Hi everyone—I’m so glad to have you here. What a week.

It is a strange feeling indeed to live in a world where ad-powered digital newspapers keep trying to insist that tails are wagging dogs and not the other way around.

Explanations for causes and effects in markets and prices have become so absurd and devoid of logic that they’re starting to resemble some freakish strain of Dada-ist performance art:

“I do not know what gave me the idea of this music, but I began to chant my vowel sequences in a church style like a recitative … For a moment it seemed as if there were a pale, bewildered face in my Cubist mask, that half-frightened, half-curious face of a ten-year-old boy, trembling and hanging avidly on the priest’s words in the requiems and high masses in his home parish. Then the lights went out, as I had ordered, and bathed in sweat I was carried off the stage like a magical bishop.”

This Report is for those of us half-frightened and half-curious enough to want to figure out what the hell is going on exactly, where the lies are coming from, and how to distinguish signal from noise.

So I will cut right to the chase: bonds are the dog.

The bond market underpins the entire stock market because debt has priority in the capital structure before equity, and the global bond market is more than twice as large as the global stock market.

As it happens I wrote about the bond market nearly one year ago (“Word Is Bond”), and keep bringing it up because it’s as important as it is ignored & misunderstood by everyday folks.

Since these debt instruments called bonds (loans that pay out interest) are traditionally seen as the low-risk savings surrogates in the financial world, if they start falling on hard times then anything perceived to be riskier will fall even harder.

Let’s have a look shall we?

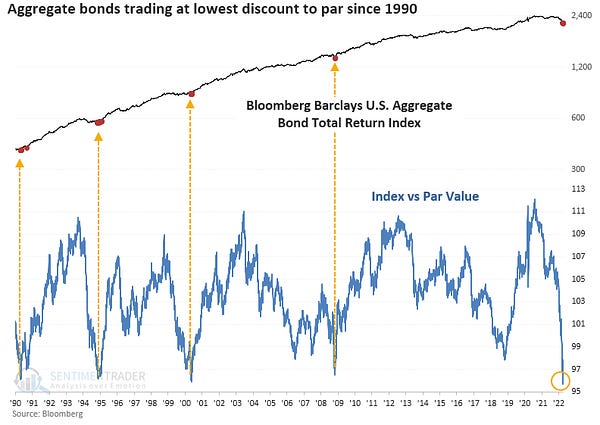

Oh dear:

We are in the middle of one of the sharpest sustained sell offs in credit instruments ever, which is sending yields soaring. (That’s how bonds work: as the value of the bond goes down, its yield goes up).

Put another way: companies (represented as stocks) take on debt (represented by bonds) to finance their operations. If the companies can’t afford those interest payments anymore because yields are sky high, then that’s a big problem and investors in those stocks might not like the look of things and start selling shares to draw up some cash of their own to pay off their own debts.

Ever hear of the “Fed funds rate”? It just means the safest amount of interest you can get. Basically it’s the rate at which the Fed (that cartel of unelected bankers who decide how much purchasing power you lose each year) suggests commercial banks borrow and lend their excess reserves to each other overnight. The Fed sets a target, but ultimately the rate is set by the lending market. Banks used to do this because they had to have certain amount of reserves in order to make loans, but that sensible practice was tossed out back in 2020 along with many other semblances of responsibility.

Right now the real Fed funds rate deeply negative, despite a target of .25-.50%. They’re not keeping up with inflation by a long shot.

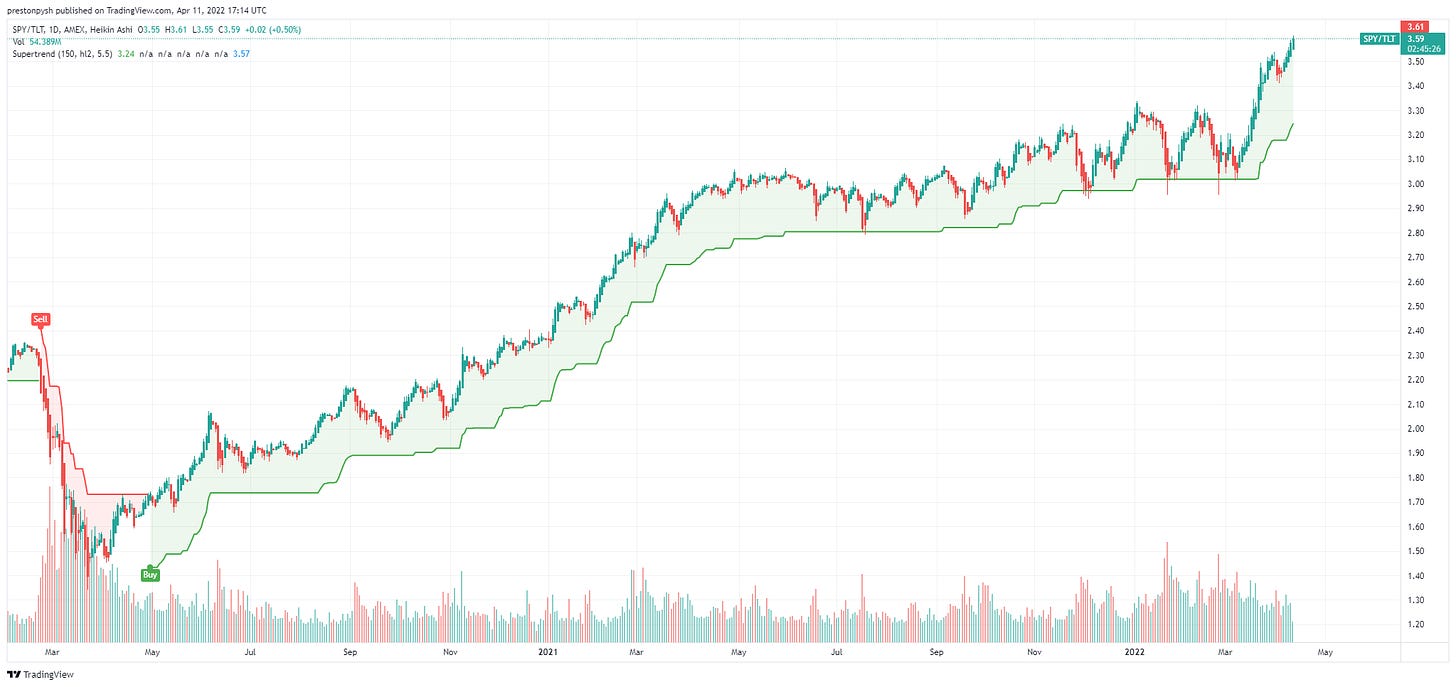

Let’s bring equities back into the picture now that we see how crumbly and jacked up the foundation is. Below is a look at the S&P Index ($SPY) with long dated bonds as the denominator. This reflects everyone’s collective realization that inflation is not, in fact, transitory. Money is flowing into stocks instead of bonds as the once-sensible 60/40 portfolio becomes a 90/10 spring-loaded catapult of doom aimed downward:

Do you see how the bond market is in charge here?

This week we also saw a record but-still-greatly-underreported print of 8.5% CPI inflation while real wages have fallen 2.8% over the last 12 months. Gas is up 48%. Used cars: 35%. Hotels: 29%. Airfare: 24%. And eggs & coffee: 11%. I hope none of you use gas, buy used cars, stay at hotels, travel, bake, or eat breakfast. Thanks a lot Vladimir Putin.

I’m kidding of course, but let’s be honest: this is not Putin's Inflation™ and it's not even Biden's Inflation™. This is the result of a bad system playing out over decades, and was eventually going to result in this mess regardless of who was in power at the time of reckoning.

Locking people in their homes and shutting down the economy and printing 40% of all dollars in existence in the span of a few months was certainly a nice squirt of kerosene on this dumpster fire of an economy, but good luck finding any government official willing to admit it.

They’re also insisting there won’t an eventual recession, and that the economy is on a “very strong basis.” Hopefully I have made a solid enough case for you to now recognize this as the b.s. it really is. 🤡

“What our economic team feels and what the U.S. government economic team feels is that the economy has a very strong basis,” said Jen Psaki, White House press secretary. “Our recovery has been incredibly strong on most measures. We created more jobs last year than any year in American history.”

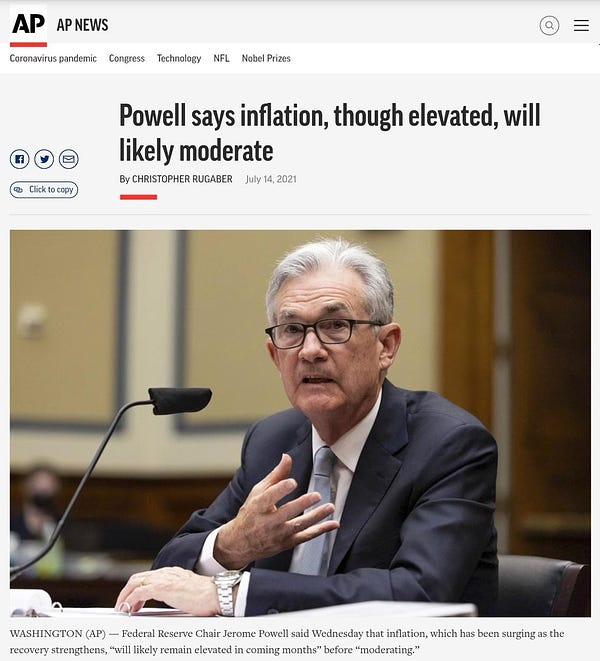

To give credit where credit is due, it was heartening to see at least one media outlet issue an honest mea culpa about being terribly wrong about inflation early on, and why.

“I can say in regards to my case that I unfairly dismissed the most boring, Econ 101 explanation for why inflation happens: that there was too much money sloshing around for the amount of stuff the economy was able to produce — meaning the price of that stuff went up.”

The Fed keeps talking about raising rates (i.e. “tightening”) to put out the flames of inflation, but look at what’s been happening without them. A lot of tightening is already priced in, suggesting a slowdown will start happening with or without the poking and prodding of their squishy little academic fingers into all of our business:

The real interest rate—the 10 year TIPS yield—is up .1% month over month.

Mortgage rates recently ran straight up to 5℅

The cost of refinancing debt right now is more expensive than the existing stock of debt for the first time in 10-12 years.

Another part of this whole dog & tail distinction—what’s happening & who’s doing what to whom—involves understanding the difference between absolute change vs. rate of change.

The rate of consumer price or bond yield increases can be slowing, but at that point it doesn’t mean the prices or yields themselves are any less high.

“I suspect that in the 2020s, much like the 1940s, there will be some local tops in inflation in rate-of-change terms, as prices permanently grind higher in absolute terms. People will celebrate the local tops despite no real reprieve occurring.”

So when the corporate media powers eventually try to spin “inflation is slowing!” as a great achievement while people pour $10 milk over their morning cereal rations, those of us who called all of this back in 2020 and made the appropriate investments in anticipation will be painted as absolute lunatics: New York Post: “Bitcoin fans are psychopaths who don’t care about anyone, study shows”

Right now Bitcoin remains fairly well-correlated to the tech-centric NASDAQ, which suggests most investors don’t yet understand it to be the separate asset class it really is. When institutional asset managers deeply understand its value proposition and don’t simply file it under existing mental models they’ve grown comfy using over the decades (“technology stock,” “digital gold”) then there will be a mad rush to own an ever decreasing amount.

Again, the total supply of Bitcoin is fixed at 21 million, with many of those coins already lost (the attainable supply is more likely closer to 19 million), with the issuance of new coins getting cut in half every 4 years. Scarcer and scarcer we go.

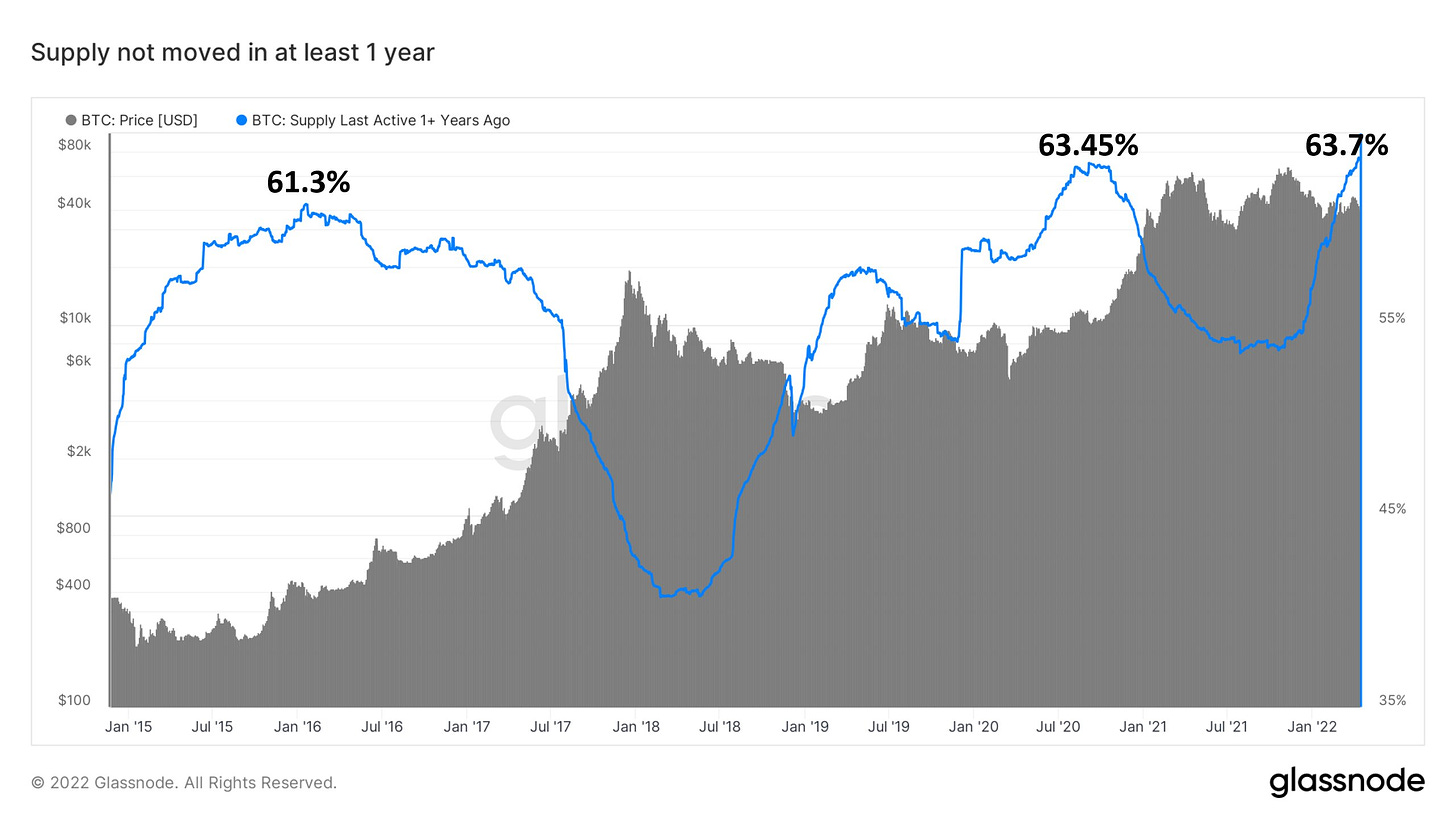

Plenty of psychopaths have caught on though. An all-time high 63.7% of Bitcoin's supply hasn't moved in at least a year. Never before has there been as many people not selling. 🧐

At the end of the day, supply falling as demand rises is the dog that wags Bitcoin’s tail from a macro perspective. But the story, policy, and vested interests with money and newspapers at their disposal can wreak all sorts of short-term havoc in the meantime.

Volatility shakes out those who prefer a smooth, predictable ride. But in a dynamic world that’s more interconnected and interdependent than ever, it’s not slow and steady we should be seeking but rather a better understanding of who—or what—is at the control panel twisting all the knobs.

“That’s the nature of finance: it’s always changing. This is why what we do at 42 Macro is look at the world in rate-of-change terms. Because once you start looking at the world in absolute terms you’re agnostic to, and frankly a victim of, regime change. You don’t realize that you’re a frog being boiled in a pot of water of inflation, or correlation risk, or things of that nature.

What you really care about is the change in these states. The change in inflation, the change in policy, the change in correlation, the change in overall risk tolerance. That stuff is really what drives financial markets forward at the margins.”

—Darius Dale, Founder & CEO of 42 Macro

What ride are we even on? What carnival is this? And is it the one I thought I was when I walked in?

The government and its bank are the tail. Do not treat them like a sentient, faithful creature with an ability to wag.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Share this post