Hi everyone—I’m so glad to have you here. What a week. And Happy New Year!

As we all bask in what is obviously, clearly a super great and healthy economy as evidenced by the S&P 500 Index reaching its 70th yearly all-time high last week, I thought it would be fun to direct everyone’s attention to this recent talk of price controls, which is no doubt also a very normal topic in a society with lots of confidence in its currency and financial markets.

I suppose since inflation isn’t transitory anymore we will need to do something about it, and that something should specifically be a thing that has never worked before and only ever made things much, much worse.

Joseph Stalin was a fan of price controls and implemented them widely, blaming greedy profit-seekers for all the high prices. Russia’s first hyperinflation from 1917-1923 nearly destroyed the economy, so the Bolsheviks turned to artificial price fixing to provide the appearance of stability. This Soviet system of price controls prevented inflation, but it also created widespread food and consumer good shortages.

Now, you might think that the horrific and disastrous aftermath was just a coincidence and not the result of the state-sanctioned fixing of prices specifically, but you would be wrong.

But don’t take my word for it: Robert Scheuttinger and Eamonn Butler outline in surprisingly entertaining detail all the ways that government intervention and price fixing in an inflationary environment can go wrong in their 1978 book Forty Centuries of Wage & Price Controls: How Not to Fight Inflation. (Available for free online thanks to the wonderful folks at the Mises Institute).

You’ll laugh, you’ll cry… you may even be inspired to share it with others who would find it enlightening, such as, say, the editors of The Guardian or your local career politician with lots of New Ideas.

The history of governments thinking they can “fix” problems by overriding free market forces and mandating specific prices and wages themselves has a long history, much longer than forty centuries. Some have argued that currency debasement with its subsequent inflation and state-sanctioned price control efforts were the primary cause of the fall of Rome.

Diocletian (Roman emperor from 284 to 305 AD) was famous for the Edict on Maximum Prices (301 AD), which was his counterproductive attempt to curb rampant inflation via price controls.

“The Edict on Maximum Prices is still the longest surviving piece of legislation from the period of the Tetrarchy. The Edict was criticized by Lactantius, a rhetorician from Nicomedia, who blamed the emperors for the inflation and told of fighting and bloodshed that erupted from price tampering.

By the end of Diocletian's reign in 305, the Edict was for all practical purposes ignored. The Roman economy as a whole was not substantively stabilized until Constantine's coinage reforms in the 310s.”

Even the Federal Reserve Bank of St. Louis has admitted that debasing the currency to inflate its supply did not do ancient Rome any favors:

"This increase in the money supply, however, resulted in rising prices for goods and services, or inflation. Debasing the currency was not an effective method for solving the economic problems of the Roman Empire."

The lesson of history appears to be that attempts at price controls always precedes total loss of confidence in government money.

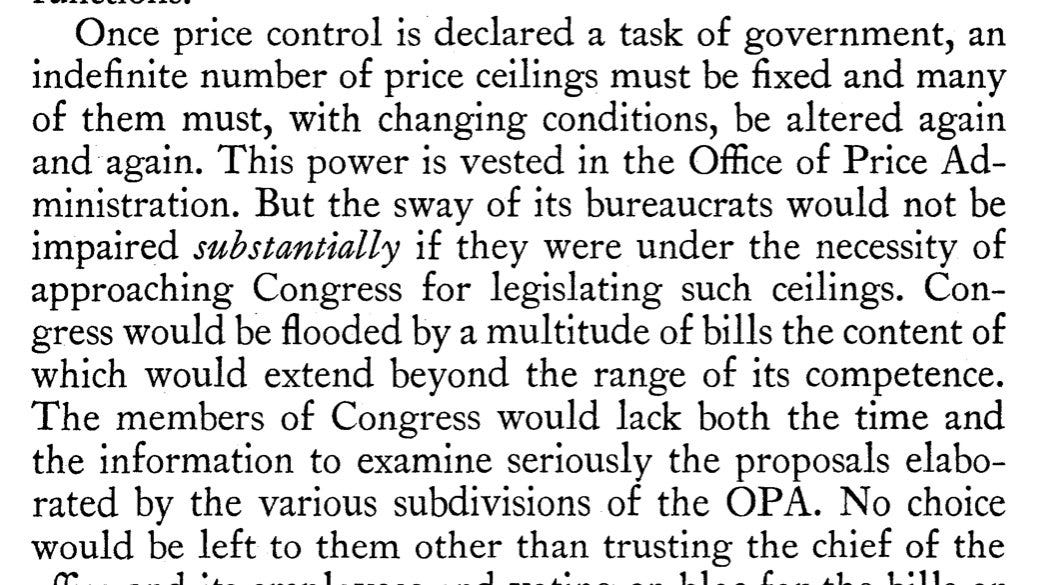

Ludwig von Mises pointed out (in his 1944 book Bureaucracy) that part of the reason price fixing doesn’t work is because it requires a level of both competence and bandwidth that members of Congress simply don’t have:

All of this might sound like fear mongering on my part. After all, we aren’t experiencing price fixing right now, we’re just seeing journalists write op-ed pieces about how price fixing is a good idea, so let’s not jump to conclusions—let’s stay in the realm of what’s actually happening.

Yes, let’s.

Turkey is currently instituting price controls right now. Part of this effort includes “asking” citizens to save money in their terrible Turkish lira and the government is taking steps toward eventual gold confiscation—not unlike Executive Order 6102 in America (1933), which required gold coin, gold bullion, and gold certificates to be turned in to the government… Or Else™

The argument for price controls by government officials is usually some flavor of, “greedy monopoly corporations are taking advantage of people by price gouging” but a modicum of effort to find evidence of this shows that clearly isn’t the case.

State-sponsored pharmaceutical companies are certainly raking it in as a result of mandated drug taking, but your local ranchers—despite sky-high beef prices—are going broke.

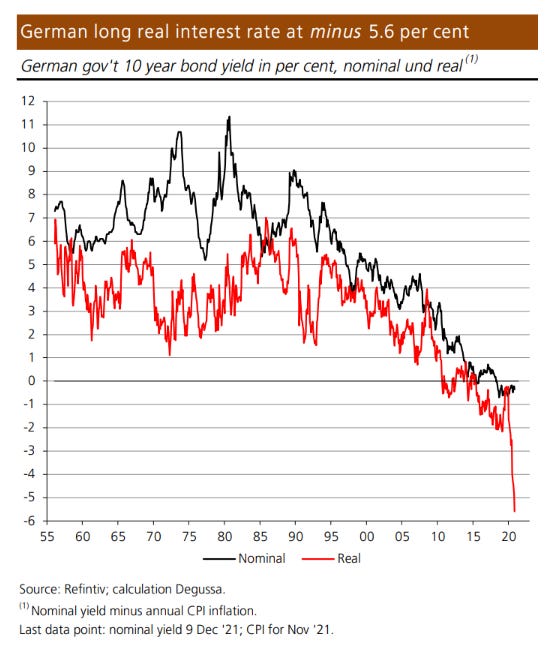

What we are experiencing is not corporate greed. What we are experiencing is one of the many knock-on effects of something called financial repression as a result of irresponsible monetary policy.

Financial repression is when the inflation rate is greater than the interest rate. The reported CPI—a manipulated metric the government uses to measure inflation—is sitting just shy of 7% while interest rates are sitting just above 0%. So while your dollars are losing 7% of their purchasing power, your savings account and treasury bonds and the like are just sitting there doing nothing. It’s the financial equivalent of sitting down on a moving treadmill.

The US dollar is the global reserve currency, so US monetary policy has ripple effects that extend out to the entire world more dramatically than if we were all merely trade partners.

The US also forces other nations to purchase oil in dollars (this is the petrodollar system that creates artificial demand for the greenback), so right now global markets and nations are all embroiled in a complex web of fiscal nonsensery.

Take a look at Germany, which right now has an almost hard to believe -5.6% interest rate. It’s never been this low. Ever. It’s comically low. You have to pay 5.6% interest for the privilege of holding these terrible things:

What does this have to with oil and the petrodollar? Germany also shut down half of its remaining (and perfectly good) nuclear reactors on December 31, 2021.

Best intentions have once again reared their ugly head as German oil futures are skyrocketing as a result for having to pick up the slack:

You’ll notice that this is all a mess and sort of makes no sense, and almost looks like a deliberate sabotage of sorts.

This is all fiat logic: the type of rationale that is only possible when those doing the deciding are not held accountable for the consequences of their decisions, and can literally create the money they need to pass the legislation necessary to remain popular enough to get votes and power. Consequences and negative externalities are deferred for the next guy or gal in power to deal with, and payment can be incurred by later generations who have no recollection or clear idea of who was responsible anyway.

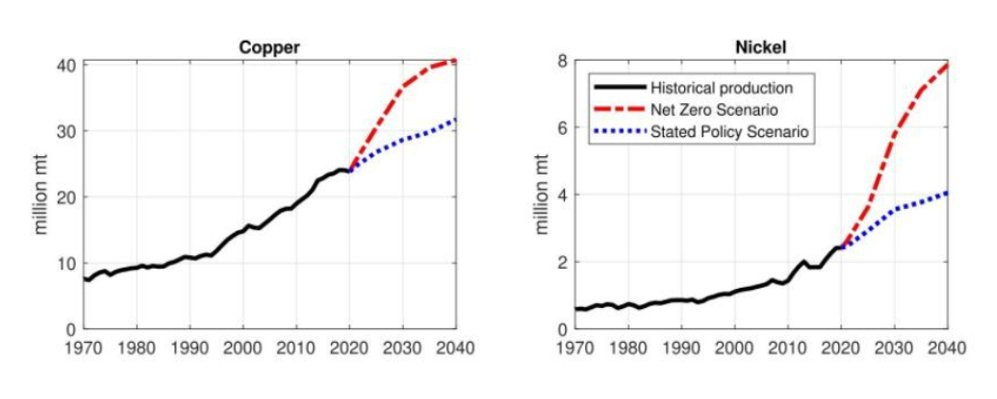

Fiat logic is the type of thinking that says battery electric vehicles are essential for a green healthy environment while also thinking the environmental impact of extracting and processing the rare earth minerals required for those batteries is bad for the environment… and giving government subsidies to EV manufacturers anyway.

Surely this has already all been factored in by ESG advocates and accounted for in the net benefit calculation… right?

Remember, fiat means “by decree.” It’s a synonym for “because I said so.” And unfortunately, much of the world is making decisions right now based on mere decree—the “I said so” of someone or other. Not rational thinking, but rather orders and incentives.

“Fiat means never having to explain yourself. Never having to say you're sorry, never having to be wrong. You are correct by fiat. People in authority decree that this is the person we need to listen to.”

—Saifedean Ammous

All of this is a problem to be sure, but maybe we can take a little solace in the fact that it’s a problem we share with civilizations long fallen and declined, and if we could travel back in time forty centuries or two millennia we would have something to commiserate about in the pubs and cafes with the disenfranchised citizens of those times.

We’ll keep making these same mistakes as a society because while we may be able to pass along knowledge and information to future generations, we haven’t figured out how to transmit wisdom or firsthand experience. As a result, we’ve never been able to truly learn the lessons of history, and we probably never will.

In the end, that may actually be the most important lesson history has to teach us.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Share this post