concerns, Google said it will stop targeting ads to individuals based on data collected directly from websites they have visited.

🤵 Reddit hired its first Chief Financial Officer as it prepares for IPO, and online learning platform Coursera filed their initial public offering on Friday after seeing its 2020 sales jump 59%.

📅 Companies around the world are beginning to embrace the four-day workweek. Two-thirds that implemented the policy saw increased productivity & client satisfaction.

🎮 Epic Games acquired Mediatonic, the creator of Fall Guys. CEO Tim Sweeny cited the company’s goal to “invest in building the metaverse.”

₿💱 The head of global macro at Fidelity said that Bitcoin “has evolved to the point that it could be treated as a form of digital gold…a possible counterweight to future monetary inflation” and Charles Schwab said it could offer digital assets this year. MicroStrategy also purchased an additional ~205 bitcoins and now holds a total of ~91,064 bitcoins acquired for ~$2.196 billion. And the IRS made clear that cryptocurrency purchases made in USD are not reportable to the IRS (only the capital gains once/if you eventually sell).

From The Tweetbox 🐦

“If you explain a simple concept using over complicated jargon, I don’t trust you.”

“School doesn't teach you how to think, it teaches you how to think like everyone else.”

I made a thread on Twitter of all my favorite excerpts from the book The Physics of Wall Street. It was a great book and I learned a lot 👌

For The Pros 😎

Some lessons learned from the biggest data breaches of 2020 - Aimed mainly at software developers, it highlights the increasing importance of cryptography and cybersecurity across the business landscape. (Link available to Pro subscribers)

An article from a 1959 issue of The New Yorker that dives into the making and selling of Coca-Cola. (Link available to Pro subscribers)

How Hard Should You Work? (Link available to Pro subscribers)

Finance as culture. (Link available to Pro subscribers)

A great perspective on how Jack Dorsey runs two public companies simultaneously, yet apparently differently. (Link available to Pro subscribers)

Less obvious ways to build an audience - a super refreshing take on the whole “how to build an audience” topic, with more subtle refinements that can make all the difference. (Link available to Pro subscribers)

Here’s An Idea 💡

“Think of the NFT (non-fungible token) as the autograph, not the art itself”

People are paying millions of dollars for things like pixel art and tweets, so this helpful take might help to explain some of the logic behind the mania. NFTs may also be behind Square’s recent ownership stake in Jay-Z’s streaming music service Tidal, setting the stage for a future of infinitely replicable music but “signature-scarce” authentic originals. 🤔

Worth A Read 📃

Apple, Its Control Over the iPhone, The Internet, And The Metaverse. This one is from early February, and like all of Matthew Ball’s epic takes on the world of media that I wait too long to read… it was completely worth it.

What matters is that a growing share of our time will be spent within virtual spaces and with virtual goods — for education, work, health, politics and leisure. Sometimes these spaces and goods will be purely virtual, other times virtual twins of physical ones, and sometimes augmented reality. For related reasons, a growing percentage of our income will be spent on virtual assets, goods, experiences — many of which we’ll be able to sell, trade, share, use or improve. And of course, enormous new industries, marketplaces and resources will emerge to enable these opportunities, with novel types of labor, skills, professions and certifications invented to serve them.

In the end, the only way to kill Bitcoin may be to make it so that people don’t need it anymore. If no one wants a devaluation-proof, censorship-resistant, permissionless, borderless, non-discriminatory, teleporting financial asset, then no one will feed it energy, and it will die. Perhaps humanity can come up with another technology that addresses these needs.

PNG 🖼

Moore’s law says the number of transistors in a dense integrated circuit doubles about every two years. (it’s why our computers keep getting smaller and faster).

Metcalfe’s law says that the value of a telecommunications network is proportional to the square of the number of connected users of the system. (it’s why things like the internet and Facebook and Bitcoin are so valuable.)

Humans are notoriously bad at comprehending the magnitude of their impact on the future, so I made this stupid contribution to the meme-o-sphere:

“The beginnings of all things are small.” —Cicero

Groms 🐣

Subscription coffee startup Bottomless raised a $4.5M Series A led by O’Shaughnessy Asset Management. The coffee comes with a digital scale that triggers automatic refills when beans are running low. Bottomless said it aims to 10x its customer base this year.

“Don’t tell me what you think, tell me what you have in your portfolio.” —Nassim Nicholas Taleb

Drop Ins 🏄

My latest investments & trades

Buy & Hold Investments (I will hold these forever)

This section is only available for contributing subscribers. If you’d like to trade and invest along with me, consider one of the paid tiers!

Swing Trades (1-3 month time horizon)

This section is only available for contributing subscribers. If you’d like to trade and invest along with me, consider one of the paid tiers!

Barrels 🎯

Portfolio Highlights

Winning Trade of the Week: $PLL, scaled out some profits for a 167.7% return.

Pods & Schools 🐬🐠

🔊 Lily Francus – Options, Passive & Speculation (EP.36). Lily Francus is an independent quantitative researcher and creator of the NOPE indicator. (Also a killer follow on Twitter). You’ll learn a lot about options, markets, thinking, and like all podcasts with Jim O’Shaughnessy, life.

🔊 Business with Jeff Booth. Hearing Jeff Booth explain why technology is inherently deflationary and completely at odds with an inflationary monetary system turns out to be much more mind-blowing than it sounds. If you don’t have time to read his book The Price of Tomorrow, make time to listen to this 53-minute pod. (Despite the podcast name, it’s mostly not about Bitcoin.)

📚 If you’re looking for a good introductory read to wrap your head around whole Bitcoin thing, the book Inventing Bitcoin by Swan founder Yan Pritzker is one of the best I’ve read. It sells on Amazon for $8.95 and has a 4.9/5 rating, but you can use this referral link to download your own copy for free. No need to set up a Swan account or anything to get the book, they just ask for your e-mail address to send it to you.

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey. You even get $10 for free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.