Hi everyone—I’m so glad to have you here. What a week.

Many in the US and EU are unaware of just how bad it’s getting out there.

Confidence in government-controlled currencies is imploding across the globe. But most of those in regimes where it hasn’t happened to the same degree appear to be under the impression that it also won’t happen to the same degree.

It’s a hubristic stance that resembles lazy slumber more than prudence—a nocturnal faith in the vague sense of inertia propelling you effortlessly through whatever narrative your consciousness has opted itself into during the depths of sleepytime.

It’s a comfortable place to be, and certainly preferable to staring economic collapse right in its inky black eye-holes and watching the despair leak out:

Sri Lankans are currently facing a devastating inflationary collapse, with miles-long lines for gas, people scavenging for food, medicine shortages, and “exams and newspapers cancelled because schools and media can’t even afford the paper to print them on.”

Deadly protests are breaking out in Peru “as people take to streets over high costs, inflation.”

Tomorrow, German retailer Aldi Nord will begin to raise prices by 20-50% on a variety of consumer staples.

Faith in fiat is falling, and fast. The International Monetary Fund appears to agree, as they drafted a white paper last month titled “The Stealth Erosion of Dollar Dominance” for everyone who, for some reason, still has an unshakable faith in the continued global reserve dominance of the ol’ greenback.

To be fair, Nobel Laureates (much like the ones behind the epic fall of bigwig hedge fund Long Term Capital Management in 1998) have also been asleep at the wheel. Even model-obsessed academic economists can miss and fail to accept what’s right in front of them. (But don’t expect an apology.)

I’ve written before that the writing was on the wall for this financial reckoning well before people recoiled over grainy video clips being sent from China in early 2020 depicting grown adults collapsing in the middle of the street, spurring governments everywhere to lock down their citizens.

At the end of October 2019, president of the European Central Bank, Christine Lagarde, said, “People are happier to have a job than to have their savings protected.” Oh we are, are we?

The belief that having everyone perform tasks for 8+ hours a day, 5+ days a week, is more important than the integrity and value of all the money they’ve already earned is a judgment call made by governments and the media (not you, notice) based on the notion that people must be “productive” in order to keep “the economy” going. Inflation rates, the logic goes, are not only far less important in comparison, but their continued rise conveniently encourages people to work more in order to try and outpace its effect.

People forget that Lebanon’s multi-year banking crisis (“The World Bank has described the crisis as one of the worst the world has witnessed in more than 150 years.”) started well before the pandemic as well, and has just led the IMF to give the Lebanese government (not the Lebanese people) $3 billion in aid over the course of 4 years.

“Lebanon’s economic crisis that began in October 2019, rooted in decades of corruption and mismanagement, has left three-quarters of the population of 6 million people, including 1 million Syrian refugees, in poverty. The Lebanese pound has lost more than 90% of its value.”

[…]

“Lebanon defaulted in March 2020 on paying back its massive debt, worth at the time some $90 billion or 170% of GDP, making it one of the highest in the world.”

Weird that all these nations had massive debt problems right before the world agreed in unison that it Definitely Needed™️ to print literally insane amounts of money, effectively declaring bankruptcy and whining about the need to have a Reset™️.

And they’re clearly addicted at this point.

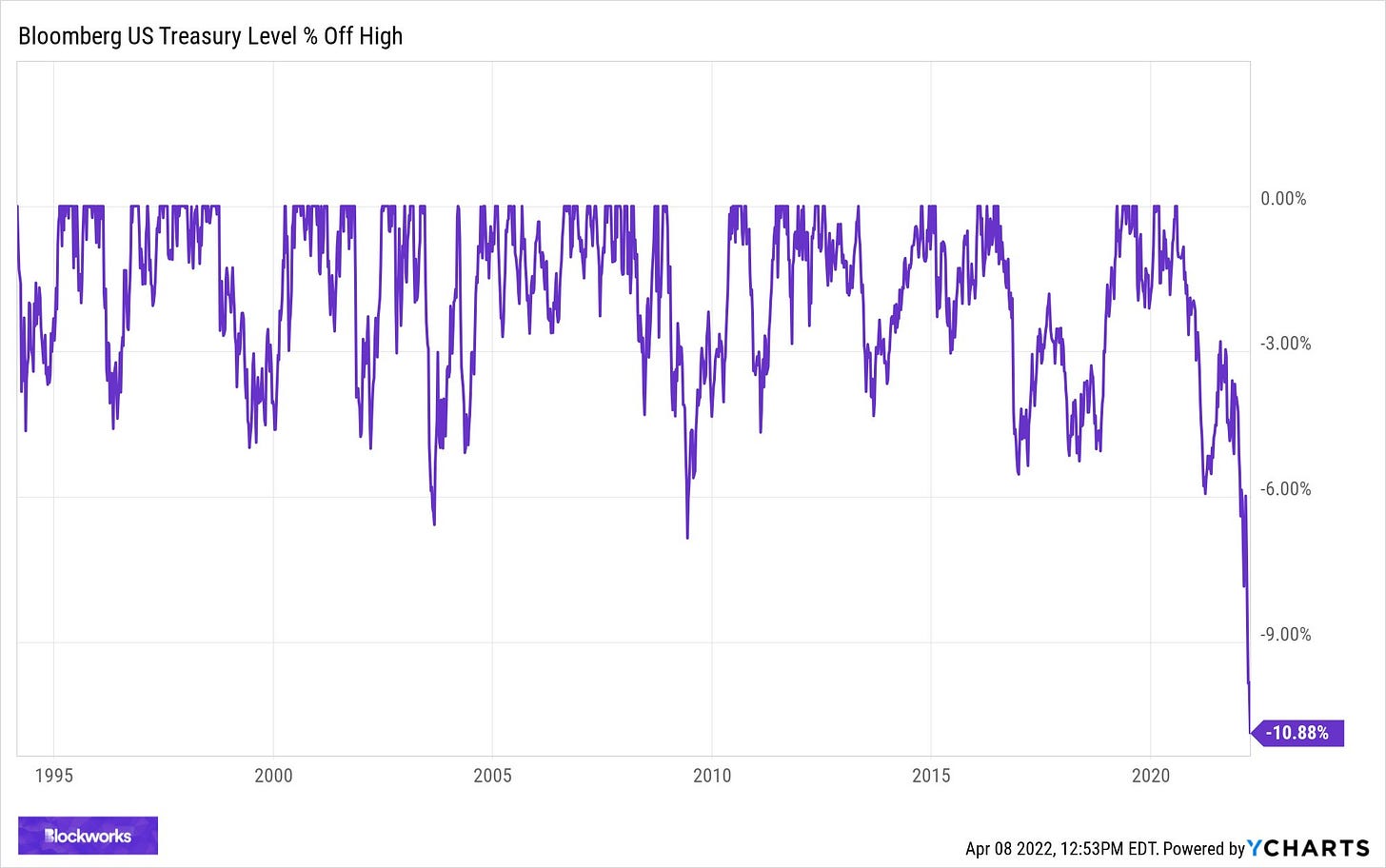

We’re now in the midst of by far the worst drawdown for U.S. Treasury bonds since the Bloomberg U.S. Treasury Index began in 1994.

Nobody wants these garbage pieces of paper. Eventually the government will want/have to step in and artificially buy its own garbage since nobody else will, which isn’t healthy but they will try to package it up as prudent, sensible, and Necessary. They will not, however, take any responsibility for their role in creating the conditions that made it Necessary.

Whatever. Garbage is garbage. The U.S. government has torpedoed its reputation on a number of economic fronts as it continues to manipulate, restrict, ban, freeze, and compel its way through a crisis of confidence rather than letting free markets do their thing.

Things have changed. Most people haven’t noticed.

Marty Bent has said that your savings should be preserved in an asset that is extremely hard to change no matter how hard some men may want to change it. “An asset that allows you to trivially verify its authenticity… an asset that aligns the incentives of everyone who holds it.”

I tend to agree. And perhaps as more people gradually awaken and draw similar conclusions we will see more weeks of news like the one we just had:

Texas bank Laredo announced that they are offering a Bitcoin Savings Plan to all their employees

On Thursday, Block (formerly known as Square) announced that its Cash App will begin allowing customers to auto-convert paycheck into Bitcoin, as well as round up payments to the nearest dollar to buy Bitcoin with the difference.

Strike has partnered with Shopify, Blackhawk, and NCR to power transactions across the bitcoin payment rails. NCR and Blackhawk are two of the world’s largest point-of-sale (POS) suppliers, serving some of the biggest retailers in America including McDonald’s, Walmart, Home Depot, Lowe’s, Best Buy, Starbucks, Chipotle, Staples, and many more.

Like I said, everything has changed but most don’t seem to have noticed yet. A successful investor once told me, “It takes time for the world to wake up.” Conclusions that appear as clear for some isn’t necessarily because certain people are smarter than others, but often because certain people are simply looking at things that most people don’t care to look at.

This is human nature. This is how we’re wired. Cognitive dissonance is a powerful bias that keeps us from accepting a reality that conflicts with our existing worldview or understanding. We engage in all sorts of mental gymnastics to avoid waking, looking, and believing if doing so is very inconvenient and unpleasant.

“If your leg is wounded, you can try to treat the leg. If you cannot, then you cut off the leg… and announce that the desire for legs is misguided and must be subdued.”

We don’t like failing at things. And we really don’t want to see the system we’re inside of and reliant upon to fail. We would rather stay comfy, trust the process, and hope for the best.

Some prefer to stay asleep until their slumber is interrupted and wakefulness thrust upon them by a loud crash. I, and others, prefer to set an alarm clock before falling asleep in the first place.

This is the difference between reactive and proactive. The difference between thinking and thinking ahead. This difference is what will separate the winners and losers in the years ahead, as it has in the years past.

Just because you’re tired doesn’t mean you don’t have to wake up, and no one is going to set your alarm clock for you.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Share this post