[Quick note: I realized far too late that last week’s audio never recorded properly and listeners had downloaded 12 minutes of silence, so I went back, re-recorded, and re-uploaded for anyone still interested: Surf Report: The part and the whole]

As in Baudelaire’s sad poem about the albatross, what is made to fly will not do well trapped on the ground, where it is forced to traipse. And it is quite fitting that “volatility” comes from volare, “to fly” in Latin.

Depriving political (and other) systems of volatility harms them, causing eventually greater volatility of the cascading type.

—Nassim Taleb, from Antifragile

Hi everyone—I’m so glad to have you here. What a week.

Blood was all over the streets on Friday as tech stocks experienced their worst week since March 2020. Netflix, a perennial darling of Wall Street, had it’s worst day in a decade, and Amazon had its worst week since 2018. And nobody likes Peloton anymore.

These kind of large, outsized intra-day events will continue to happen as people are forced into markets whether they like it or not, looking for any growth at all to protect their purchasing power, which is being melted away by inflationary decision-making at the highest levels of centralized authority.

People are buying “blue chip” assets at any price, many not having done any due diligence necessary to determine if these are actually things they want to hold or trade. Greed and fear are what move markets, and when fear kicks in you learn how you really feel about what you claim to be “invested” in.

This is why Fed policy—this charade of manipulating interest rates and buying Treasuries no one else wants to create artificial demand and incentivize spending or saving at will—is so pernicious. It’s not only distorting price signals into numbers no one can trust, but it creates the conditions for certain behaviors done not out of individual desire but because there’s essentially no other choice.

There is a record $1.7 trillion in excess liquidity that nobody wants sitting in the Fed reverse repo facility right now. That’s money that firms would rather park with the Federal Reserve for negligible yield than invest anywhere else.

The Fed (with their cringey sidekick the U.S. Treasury) has artificially created a market of shallow participants with low conviction and plenty to lose. And once something triggers The Fear, a cascade of ripple effects is set into motion with prices hitting lows that trigger margin liquidations and panic selling… it’s a real mess. But this is what happens. This is what always happens.

The problem is that these events are never allowed to occur on a large scale to flush out over-leveraged traders and low-conviction sellers. Instead, if we experience a market “crash,” the Fed now steps in and does something to “help.” But their intervention just makes things worse because the system itself never eliminates the problem. Excessive risk takers never face true consequences. Consequences are information, so all they’re doing is preserving poor decision-making entities by providing confidence that bailouts and bandages are assured.

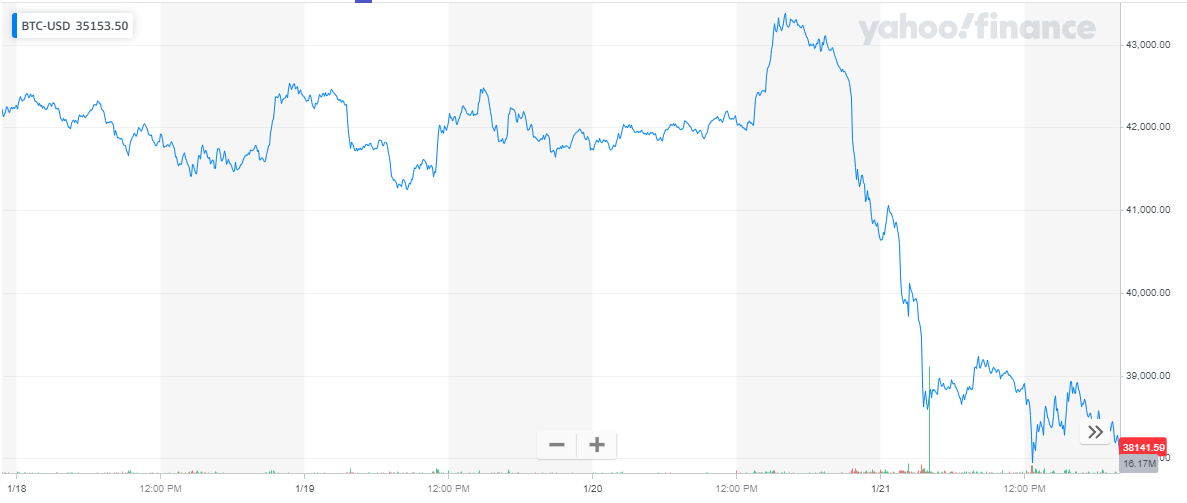

Friday was dramatic but not devastating. Lots of markets plummeted—altcoin company tokens, industrials, commodities, tech stocks—as generalized fear, uncertainty, and doubt swept through everything, including Bitcoin:

The reasons for individual asset performances always vary. For example, Netflix stock sold off because they had an earnings report on Thursday evening and investors learned, among other things, that new customer growth has stalled. Investors fear Netflix has essentially soaked up all the eyeballs they can and there’s no where else for growth to come from.

But overall, the culprit for generalized market jitters was once again The Fed who have said, again, that they plan to hikes rates several times this year as part of their plan to “reign in” the inflation they made.

Of course, they can’t raise rates. Not in any meaningful way that will truly curb inflation the way Fed Chair Paul Volcker did back in the 80’s. Doing so would tank the economy so viciously heads would spin (and no doubt heads would roll, too), and would literally bankrupt the government along the way.

But notice how just by saying they’ll raise rates they can get market actors to behave in a certain way. And if they raise rates a little this year, and things start getting out of hand in their opinion, they can then “walk it back” to “calm markets” and “ease fears” etc. They don’t need to raise rates. They can just say they will, and then say they won’t, to get the reaction they want.

This is the game. This is how it’s played. It’s absurd. They want to jiggle their way out of this mess carefully like a Jenga player flicking their chubby finger against a stubbornly wedged wooden slat at the base of the tower.

As for Bitcoin: if anything, news was bullish as ever. Intel announced plans to fabricate a new Bitcoin mining chip and has already secured a customer for 25% of its chip production through 2025. This is a massive signal by a massive, traditional firm that there is strong interest in and demand for the asset class.

This in the same week that world leaders continued looking to El Salvador for fiscal policy insight after their move last year to make Bitcoin legal tender—specifically leaders currently dealing with a broken economy (“Turkey’s Erdogan Meets El Salvador’s Bitcoin-Boosting Leader Amid Economic Crisis”)

In my opinion, it’s naive to think that Erdogan, a literal dictator, would be keen to opt for an open, decentralized monetary standard over his own national currency that he can control, but the appeal of a politically neutral global reserve base money for settling debts and for trading could still be on the table… or he he may just be looking for Bitcoin PR advice to boost morale. Who knows.

To really get at the truth of things in this whole volatile environment you need to zoom out. Below are 10-year, log-scale charts of both the NASDAQ and Bitcoin priced in USD. As you can see, this week’s events are visible, but barely:

The fact that nothing fundamental has changed about Bitcoin is important, and worth emphasizing. While everyone was watching the price, mining difficulty actually reached an all-time high. This is a very good thing, and shows there’s increasing investment to participate in and secure the network, which people are putting serious time, money, and energy into doing.

Unlike the Fed, we know exactly what Bitcoin is doing, and will always do, because its rules are out of the meddling hands of humans. Issuance supply is fixed. The declining block subsidy reward is fixed. The supply halving event is fixed. The difficulty adjustment algorithm is fixed.

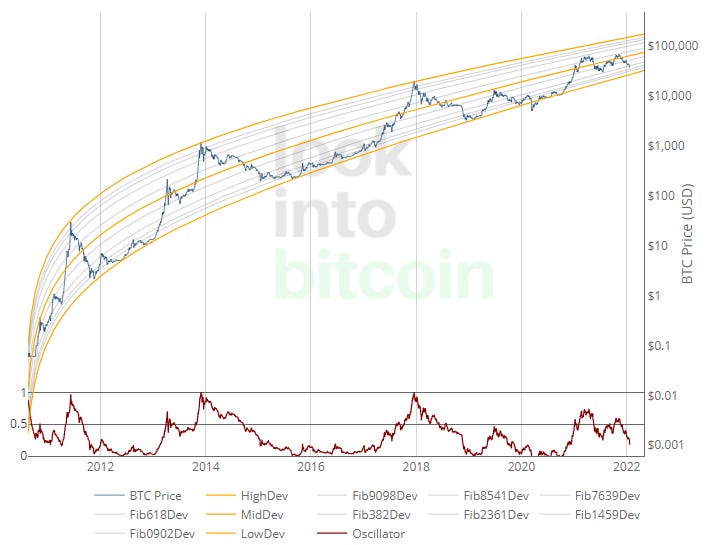

This is what a trustworthy and unmanipulated monetary policy looks like:

This is why more and more investors are beginning to think about their portfolio in Bitcoin terms rather than USD terms, and are exploring the idea of pricing goods and services in Bitcoin. When you can finally trust the money, you can better trust whatever is built with, as well as the person using, the money.

"Ownership of sound money leads to ownership of sound equities and creation of sound business models."

There is disagreement among market participants about what Bitcoin’s value is to them personally, hence its USD price volatility, but it continues to oscillate around general consensus over time like all assets in all markets, as always.

Disagreement about the value of a thing is what allows exchange to be possible at all.

Disagreement is not a bad thing—it reveals that individuals are living different lives, have different understandings, hold different priorities, and want different things at different times.

As I mentioned earlier, greed and fear move markets. Markets are comprised of human beings, and humans are fallible, emotional creatures above all—well before they employ reason to try to override or mitigate the impact of their feelings

When assets sell off it’s simply a transfer event. Assets move out of weaker hands and into stronger hands. Over time, this ensures the right people are the holders, because they demonstrate they want it for fundamental reasons and not because of the tone of Jerome Powell’s voice on a Wednesday.

‘To each their own’ is an expression having to do with leaving people alone, but it also serves as an observation about the flow of capital through markets. When people are allowed to get what they deserve, whether good or bad, then the relation between all market participants is strengthened by the understanding that no one is coming to save them, risks are real and should be taken seriously, and losses or gains accrue to rightful owners eventually over time.

But when the Fed papers over losses and prints money to give away and says things on TV to convince people to either save or invest as they see fit, they create the conditions for cheaters to prosper, the honest to fail, and sensible equity valuation models to be punished.

If we don’t get to face our consequences and learn our lessons fully, we may have the perception of stability but will always be blind to the truth of what’s actually happening and what could happen again.

People don’t learn. Skin in the game has the attribute of removing bad drivers from the system. Systems learn by removing.

—Nassim Taleb

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Share this post