Hi everyone—I’m so glad to have you here. What a week.

Surf Report is back for what can best be described as Season 2! I can’t promise that there will be a Season 3. It may be that Season 2 continues on indefinitely, which isn’t at all how seasons are supposed to work but hopefully gives you an idea of the kind of whimsy and roguish dismissal of status quo you signed up for. Here at Surf Report, conventional is a four letter word.

If you’re new to the Report: welcome. If you’re a veteran supporter: I salute you.

In fact, it was a handful of you veteran supporters who were asking about the Report and wondering when it would return, which was more than enough for me to get things moving. I could have put it off until the new year and make Season 2 a resolution, but that would have been weak. Resolutions are great, but you don’t need to wait for new years to have them.

A few changes have been made around here during the off season, mostly drawn from some of the feedback I’d received:

Insight #1: Most people mostly just read the intro essay. Well guess what, now Surf Report will be just the intro essay. Links, news items, and recommendations will be hyperlinked into the text where relevant. I hope this makes for less daunting an inbox arrival.

Insight #2: Most people don’t like to read a lot. An odd preference for a newsletter subscriber to have, but I get it. So I’m running a bit of an experiment and will be trying out Substack’s “podcast” feature to include a recording of me reading the contents of each e-mail. Let’s see how it goes.

Insight #3: Free is the way to be. My contributing subscribers gave me so much motivation and inspiration to put out high quality, valuable content week in and week out, and it’s really because of them that I’ve taken this newsletter as far as I have. But most of my sign-ups have been on the free tier, and I’m giving them just as much of my time and effort. So now that this project has proven itself and was launched into orbit, I’ve decided to remove the paid tiers for now and make the whole thing free.

I’ll still aim to get these out by Sunday night, after I’ve had a chance to process the week and synthesize something resembling a cogent point.

Now then…

I’ve made some moves since we last met:

For one thing I joined the team at ZEBEDEE, a company that sits at the intersection of Bitcoin, gaming, and fintech, to help level-up their marketing efforts in a big way. ZEBEDEE gives game devs the tools they need to easily add bitcoin to their games, and allow players to earn real-world money from games that they can seamlessly withdraw and spend in the real world. To say the role is a good fit is an understatement, but it also means I’ll be having lots more to say on here about the topics of payment, value exchange, and financial inclusion in our increasingly online and digitized world. (Some of you may recall ZEBEDEE from a couple past issues of Surf Report, the first being this issue back in April)

I also got a chance to head to the Atlanta Bitcoin Conference, where I learned a ton and met some industry titans along the way.

I then headed straight from Georgia to Mexico to do some work, because that is how work is done here at Surf Report.

But I wasn’t the only one making moves.

Our dear and deleterious Federal Reserve Chair, Jerome Hayden Powell, decided it was best to “retire the word ‘transitory’” when describing inflation, after it failed to catch on as a legitimate explanation among the people of this great nation who saw right through the semantic charade and called bs. It was also heartening to see people around the globe call bs on even the idea of thinking you can ‘retire’ a word at all, and have a change of heart regarding major economic direction without so much as uttering a shadow of an apology for being nothing short of dead wrong. US dollar inflation is in fact persistent, larger than is being officially reported, getting worse, and a direct result of irresponsible Fed policy.

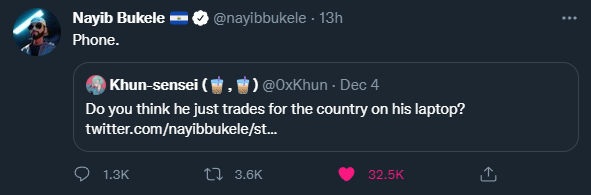

But while J-Pow was busy playing word games, the president of El Salvador (a dollarized nation, mind you) continues to build on the decision to accept bitcoin as legal tender by buying price dips with glee.

And that’s not even the half of it: the country will be issuing a $1B ‘volcano bond’ offering, which will be split into two $500M tranches: one to purchase and hold bitcoin for at least five years, and the other to invest in infrastructure for a new tax-free “Bitcoin city” being built at the base of the Conchagua volcano. The first 10-year issue will occur in early 2022 and carry a coupon of 6.5%.

El Salvador already harnesses the otherwise stranded and wasted geothermal power from its Tecapa volcano to mine bitcoin, and this bond offering will allow more pragmatic global investors to gain exposure to the asset class within a financial debt instrument they are more comfortable holding and incorporating into their traditional risk models.

So what’s going on here? It’s nothing short of a speculative attack on the dollar. A bet that as dollars continue to have less and less purchasing power over time bitcoin will continue to have more, and therefore taking on increasingly cheap USD debt to finance the purchase of increasingly valuable BTC purchases. As BTC grows in value the debt becomes cheaper and cheaper to service.

This is what Michael Saylor did with MicroStrategy last September, and continues to do with what can only be described as an increasing sense of urgency. His company’s balance sheet isn’t 100% allocated to bitcoin… it’s 500% allocated.

El Salvador has about $20B in outstanding foreign debt which they will soon be able to recapitalize. Remember: as the US debases its currency by printing a ton of it and giving it away in the form of stimulus checks directly to its citizens, El Salvador—despite being a dollarized country—isn’t getting a check. They only get the

inflation.

It’s a raw deal to be sure, so Bukele decided to come up with a deal of his own. By monetizing geothermal volcano energy, converting it into digital energy (bitcoin), and using it to issue bonds—all without IMF involvement or geopolitical meetings—El Salvador is demonstrating to other nations receiving a raw deal that there could be a way out. In fact, several industry analysts expect this bond issuance to be oversubscribed and so popular as a fundraising mechanism to inspire other nations to consider something similar, as they watch talent and capital flood into a tiny Central American nation to invest, spend, and conduct business.

One might wonder if this is just a gimmick. A way to ride the cRyPtO hype wave to grab attention and capitalize on a sector of finance that is still arcane and fuzzy to most of the world. I don’t know, is non-state tax a gimmick in the US? Is tourism a gimmick? Is Broadway a gimmick?

This volcano bond and associated bitcoin purchases seem like a big risk to take with an awful lot at stake to be a mere gimmick. At a certain point any decision or policy becomes so impactful and persistent that it looks less and less like a gimmick and gradually becomes… just the way things are.

Money goes to where it’s treated best, but so do people. And, as we’re seeing with Nayib Bukele’s pioneering conversion to a Bitcoin standard, so do entire nations. You can’t improve your situation by conforming to the status quo and being an obedient player in a game you’re losing and where the odds are stacked against you.

The lesson here is that when you’re being treated poorly or ignored entirely, don’t ask permission to act boldly and try something new. You certainly don’t owe an apology or explanation to those who dismiss you.

The journey forward always includes obstacles and setbacks, but as anyone who’s ever played video games knows: if enemies are blocking your path it means you’re going in the right direction.

"The right way to do it is borrow a billion or invest a billion of real money, take the risk on Bitcoin, and then wait for it to appreciate. And if you do that that's technically sound, financially sound, and ethically sound.

The negative is there'll be some volatility, but you know there's volatility in the real world. If you're gonna do things with courage and conviction in life you have to be prepared for the volatility.”

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I recently became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Share this post