Surf Report: You down with YCC?

Issue 26: 03.21.2021 (Free Version)

INTRODUCTION

March 21, 2021

Hey everyone—I’m so glad to have you here. What a week.

Recently a fellow on the tweetbox had this to say about all the anxiety and chatter right now about bond yields:

I don't get the recent drama around bond yields.

They were always expected to go back to pre pandemic levels.

We are recovering.

It feels like people use them as an excuse to justify the drops in their overvalued stocks... 🤔

As you know by now, I am one of the ones sounding the alarm about the cracks in the bond market so obviously I disagree with this take, but many of you may sympathize with it. After all it’s not an unreasonable perspective, and honestly makes plenty of sense at first glance.

But Ray Dalio echoed my sentiment on Monday in a blog post on LinkedIn, and I recommend reading the whole thing. It’s a stunner.

… The economics of investing in bonds (and most financial assets) has become stupid.

… The world is a) substantially overweighted in bonds (and other financial assets, especially US bonds) at the same time that b) governments (especially the US) are producing enormous amounts more debt and bonds and other debt assets.

… If history and logic are to be a guide, policy makers who are short of money will raise taxes and won’t like these capital movements out of debt assets and into other storehold of wealth assets and other tax domains so they could very well impose prohibitions against capital movements to other assets (e.g., gold, Bitcoin, etc.) and other locations. These tax changes could be more shocking than expected.

For the first time ever Ray is talking about seriously using Bitcoin (along with gold) to escape incoming inflation. And this is a guy who’s made a fortune trading debt markets for 50 years, and successfully predicted the last recession through the lens of his now famous theory of long- and short-term debt cycles. (👈 Great video explainer in that link)

Now to be fair, our current financial system actually expects and relies on inflation to some degree. But the prospect of sudden, runaway hyperinflation is on the table and is what has people worried. (The book When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany does a great job recounting the famous example of a German republic in the aftermath of World War I when its currency was made effectively worthless and society was reduced to a barter economy.)

Hyperinflation happens when there is an accelerating increase in money supply that isn’t supported by a corresponding growth in the output of goods and services, creating a feedback loop that demands ever more money to stay afloat. Quickly increasing prices make people unwilling to hold the currency for very long, which in turn causes further acceleration in prices given all the new demand for spending. Yada yada yada, and before you know it you have $100 loaves of bread & people trading a used car for a few cases of canned tuna. This scenario might seem far fetched to someone living in the US, but is well understood by people who have recently experienced it in places like Zimbabwe, Venezuela, Greece, and Hungary.

Fed Chairman Jerome Powell spoke last week about the state of things, but expertly avoided and delayed the topic of extending the SLR for banks, even after being asked about it directly as one of the first questions during the live Q&A session. In fact, most of what he had to say about everything was vague and “dovish,” suggesting the Fed will do everything it can to just let the market run hot on inflation and course correct naturally. The Fed does not want to impose yield curve control (YCC), which is a last-resort option used to artificially stop long term treasuries from continuing to spike sharply by pegging them to a specific fixed rate and stepping in to buy bonds (and other assets) themselves.

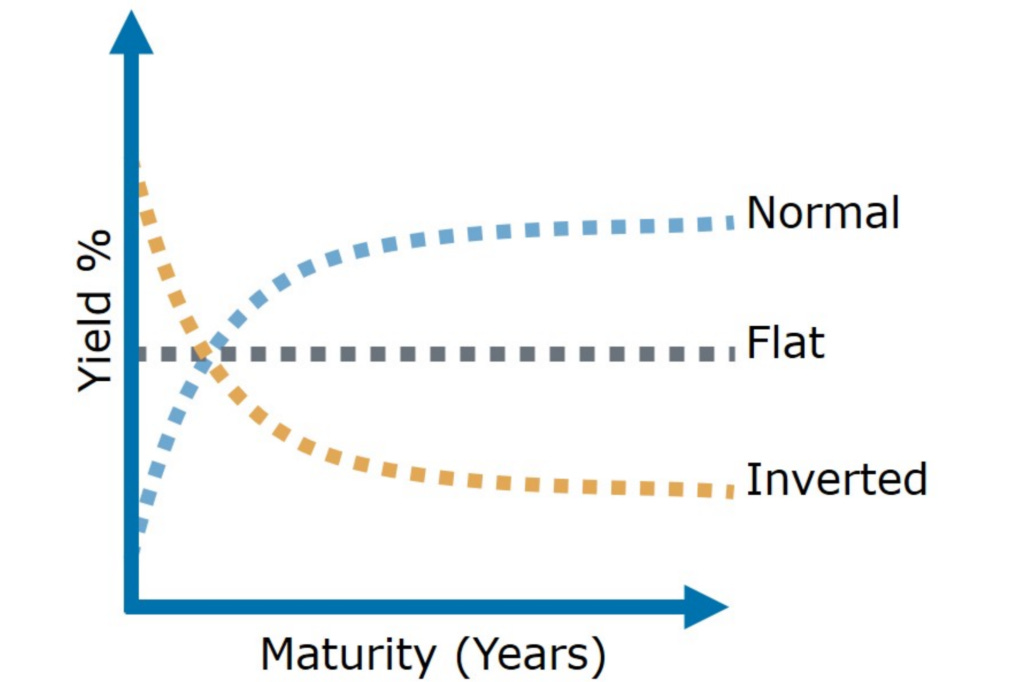

What we all ideally want is a Treasury yield curve that smooths out gradually as it extends, flattening down naturally and making the future a bit more predictable:

Unfortunately right now we have an inverted yield curve. This has successfully predicted the past seven recessions, since it means 1.) people see the future as more uncertain and therefore want higher interest to take on the risk of holding long term bonds, and 2.) they are more likely to save than spend:

But Powell and that Twitter guy think that we are all going to emerge from lockdowns vaccinated and ready to spend, fresh stimulus money in hand. They think our economy is “recovering,” and business will be booming this summer. They expect people to return to some semblance of normal and continue with most of their pre-Covid behaviors, and not keep saving money at record levels as they have been. And they think that concern about bond yields is overblown because people will feel so good about the economy that they will continue to pay a premium to own stocks and real estate at current valuations knowing their expected future valuations are totally justified.

Well, perhaps.

Michael Batnick says the economy is going to boom and that investors shouldn’t overthink things. And Juliette Declercq says equity markets are standing on firmer ground than most people realize. I listened to each of their full explanations and disagree on a number of points, but this type of thing is an important part of my learning process. I try not to steep my education in too much consensus. In this case I hold an admittedly unpopular minority view, so finding disagreement hasn’t be difficult.

But keep an eye on the 10 Year Treasury and the velocity of the broad money supply in the coming months—the effects of inflation become more pronounced the more money people start spending. If these two rise steeply in tandem it would be rocket fuel for the inflation shuttle and signal a big repricing event ahead (read: correction) in assets and real estate across the board.

But hey, for all our sakes: hopefully Twitter guy & Jerome Powell are more correct than Ray & I. Place your bets accordingly.

Until next time 🤙,

“The thing about smart people is that they seem like crazy people to dumb people.”

—Stephen Hawking

Breaking 🌊

💳 Online payments giant Stripe closes a $600M round at a $95B valuation, more than triple their valuation one year ago.

🖱 Drag & drop website building platform Squarespace raised $300M at a staggering $10B valuation.

🏪 Creative marketplace Gumroad is raising $6 million at a $100 million valuation, with $5 million coming from anyone willing to fork over at least $100. They’re hoping to work with the SEC and bring equity crowdfunding more mainstream for the masses.

🌐 Wikipedia wants to charge Google, Amazon, and Apple for using its content

₿💱 Morgan Stanley, the largest US brokerage, is embracing Bitcoin as a result of high-net-worth client demand, and released a report called “The Case for Cryptocurrency as an investable asset class in a diversified portfolio."; Visa plans to enable Bitcoin payments at 70 Million merchants; Investing legend Howard Marks changes his mind on Bitcoin, and says he’s glad his son owns a meaningful amount for his family; Deutsche Bank says Bitcoin is ‘too important to ignore’;

From The Tweetbox 🐦

Emotional investing is rarely good investing.

Six threads better than a college degree

The share of US debt held by foreigners has fallen to its lowest level since 2002

Here’s why traditional investors don’t understand #Bitcoin

For The Pros 😎

A great roundup of high-quality tools, newsletters, books, podcasts, courses, and events. (Link available to Pro subscribers)

50 years of gaming history, by revenue stream, in one gorgeous data viz graphic. (Link available to Pro subscribers)

One global Chief Strategy Officer on why Bitcoin has been misunderstood (Link available to Pro subscribers)

How Covid accelerated the future… and why you need to seize it (Link available to Pro subscribers)

How one expert marketer used international SEO to add over £8M revenue for an ecommerce brand (the same approach could be used for SaaS products) (Link available to Pro subscribers)

How to get your first $100k of monthly recurring revenue (Link available to Pro subscribers)

How one founder made >$500k in one week through pre-sales (Link available to Pro subscribers)

Worth A Read 📃

How indie game makers turned Roblox into a $30 billion company

Roblox has quietly grown into one of the most valuable gaming companies of all time, leading one commentator to call it the “biggest video game none of us are talking about.” And it isn’t so much a game, but a free online platform where ~33M people (mostly children under 16) log on every day to play one of the 20M user-created games.

It’s been huge for creators too, who earned nearly $330M last year in the platform’s digital currency, “robux.” Hundreds of creators earned six-figure salaries in 2020, and made at least one 21-year-old millionaire.

With no school to attend and birthday parties canceled, kids turned to Roblox, where they can socialize virtually, navigating theme parks, attending concerts and playing action games while also staying in touch using its popular text chat feature.

PNGs 🖼

Most of the energy we currently generate is completely wasted:

“The beginnings of all things are small.” —Cicero

Groms 🐣

Gaming startup Overwolf has raised $52.5M for its platform to build, distribute and monetize in-game, user-generated content.

Overwolf is a full fledged market place for user-created modifications (mods) and additional tools for all kinds of PC games. It was developed as a response to demand from avid gamers for more tools to improve their experience of the game, sometimes very specific ones that might not be core to everyone’s experience but definitely wanted by enough people to merit their creation.

Pods & Schools 🐬🐠

🔊 The Bitcoin Standard podcast with Saifedean Ammous, Episode 41: Can bitcoin obsolete bonds?

A recording of Saifedean’s latest weekly seminar. Topics addressed include: “Are there any good reasons for bonds to exist in a world in which bitcoin works?” & “What is the case for holding gold in a bitcoin world?”

Tools of the Trade ⚒

Products I use to make money

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey. You even get $10 for free ✨

StockCharts. I easily make back the small monthly subscription fee with the superpowers it gives me.

Carrd. I use card for all my landing page needs. Use this link or referral code 892PYX69 to start your own web empire.

Disclaimer

Nothing in this email is intended to serve as financial advice. Do your own research.