“Every time you confront something painful, you are at a potentially important juncture in your life—you have the opportunity to choose healthy and painful truth or unhealthy but comfortable delusion.”

—Ray Dalio

Hi everyone—I’m so glad to have you here. What a week.

It’s been a truism through the ages that health and wealth are linked.

Those with more monetary means have easier access to more nutritious ingredients and meals, and don’t have to subsist on cheaper, lower quality foods. Junk food is cheap, and proliferates because of its larger profit margins for the companies that produce them.

Conversely, those in good health are evidently the type of people who have maintained healthful habits and can reliably delay gratification. These types of people are more in control of their urges and tend to avoid behaviors that cause harm over long time intervals, so they are also more likely to make similarly beneficial decisions in their financial life.

Also: the healthier an individual is the longer they can also expect to live, which means their investments are given more time to compound and grow. Time is your greatest ally when it comes to wealth accumulation.

These two qualities of health and wealth are reciprocally reinforcing, but the point is that the actual cause of both health and wealth have to do with the nature of the person doing the eating and earning. We need to look at the person—their upbringing, their environment, their personality, events in their life, etc.—to get a better grasp at the underlying cause of whatever wealth and health they happen to have accrued.

But it doesn’t stop there. Right now we happen to be living through a health crisis that is also, unsurprisingly, having major financial and economic consequences. A population stricken with illness will inevitably impact financial markets too.

A key concept in the worlds of both health and wealth is iatrogenic, which is the notion of unintentional harm done by the healer. For example, if in ancient Greece a physician, in an attempt to alleviate a patient of his or her black bile that was believed to be causing the illness, performs a bloodletting operation that leads to the patient dying of blood loss, that would be an example of an iatrogenic outcome.

We don’t hear about iatrogenics in the realm of finance (though former options trader Nassim Taleb did draw attention to it as a key principle in his book Antifragile), but a word we do hear when markets are explosively exuberant is euphoria.

This, too, is a word of medical origin and has to do with illness:

So when markets are “euphoric,” it's best to take that to mean that they are irrationally exuberant—not at impressive levels of good health, but rather at excessive levels of feeling more comfortable and confident than they actually are.

On January 4th, futures surged to “euphoric” levels, but the next day the market experienced it’s largest drop since March 2020.

Commentators have attributed all of these erratic events as resulting from Fed Chair Powell’s comments or maybe infectious disease outlooks… hard to say. Some of these things may have precipitated a market reaction, but that’s different from saying they actually caused them.

For most of you it should comes as no surprise that I do not believe we are living through healthy times, and I mean that in both the financial and biological sense. In fact, I believe society has been so deeply unhealthy for so long that many of the ills we’re now experiencing are hard to alleviate because their underlying cause has been so systemic and deep seated.

To understand the health of a system it’s necessary to look at the right indicators—the right metrics. In medicine these are called health markers. They are things like blood pressure, resting heart rate, and body mass index (BMI).

So what is an example of a good health marker for the economy? Cullen Roche thinks that the inflation rate is one of the best indicators for understanding economic health and I tend to agree:

“If you could pick one variable in the whole world that you had to understand that would be your go to indicator, inflation would be the thing to me.

You tell me what the rate of inflation is in twenty years, I’ll tell you pretty much what most financial assets have done, whether it’s bitcoin, bonds, stocks, whatever.”

—Cullen Roche [Source]

Taken literally, this is a bit of a stretch of course, but I appreciate his point. Analyzing the inflation rate of a society over time can reveal lots of information about its underlying condition.

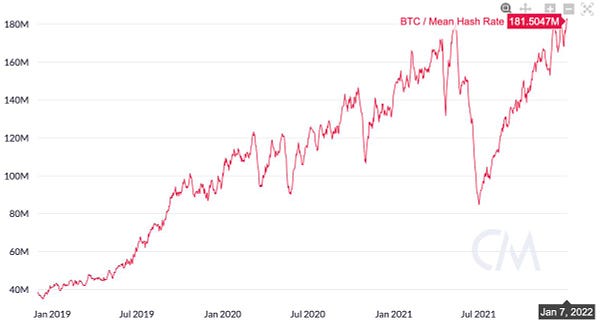

Bitcoin is different. It’s a deflationary asset with a high stock-to-flow ratio. A good health marker for Bitcoin (akin to the metabolic rate or thyroid function in humans) is the hash rate of the entire network. This refers to the amount of computing and processing power being contributed to the network through mining, which in turn provides the security necessary to withstand potential attacks.

It’s a key metric I watch that, if it ever slows or flattens, would be an indication to me that something is systemically wrong with the underlying system or the sentiment/circumstances of its participants.

The Bitcoin network hash rate is at an all-time high and withstood the exogenous event in July when China banned mining within all provinces. But why is this all-time high a sign of good health while the S&P 500 all-time high isn’t?

Because the Bitcoin hash rate is a measure of energy commitment that also secures the network, while the S&P is a market-capitalization-weighted collection of an ever-changing list of the 500 leading publicly traded companies in the U.S. They are both numbers, but numbers representing completely different things.

The S&P index doesn’t account for companies that fall out of it, since another company is always there to take its place in the top 500. Similar logic is employed with the Consumer Price Index, which is an ever changing basket of goods that can be adjusted to reflect whatever number is more politically advantageous.

You can’t talk about health and wellness without accounting for these losses or removals from a system. In market terms this can refer to a drop in the overall number of market participants or employed workers or members of the S&P 500. In health terms this refers to… deaths.

At the moment most people are busy tracking the specific death count of a very specific illness, but a more complete metric to keep an eye on is all-cause mortality, which eliminates any confounding variables such as testing rate and subjective attribution.

Right now all-cause mortality is skyrocketing to disastrous levels, with deaths up 40% among the 18-64 year-old age cohort. Not great. And not nearly as many people are talking about this metric. Also not great.

What I’m really talking about here is the difference between thermometers and thermostats—which is another way of talking about symptoms and causes.

A thermometer is something that measures the temperature, but a thermostat is the mechanism that sets the temperature. The former is a trailing indicator, and the latter is a leading regulator. Confusing and conflating the two creates problems. You can’t manually adjust a thermometer reading and expect the temperature in the room to change, though that’s exactly what the Federal Reserve and US Treasury are trying to convince you of when they create money to give away and point to all the resulting spending as a sign that things are improving.

Treating a symptom instead of the cause may create short term alleviation, but in neglecting the underlying issue you leave the cause untreated and therefore more likely to actually get worse.

Confusing thermometer and thermostat is not uncommon in the world of health and nutrition. For example, cholesterol level is used as an indicator of health, and high levels are treated with medicine that reduces the cholesterol reading or with diets that contain less of it. But this confuses the difference between dietary cholesterol (which your body uses in combination with sunlight to synthesize vitamin D, which is important for immune function), and inflammatory cholesterol (a reaction produced by your body to repair blood vessel damage caused by systemic inflammation caused by blood glucose spikes and long-term omega-6 intake). To make matters worse, many people also avoid the sun and wear sunglasses despite the fact that your body gets most of the sunlight used for vitamin D synthesis through the retina.

I’m not prescribing one diet or lifestyle over another since everyone’s situation is different, but I am pointing out that these facts should be considered and discussed when determining treatment and disease mitigation in general. Thinking in terms of systems instead of a single cause-and-effect action is the key mental framework to best navigate large-scale, complex networks or groups of individuals, whether financial or nutritional.

Decentralization is a key principle to systems thinking.

That a copy of your entire genome is included inside every individual cell in your body is analogous to a copy of the entire Bitcoin blockchain being located inside every full node on the network, and I don’t think this comparison is trivial or coincidental. Bitcoin is an objectively healthier system to rely on than Fed policy and artificial interest rate manipulation, which has a lot to do with its resilient, decentralized properties and leaderless structure.

Top-down systems—like central banks and medicine—are coercive and depend on centralization, but bottom-up systems—like bodies and markets—are emergent and depend on decentralization.

So should you invest in the stock market right now? Should you buy or sell your bonds? Is now a good time to buy Bitcoin? How much? When?

There’s a reason I don’t provide this type of specific advice: it depends on individual circumstances, in the same way health advice needs to factor in personal genetic or environmental factors. Attitudes, time-horizons, priorities, values… making choices and decisions is and has always been the product of personal, subjective assessment.

This is also why an entire economic school (whose roots reach far back into ancient times) was founded to challenge conventional top-down Keynesian thinking by focusing on individual bottom-up human actions as the way to determine economic policy.

So my advice is simple:

Commit more to systems that have markers of overall health

Favor behaviors that yield long-term benefits over time

Make decisions that put you in the best position to survive and avoid complete ruin

Your individual choices lead to a unique mix of tradeoffs and compromises. And to me, respecting these differences among individuals is the first step toward healthy outcomes of all kinds.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Share this post