Hi everyone—I’m so glad to have you here. What a week.

Remember that Leslie Gore song “You Don’t Own Me”? What a great song. And she was one hell of a talent. Take a minute to watch the clip above and enjoy a timeless 60’s pop classic.

And soak it in, because from here on it’s only going to get darker.

As is tradition, this Report is about sharing with you the truth of things in as delightful a way as a person can when dealing with topics of lies, theft, misdirection, and obfuscation in the world of investing & finance. It is arguably the most entertaining set of words on the internet for learning about arcane economic grifts and how to combat the creeping totalitarian infringement on freedom and personal property rights. Weeee! 🎉

In fact, let’s talk about property & ownership. Specifically home ownership. A recent episode of the Human Action Podcast revealed some, uh, concerning statistics regarding how many mortgages and mortgage-backed securities are owned by the [checks notes] Federal Reserve:

The Fed owns almost $3 trillion (That’s three million million dollars. $3,000,000,000,000) worth of mortgages and mortgage-backed securities on its balance sheet.

This means almost 25% of U.S. mortgages are owned by the Federal Reserve, which constitutes about 30% of the Fed’s entire balance sheet.

This is significant because The Fed never owned any mortgages prior to the 2007 crisis. Owning mortgages is not their mandate, and was not part of their charter.

A bit weird, no? Well, maybe not—after all, mortgage-backed securities were at the center of the 2008 crisis and subsequent recession that lasted for years, so perhaps it does make sense to have these caustic financial products in the hands of the people who bailed out all the banks. 😀

You may recall last year when multinational investment firm and the world’s largest asset manager, BlackRock, went around all of America buying up affordable single family houses while everyone was dealing with the pandemic. Left-leaning pubs like Vox and The Atlantic said it’s not actually an issue and BlackRock isn’t to blame. Right-leaning pubs like Fox News said they’re killing the dream of homeownership. And some blog called A Wealth of Common Sense had a take I quite liked that sat somewhere near the middle, where the truth is usually found:

“You could make the case that having these huge companies with the resources and scale build more homes like this could be a good thing. They handle the upkeep. They pay the taxes. They handle the lawn care and maintenance. They pay for remodels when parts of the house eventually break down.

The biggest problem for many is they lose out on the American Dream.

This means you’re not getting the equity that comes with owning a home, which for many acts as a form of forced savings.”

A big part of why people feel so strongly about BlackRock’s actions is because homes have been monetized. That is, they’re not just priced to be housing, they’re also functioning as a savings vehicle and carry that monetary premium too—as a store of value. (Oh and by the way, the president of BlackRock thinks inflation will hurt an “entitled generation that has never had to sacrifice.” He did not specify which generation he considered to be “entitled.”)

And Larry Fink, BlackRock’s CEO, is a board member of the World Economic Forum, which is the same despotic clown show organization led by Klaus Schwab that says by 2030 “you will own nothing, have no privacy, and life has never been better.”

(By the way, who the hell is Klaus Schwab? Who put him in charge? Did we vote for this or something? What’s the WEF agenda? Why do they keep saying “Great Reset”? All great questions I encourage you to query yourself in your favorite search engine.)

Anyway, at least now we’re getting to the crux of the issue.

For first time home buyers, the inflation rate is 19.2%. (This number is drawn from something called the Case-Shiller Home Price Index). It’s largely due to supply and demand—there aren’t enough homes for sale to meet the demand for them.

So if the currency supply is expanding faster that the housing supply…

And people see houses as a way to save their money…

And housing prices are serving this function by rising in value across the board…

Then US treasuries—which are supposed to be designed to be a store of value by offering an interest rate that outpaces inflation—are currently offering a real yield of -17% in comparison.

Things have gone haywire. The system is topsy turvy.

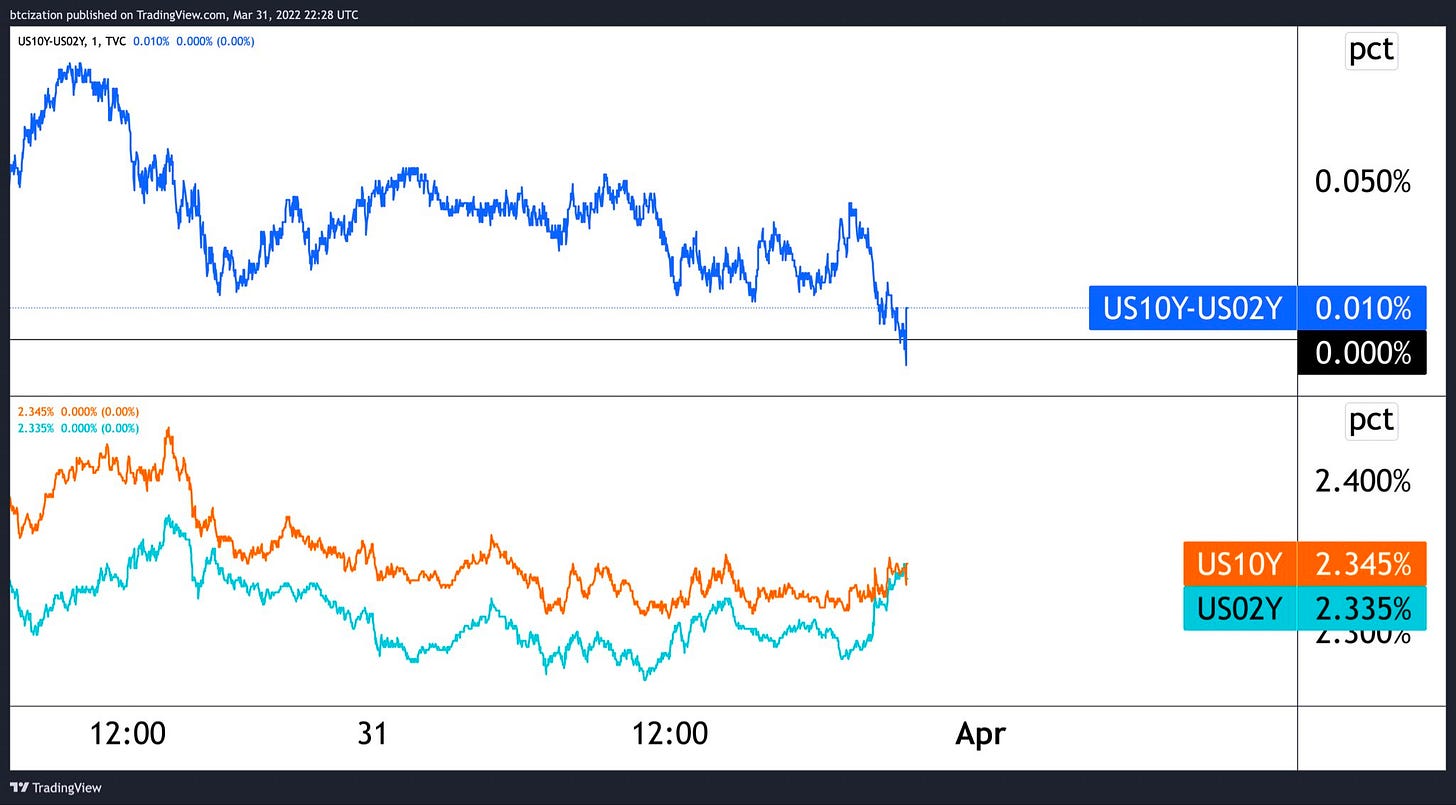

On the last day of the month of March, and thus the end of Q1 2022, the 10- to 2-Year yield curve officially inverted. The next day, the 5- to 30-Year curve inversion deepened to 8.8 basis points (.088%). Not good.

Why might you want to care about this? Inversions of the yield curve on US Treasury bonds have preceded most recessions for the past 150 years.

A yield curve is just a plot of the interest rates of bonds having equal credit quality but different maturity rates. So just by looking at the slope of the line (its “curve”) you can get an idea of future interest rate changes.

A yield curve “inverting” is a very unusual event. Long-term interest rates are usually expected to be higher than short term interest rates, the thinking being: as a holder of a long-term bond you are taking on the risk of an uncertain future. It’s very hard to know what the future holds, and the farther out you go the harder it is to know how the world—and your own life—will pan out. And so you are paid a higher coupon (i.e. interest rate percentage, i.e. yield) for taking on this risk.

So when a yield curve inverts, it means short-term interest rates have become higher than long-term interest rates. This means investors are seeing the near term future as being even more risky and unknowable than the long-term future, and want to be paid for taking on that risk. Pretty weird when you say it like that, right? (Even a flat yield curve is no bueno because it’s saying people see the distant future and the next few years as being equally as risky and uncertain.) That’s why a flat or inverted yield curve sends alarm bells ringing through the markets.

But don’t expect the people in charge to alarm you. They don’t want you informed they want you calm, complacent, and not panicking.

That’s why Federal Reserve Bank of New York chairman William McDonough said in February 2000: “Ignore the yield curve… Typically, the inverted yield curve is seen as a sign of a coming recession. I don't see that as the explanation.” A few months later the dot com bubble burst. 🤡

And Fed Chair Ben Bernanke told everyone to “Ignore the yield curve" in 2006, 2 years year before the entire financial system collapsed. “I would not interpret the currently very flat yield curve as indicating a significant economic slowdown to come, for several reasons...” he said. 🤡

Who knows, maybe this time it’s different. Maybe Jerome Powell in his infinite wisdom wielding a .25% rate hike can manipulate the market back to a sensible place as effectively as he manipulated it into its current distortionary terribleness. Maybe! Stranger things have happened. The future is unknowable, so you’re free to place your bets as you see fit.

But there’s good reason to believe that not only is this time not different, it’s worse. At least in the past the rest of the world was forced to use our primary export—the US dollar—to transact in energy markets, while the US imported most of its stuff manufactured in other countries. We give those countries dollars, we get stuff, they now have dollars to buy the energy used to make our stuff. At least in the past, this was the deal.

But that deal is off now.

Putin is now demanding that Russian energy be paid for not in dollars but in rubles. Remember how the value of the ruble plummeted after the Russian invasion of Ukraine? Well, it’s back.

As for the US, the administration is doing whatever it can do to deflect blame from their own role in all this, and to justify the printing of even more money, which will only make matters worse.

Left, Right, Blue, Red… it doesn’t matter your political persuasion, which is another ongoing theme of this Report. The narrative has been established. All corporate media ad sales businesses insist This Is What’s Happening™️.

So as the government takes our homes and gives us helicopter money to paper over their debasement of the currency, we’re expected to be grateful but all it makes us is more dependent on them. And being dependent on a government has never led to good outcomes unless you actually work for said government.

Part of the reason I focus so much on Bitcoin being at least one part of a larger strategy one can employ to deal with this dystopian hellscape of mendacity and perverse incentives is because other crypto companies and projects, while sometimes interesting, have been designed in such a way that mimics the structural problems inherent in our current financial system. They’re not open, decentralized, impartial, unmanipulated, or fair. They are quite literally the opposite. They are different Bitcoin both in kind and degree.

Even the creator and head of the crypto project Ethereum, Vitalik Buterin (who used to be a Bitcoin core contributor and was the original co-founder of Bitcoin Magazine) agrees: “In Defense of Bitcoin Maximalism”

(This was published on April 1st, so it’s best to read this as a kind of galaxy-brain steelman argument in celebration of April Fools’ Day and not a sincere endorsement but… it’s also a very good endorsement.)

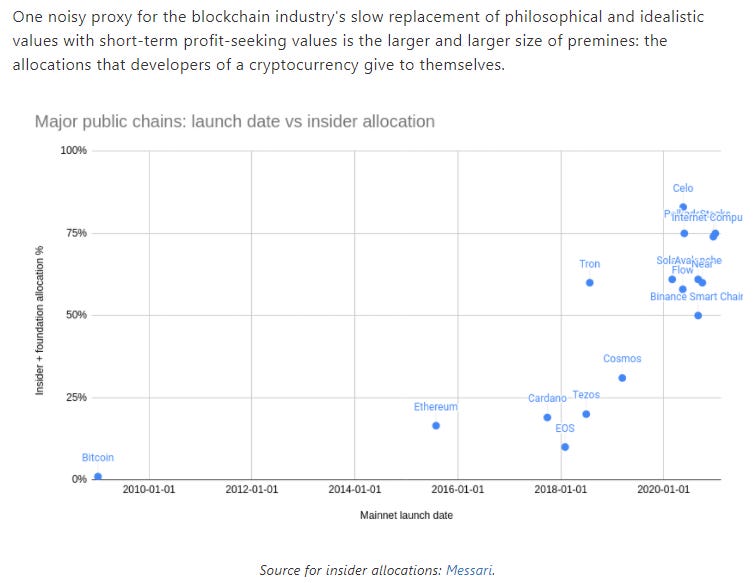

The creators and leaders of these very much not decentralized projects are increasingly allowing insiders to allocate more and more shares before public launch of their PlatypusCoin™️ or whatever, at which point they dump their now hugely valuable tokens onto the public retail investor for massive gains. Everyone not in-the-know is left holding PlatypusCoins™️ and clinging to whatever marketing and techno-jargon detritus was left behind by the founders.

Rinse. Repeat. To be fair, it’s a good racket to be in.

“Basically everyone is scrambling for more and more digital seigniorage, except the original [Bitcoin].

Developers and VCs that build on the original are consciously forgoing seigniorage altogether, which is why the speculation-to-utility ratio tends to be so much lower there.

As you go out further and further, it trends towards seigniorage and speculation.”

—Macroinvestor and analyst Lyn Alden

Sadly, most of these projects will end in tears, much like the 2017 crypto mania and subsequent crash which I remember vividly. The vast majority of those “Initial Coin Offerings” no longer exist at all. Caveat emptor.

Another sad part is even conservative and risk-averse investors who have no interest in any of this crypto stuff may be left in tears too. The housing market may or may not be bubbling into a froth, so if homeowners are banking on their home also being their bank account it may be a rough decade for them too.

This is what tends to happen when wealth is overly concentrated and investments are part of a manipulated system beholden to central planners who have larger agendas that don’t include you.

I think Leslie Gore may have actually said it best in the end: you would cry too if it happened to you.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨